United Bankshares’ latest acquisition should provide a boost in high-growth markets and hasten its effort to become a dominant force in the Southeast and MidAtlantic.

The $19.8 billion-asset company's

The move is the latest effort by United, based in Charleston, W.Va., to go big in markets known for income and population growth. The $4 billion-asset Carolina Financial has branches in most major cities across the Carolinas and a

“That’s been our strategy all along — to be in the best markets in our regions — and this deal is a great fit with that,” said Richard Adams, United’s chairman and CEO.

North Carolina and South Carolina were among the 10-fastest growing states in terms of population last year, according the Census Bureau. Those gains are driven by expanding economies and job opportunities around cities such as Charlotte and Raleigh in North Carolina and Columbus, S.C.

“We see tremendous opportunity” to build on Carolina Financial’s foundation, Adams said.

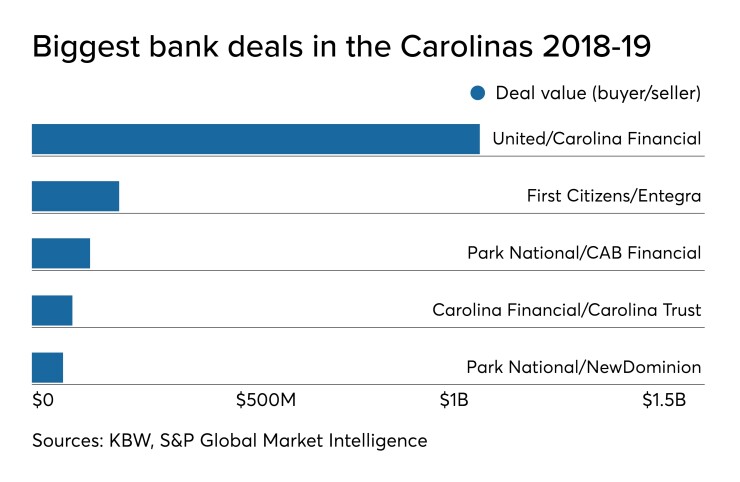

The Southeast has been a hotbed of M&A activity, including

North Carolina, for instance, has lost about 40% of its banks since late 2010.

That could help explain why Carolina Financial is selling for 207% of its tangible book value. The average seller's premium this year has been 155% of tangible book value, according to data compiled by Compass Point Research & Trading.

It has become challenging to find sellers in the Carolinas that provide immediate scale, Adams said, which made the $4 billion-asset Carolina Financial a particularly attractive target.

United has relied heavily on bank acquisitions over the past three decades as it grew from a one-branch, $100 million-asset bank to a company with 140 branches in West Virginia, Maryland, Virginia, Ohio, Pennsylvania and Washington.

Carolina Financial is United’s 32nd — and largest — bank deal. It will push United’s branch count above 200. It is also United’s first acquisition since it bought Cardinal Financial in Northern Virginia for $900 million in April 2017.

United has expanded in the nation’s capital substantially over the past two years, Adams said, and he expects to do the same in the Carolinas.

“We’re pretty darn good at execution,” he said.

Expect more acquisitions for United as it focuses on expanding its existing footprint, and potentially entering contiguous states.

“I think there will be more acquisitions to come,” Adams said. “M&A is a line of business for us.”

More sellers are popping up as management teams realize that they need scale to compete with bigger banks and invest in emerging technology.

“It’s more competitive than it’s ever been, and more banks feel they’re not able to keep up with the digital revolution on their own,” Adams said.

The deal’s terms seem reasonable and are appealing for Carolina Financial, said Robert Bolton, one of the company’s shareholders. He was particularly pleased that it will take less than three years for United to earn back any dilution to its tangible book value.

“We like to see that earnback under three years, so that’s good,” said Bolton, president of Iron Bay Capital.

Bolton said he will likely hold onto United’s stock, given the company’s proven growth trajectory. He also thinks United will have more deal opportunities.

“Between costs and margin pressure from low rates, a lot of community banks are seeing stress and could sell,” Bolton said. “It creates opportunity for [United] to create an even bigger presence and, at some point, it could become an attractive target itself for a much larger regional bank down the road. That’s another reason to like this.”