The combination of higher regulatory expenses and reduced income from interchange fees is taking a toll on the profitability of banks with $10 billion to $50 billion of assets.

Despite having a size advantage, this group of regionals was less profitable than

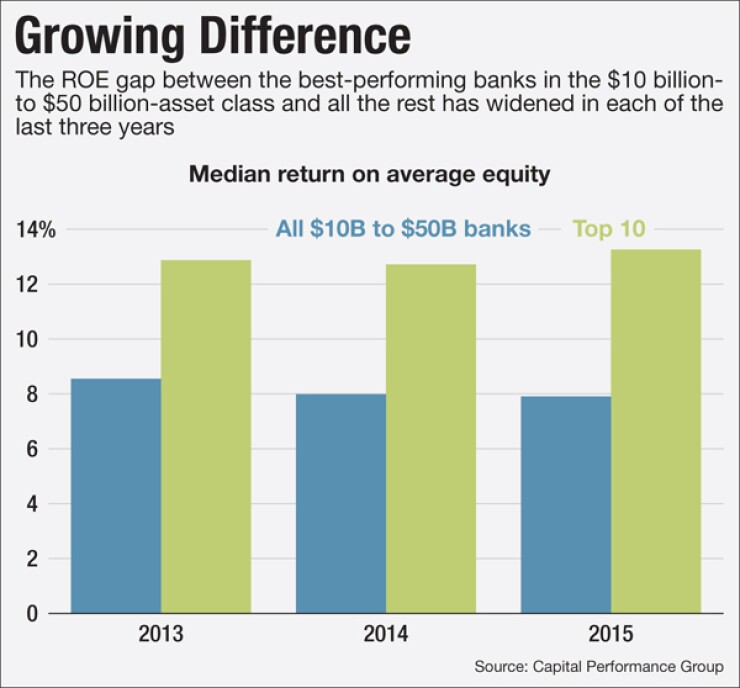

In nearly every major category — including loan, deposit and revenue growth — the regionals lagged their smaller counterparts, and that translated into lower returns on assets and equity, according to an analysis by Capital Performance Group. For three-year return on average equity — the basis for our rankings — the regionals posted a median of 8.03%. That is well below the 8.79% median for the banks with $2 billion to $10 billion of assets.

-

Large enough to meet the needs of most customers yet small enough to escape some of the Dodd-Frank Act's most onerous compliance expenses, banks with assets of $2 billion to $10 billion are more profitable, as a group, than their smaller and larger counterparts, according to an analysis by Capital Performance Group.

May 26 -

Profitability is under a lot of pressure for small institutions. But some are handling that pressure better than others, as our annual ranking of publicly traded banks and thrifts with less than $2 billion of assets shows.

April 25 -

Achieving high performance is a challenge. But these five traits help the elite banks drive such impressive results.

June 1 -

Want customers and noncustomers to hold your bank in high regard? Then get executives to offer thought leadership on social issues, rather than just having them be a mouthpiece for quarterly earnings. That's what the Reputation Institute recommends, as leadership replaces performance as a key driver of bank reputations.

July 1

A simple explanation is that regionals must deal with higher compliance requirements and caps on swipe fees once they pass the $10 billion-asset threshold, said Kevin Halsey, a senior analyst at Capital Performance Group. “Compliance costs are really impacting these institutions and keeping them from being as efficient as possible,” he said.

Still, there are plenty of stellar performers in the $10 billion- to $50 billion-asset group. The top three banks in the ranking, Bank of Hawaii, FirstBank and Western Alliance, all posted three-year ROAE above 14% by either capitalizing on growth opportunities at home or expanding to new markets.

For the $16 billion-asset Bank of Hawaii, the economic rebound in its home state has been the key to its recent success, said Peter Ho, chairman and chief executive. Bank of Hawaii gets about 90% of its business from the Aloha State, he said. Not coincidentally, Hawaii had just 3.2% unemployment, fifth lowest of all the states, as of May 31.

“A bank can only be as good as the environment they exist in,” Ho said. “We’re getting good inflows from the U.S. mainland as well as the Asian markets. And the housing market has been very, very strong and very balanced, and it’s likely that will continue for a while.”

The $16 billion-asset

Bank of Hawaii and FirstBank share other characteristics. Neither made a whole-bank acquisition during the three-year period measured by the ranking, and both have fairly diverse loan portfolios. “Moderation is the key across the risk spectrum,” Ho said. “We want to be omnivores across many different asset categories.”

The best-performing regionals also tend to manage their expenses better, Halsey said. Noninterest expenses as a percentage of average assets for the top 10 regionals was 2.29% last year. That is 20 basis points lower than for the entire peer group, which makes a big difference, Halsey said.

Acquisitions have helped bolster the performance of some strong performers, such as Western Alliance, while other banks are still waiting for deals to pay off.

The three-year ROAE for active acquirers lagged when compared with the 13.09% median for banks in the top 10. Each of the six banks in the peer group that made at least three whole-bank acquisitions from 2013 to 2015 had a three-year ROAE below 9.2%.

Banks with $10 Billion to $50 Billion of Assets, Ranked by 3-Year ROAE | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rank | Institution | Location | Total Assets ($000) | 3-Year Avg. ROAE (%) | ROAE (%) | ROAA (%) | Efficiency Ratio FTE (%) | Net Interest Margin (%) | Net Income ($000) | Change in Net Income, YOY (%) | Noninterest Income/Avg. Assets (%) | Cost of Funds (%) |

| 1 | Bank of Hawaii Corp. (BOH) | Honolulu, HI | 15,455,016 | 15.03 | 14.82 | 1.06 | 58.95 | 2.81 | 160,704 | -1.43 | 1.16 | 0.28 |

| 2 | FirstBank Holding Co. | Lakewood, CO | 15,553,681 | 14.96 | 14.07 | 1.19 | 55.22 | 3.53 | 177,878 | 1.39 | 0.79 | 0.17 |

| 3 | Western Alliance (WAL) | Phoenix, AZ | 14,275,089 | 14.80 | 14.67 | 1.56 | 45.12 | 4.51 | 194,244 | 31.29 | 0.24 | 0.30 |

| 4 | SVB Financial Group (SIVB) | Santa Clara, CA | 44,686,703 | 14.66 | 11.65 | 0.92 | 55.97 | 2.57 | 374,820 | -21.69 | 0.94 | 0.11 |

| 5 | Signature Bank (SBNY) | New York, NY | 33,450,545 | 13.53 | 13.77 | 1.23 | 33.65 | 3.26 | 373,065 | 25.74 | 0.12 | 0.47 |

| 6 | East West Bancorp (EWBC) | Pasadena, CA | 32,350,922 | 12.65 | 12.74 | 1.27 | 46.20 | 3.35 | 384,677 | 11.22 | 0.47 | 0.39 |

| 7 | Midland Financial Co.* | Oklahoma City, OK | 11,605,700 | 12.36 | 15.07 | 1.41 | 58.01 | 3.80 | 259,904 | 21.98 | 1.61 | 0.76 |

| 8 | Commerce Bancshares (CBSH) | Kansas City, MO | 24,604,962 | 11.57 | 11.25 | 1.12 | 60.67 | 2.94 | 266,975 | 1.59 | 1.89 | 0.13 |

| 9 | BankUnited (BKU) | Miami Lakes, FL | 23,883,467 | 10.97 | 11.62 | 1.18 | 58.32 | 3.94 | 251,660 | 23.23 | 0.44 | 0.72 |

| 10 | Bremer Financial Corp. | St. Paul, MN | 10,723,184 | 10.88 | 11.73 | 1.14 | 60.65 | 3.77 | 115,004 | 17.00 | 1.23 | 0.25 |

| 11 | PrivateBancorp (PVTB) | Chicago, IL | 17,259,421 | 10.75 | 11.57 | 1.13 | 50.72 | 3.26 | 185,311 | 21.06 | 0.76 | 0.46 |

| 12 | Texas Capital Bancshares (TCBI) | Dallas, TX | 18,909,139 | 10.72 | 9.34 | 0.79 | 54.25 | 3.12 | 144,854 | 6.24 | 0.26 | 0.28 |

| 13 | Hilltop Holdings (HTH) | Dallas, TX | 11,867,001 | 10.36 | 12.41 | 1.70 | 83.43 | 3.81 | 212,579 | 88.86 | 9.15 | 0.61 |

| 14 | Cullen/Frost Bankers (CFR) | San Antonio, TX | 28,567,118 | 9.86 | 9.65 | 1.00 | 56.78 | 3.42 | 279,328 | 0.49 | 1.17 | 0.05 |

| 15 | BOK Financial Corp. (BOKF) | Tulsa, OK | 31,476,128 | 9.49 | 8.66 | 0.96 | 65.52 | 2.56 | 292,259 | -1.09 | 2.15 | 0.24 |

| 16 | Prosperity Bancshares (PB) | Houston, TX | 22,037,216 | 9.16 | 8.51 | 1.33 | 40.06 | 3.38 | 286,646 | -3.63 | 0.56 | 0.22 |

| 17 | International Bancshares (IBOC) | Laredo, TX | 11,772,869 | 9.15 | 8.37 | 1.12 | 51.99 | 3.32 | 136,710 | -10.87 | 1.31 | 0.42 |

| 18 | Cathay General Bancorp (CATY) | Los Angeles, CA | 13,254,126 | 8.82 | 9.52 | 1.34 | 48.31 | 3.39 | 161,109 | 16.89 | 0.30 | 0.72 |

| 19 | TCF Financial Corp. (TCB) | Wayzata, MN | 20,691,704 | 8.80 | 9.28 | 1.03 | 70.57 | 4.42 | 205,823 | 13.33 | 2.21 | 0.42 |

| 20 | Webster Financial Corp. (WBS) | Waterbury, CT | 24,677,820 | 8.57 | 8.64 | 0.87 | 59.97 | 3.08 | 206,340 | 3.31 | 1.01 | 0.45 |

| 21 | Trustmark Corp. (TRMK) | Jackson, MS | 12,678,896 | 8.51 | 7.94 | 0.95 | 66.90 | 3.78 | 116,038 | -6.09 | 1.41 | 0.19 |

| 22 | EverBank Financial (EVER) | Jacksonville, FL | 26,601,026 | 8.31 | 7.23 | 0.55 | 65.52 | 2.99 | 130,526 | -11.86 | 0.91 | 0.98 |

| 23 | United Bankshares (UBSI) | Charleston, WV | 12,577,944 | 8.22 | 8.10 | 1.12 | 47.83 | 3.56 | 137,959 | 6.21 | 0.58 | 0.38 |

| 24 | Old National Bancorp (ONB) | Evansville, IN | 11,991,527 | 8.11 | 7.88 | 0.98 | 67.61 | 3.72 | 116,716 | 12.59 | 1.65 | 0.32 |

| 25 | Central Bancompany (CBCYB) | Jefferson City, MO | 12,041,047 | 8.04 | 7.91 | 1.02 | 61.68 | 3.36 | 121,492 | 5.21 | 1.24 | 0.20 |

| 26 | FirstMerit Corp. (FMER) | Akron, OH | 25,524,604 | 8.02 | 7.90 | 0.91 | 61.01 | 3.37 | 229,484 | -3.56 | 1.08 | 0.27 |

| 27 | Washington Federal (WAFD) | Seattle, WA | 14,684,899 | 8.00 | 8.04 | 1.08 | 49.76 | 3.12 | 157,007 | 0.95 | 0.25 | 1.01 |

| 28 | UMB Financial Corp. (UMBF) | Kansas City, MO | 19,094,245 | 8.00 | 6.43 | 0.65 | 77.80 | 2.64 | 116,073 | -3.80 | 2.56 | 0.12 |

| 29 | F.N.B. Corp. (FNB) | Pittsburgh, PA | 17,557,662 | 7.66 | 7.70 | 0.96 | 56.12 | 3.42 | 159,649 | 10.83 | 0.97 | 0.34 |

| 30 | Fulton Financial Corp. (FULT) | Lancaster, PA | 17,914,718 | 7.63 | 7.38 | 0.86 | 68.38 | 3.21 | 149,502 | -5.31 | 0.99 | 0.56 |

| 31 | Arvest Bank Group | Bentonville, AR | 15,856,246 | 7.56 | 4.50 | 0.39 | 88.01 | 2.81 | 61,119 | -34.36 | 2.49 | 0.28 |

| 32 | First Citizens BancShares (FCNCA) | Raleigh, NC | 31,475,934 | 7.43 | 7.52 | 0.68 | 74.62 | 3.22 | 210,386 | 51.84 | 1.33 | 0.16 |

| 33 | Wintrust Financial Corp. (WTFC) | Rosemont, IL | 22,917,166 | 7.33 | 7.02 | 0.75 | 66.13 | 3.36 | 156,749 | 3.53 | 1.28 | 0.42 |

| 34 | BancorpSouth (BXS) | Tupelo, MS | 13,798,662 | 7.15 | 7.71 | 0.94 | 70.69 | 3.57 | 127,491 | 9.20 | 2.05 | 0.24 |

| 35 | Valley National Bancorp (VLY) | Wayne, NJ | 21,612,616 | 7.04 | 5.26 | 0.53 | 69.12 | 3.20 | 102,957 | -11.38 | 0.39 | 0.91 |

| 36 | MB Financial (MBFI) | Chicago, IL | 15,585,007 | 6.92 | 7.73 | 1.07 | 63.91 | 3.84 | 159,206 | 84.28 | 2.17 | 0.23 |

| 37 | Stifel Financial Corp. (SF) | St. Louis, MO | 13,335,915 | 6.81 | 3.78 | 0.92 | 93.10 | 2.02 | 92,336 | -47.56 | 21.93 | 0.77 |

| 38 | PacWest Bancorp (PACW) | Beverly Hills, CA | 21,288,490 | 6.79 | 7.99 | 1.70 | 38.46 | 5.60 | 299,619 | 77.39 | 0.46 | 0.44 |

| 39 | Investors Bancorp (ISBC) | Short Hills, NJ | 20,888,684 | 6.65 | 5.26 | 0.92 | 51.38 | 3.09 | 181,505 | 37.80 | 0.19 | 0.81 |

| 40 | Associated Banc-Corp (ASB) | Green Bay, WI | 27,715,021 | 6.55 | 6.50 | 0.70 | 67.37 | 2.84 | 188,301 | -1.16 | 1.19 | 0.32 |

| 41 | Hancock Holding Co. (HBHC) | Gulfport, MS | 22,839,459 | 6.44 | 5.38 | 0.62 | 65.83 | 3.33 | 131,461 | -25.19 | 1.12 | 0.29 |

| 42 | Synovus Financial Corp. (SNV) | Columbus, GA | 28,792,653 | 6.26 | 7.49 | 0.80 | 62.70 | 3.16 | 226,082 | 15.79 | 0.94 | 0.48 |

| 43 | Iberiabank Corp. (IBKC) | Lafayette, LA | 19,504,068 | 5.58 | 6.32 | 0.78 | 65.07 | 3.58 | 142,844 | 35.55 | 1.19 | 0.37 |

| 44 | Astoria Financial Corp. (AF) | Lake Success, NY | 15,076,211 | 5.41 | 5.43 | 0.57 | 72.21 | 2.35 | 88,075 | -8.17 | 0.36 | 1.00 |

| 45 | Umpqua Holdings Corp. (UMPQ) | Portland, OR | 23,387,205 | 5.41 | 5.82 | 0.97 | 61.33 | 4.44 | 222,539 | 50.71 | 1.19 | 0.31 |

| 46 | People's United (PBCT) | Bridgeport, CT | 38,877,400 | 5.29 | 5.54 | 0.70 | 64.34 | 2.88 | 260,100 | 3.34 | 0.93 | 0.43 |

| 47 | Apple Financial | New York, NY | 12,795,071 | 4.67 | 4.04 | 0.34 | 60.44 | 1.67 | 40,260 | -23.82 | 0.12 | 0.53 |

| 48 | Sterling Bancorp (STL) | Montebello, NY | 11,955,952 | 3.93 | 4.86 | 0.69 | 50.70 | 3.65 | 66,114 | 12.66 | 0.60 | 0.45 |

| 49 | Third Federal Savings | Cleveland, OH | 12,390,594 | 3.76 | 4.15 | 0.46 | 62.86 | 2.18 | 58,471 | 14.93 | 0.14 | 1.04 |

| 50 | First Niagara Financial (FNFG) | Buffalo, NY | 39,918,386 | -1.28 | 5.42 | 0.57 | 68.45 | 3.01 | 223,705 | NM | 0.85 | 0.41 |

| Median: All Institutions | 19,001,692 | 8.03 | 7.91 | 0.95 | 61.17 | 3.32 | 160,907 | 5.21 | 1.00 | 0.38 | ||

| Median: Top 10 Institutions | 19,718,574 | 13.09 | 13.26 | 1.19 | 56.99 | 3.44 | 255,782 | 14.11 | 0.86 | 0.29 | ||

| Average: All Institutions | 20,555,582 | 8.47 | 8.43 | 0.95 | 61.07 | 3.30 | 182,873 | 10.11 | 1.61 | 0.43 | ||

| Average: Top 10 Institutions | 22,658,927 | 13.14 | 13.14 | 1.21 | 53.28 | 3.45 | 255,893 | 11.03 | 0.89 | 0.36 | ||

Notes: Ranking is of top consolidated bank holding companies, banks, and thrifts with total assets of between $10 billion and $50 billion as of 12/31/15 and is based on three-year average ROAE from 2013 to 2015.

Additional data is for the 12 months ended 12/31/15; year-over-year changes compare 2015 to 2014. Financials are from SEC filings. If unavailable, regulatory financials were used.

Excludes industrial banks, nondepository trusts, foreign-owned banks, and bankers' banks, as well as institutions with credit cards to total loans of more than 25%, loans to total assets of less than 20%, or loans to total deposits of less than 20% at 12/31/15. Excludes institutions with a leverage ratio of less than 5%, Tier 1 risk-based capital ratio of less than 6%, or total risk-based capital ratio of less than 10% during any quarter in the ranking period. Excludes institutions that received a tax benefit of greater than 10% of net income or that did not report data for any year in the ranking period. Also excludes institutions that have fewer than five depository branches and are owned by a company not primarily focused on commercial or retail banking. Ties broken using the 2015 ROAE and subsequently the 2014 ROAE.

* Denotes an institution that operated as a subchapter S corporation for at least one quarter between 2013 and 2015. Its profitability ratios were calculated from regulatory financials and adjusted using an assumed tax rate.

Source:

© 2016 American Banker Magazine