A consumer’s credit score used to be a commonly understood number — the time-honored FICO score — that banks all used in their underwriting. But banks increasingly are relying on dozens of scores that reflect a variety of data sources, analytics and use of artificial intelligence technology.

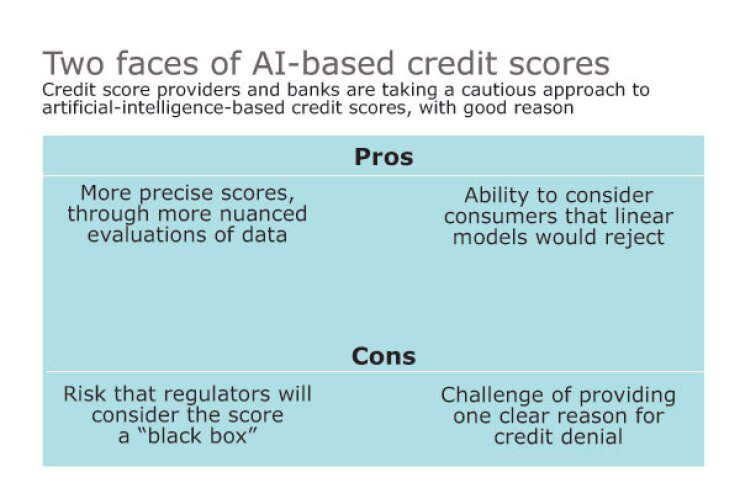

The use of AI offers lenders the ability to get a precise look into someone’s creditworthiness and score those previously deemed unscorable.

But such scoring techniques also bring uncertainty: What it will take to convince regulators that AI-based credit scores are not a black box? How do you get a system trained to look at the interactions of many variables, to produce one clear reason for declining credit? Data scientists at credit bureaus and banks are working to find answers to questions like these.

The benefits of AI-powered credit scores

There are two main reasons to use artificial intelligence to derive a credit score. One is to assess creditworthiness more precisely. The other is to be able to consider people who might not have been able to get a credit score in the past, or who may have been too hastily rejected by a traditional logistic regression-based score. In other words, a method that looks at certain data points from consumers’ credit history to calculate the odds that they will repay.

[Digital identity is broken, and fixes are urgently needed. Learn how large financial service and healthcare companies are tackling the issue – to enhance customer experience, to stake out positions in their business ecosystems, and to manage risk – on our Feb. 23 web seminar. Click

Machine learning can take a more nuanced look at consumer behavior.

“A neural network more closely mimics the way humans think and reason, whereas linear models are more dogmatic — you’re imposing structure on data as opposed to letting the data talk to you,” said Eric VonDohlen, chief analytics officer at the online lender Elevate. The more complex reasoning of artificial intelligence can find things in the data that wouldn’t be apparent otherwise.

And instead of considering one variable at a time, an artificial intelligence engine can look at interactions between multiple variables.

“It’s harder for the workhorse, logistic regression, to do that,” said Dr. Stephen Coggeshall, chief analytics and science officer at ID Analytics. “You have to do a lot of data preprocessing using expert knowledge to even attempt to find those nonlinear interactions.”

Consumers with several chargeoffs in their histories would most likely be considered high-risk borrowers by most traditional models. But an AI engine might perceive mitigating variables; though the consumers might have skipped payments on three debts in the past 24 months, they have paid on time consistently for the past year and have successfully obtained new lines of credit.

“It looks like that bad performance or bad history is in your past,” VonDohlen said. “That would be a simple example of how an AI world might help cast data in a more positive and more accurate light.”

AI-based credit scoring models let Elevate make sharper predictions of credit risk, approve the right people and offer better pricing to people who deserve it, VonDohlen said.

Elevate is deploying its new, AI-based models gradually, starting with 1% of potential borrowers, testing the results, and gradually applying them to more people.

Credit bureaus are starting to adopt AI in their credit scores, too.

Equifax calls the machine-learning software that it uses in credit scores NeuroDecision Technology.

Technologies like

“Before, if you gave me a million observations, it would take a week to sort through it,” Maynard said.

ID Analytics uses what it calls “convolutional neural nets,” a flavor of deep learning, in its fraud and credit scores, Coggeshall said. For its Credit Optics Full Spectrum credit score, AI engines look at consumer payment data from wireless, utility and marketplace loan providers, to score consumers who have “thin” or no credit bureau files, including young people and new credit seekers.

Experian is taking a more cautious approach. It uses traditional logistic regression methods for its credit scores, but in its labs it experiments with machine learning.

When the technology seems to make a significant difference in performance, the company will provide credit scores based on machine learning, said Eric Haller, executive vice president of Experian’s Global DataLabs. For now, he sees machine learning giving only a nominal lift in results.

“The opportunity is not building the next VantageScore, because believe it or not, those scores work really well,” he said.

To let clients experiment with machine learning, Experian offers an analytical sandbox with its credit data loaded into it.

“They can load their own data in and we’ll sync it up with historical credit archive data, and we’ve overlaid it with a set of machine-learning tools,” Haller said. Most large financial institutions are using the sandbox today, he said.

TransUnion, the other major credit rating agency, did not respond to requests for an interview.

Now for the confusing part

The cons of AI-enhanced credit scores include the risk that the full underwriting process will be hidden from consumers and that the practice would raise transparency questions among regulators.

Last month, the Consumer Financial Protection Bureau imposed $23 million in fines to TransUnion and Equifax, noting they claim banks use their scores to determine creditworthiness, when that isn’t always the case.

“In their advertising, TransUnion and Equifax falsely represented that the credit scores they marketed and provided to consumers were the same scores lenders typically use to make credit decisions,” the CFPB said in a press release announcing the fines. “In fact, the scores sold by TransUnion and Equifax were not typically used by lenders to make those decisions.”

Some say the regulator was misguided.

“Both scores being sold by TransUnion and Equifax, VantageScore and the Equifax RiskScore, are real credit scores that are Equal Credit Opportunity Act compliant, are commercially available to lenders and are, in fact, used by lenders,” said credit expert John Ulzheimer.

Equifax says it ran all of its AI-based scoring technology past the OCC, Fed and CFPB and got a positive response. ID Analytics said it worked closely with lawyers, compliance officers and regulators to assure the technology complied with various lending rules.

Another challenge to using artificial intelligence, specifically neural networks, in credit scores and models, is that it’s harder to provide the needed “reason code” to borrowers — the explanation of why they were denied credit.

Concerns about the reason code are the main reason many businesses don’t use nonlinear machine-learning models for credit scores yet.

“A lot of the confusion and heartburn is around, ‘How do you boil an extremely data-rich learning process into a marginal rationale for declining a loan?’ ” VonDohlen said.

However, neural networks, which are essentially designed to think like a brain, can also be used to help find the one variable that represents the greatest risk.

“It’s almost never the case that you would decline someone for a rat’s nest of variable relationships,” VonDohlen said. The reasons for credit denial, he said, "are almost always very clear.”

Equifax has developed a proprietary algorithm that can generate reason codes for consumers, Maynard said.

Experian is also working on techniques that would make AI credit-based score decisions more explainable and auditor friendly.

“We’re not operating under any assumption that a black box credit scoring model would even work or be accepted in the market,” Haller said. “We are 100% focused on how do we bridge the gap such that we can bring better performance to models, but still maintain the same integrity, where they can be explained to the OCC and our clients are comfortable with understanding how the models are working and the results they’re getting.”

But in the end, consumers won’t be confused, according to Ulzheimer.

“Regardless of how many scoring systems are being used, they are all based on three credit reports,” he said. “If you've got three great credit reports, then every single scoring system being used is going to yield a high score.”