-

Apps that help people manage their money on a day-to-day basis are all the rage among millennials. Here are the most effective of the bunch.

September 10 -

Banks needs to deeply understand the needs of their customers before they start rolling out ambitious high-tech plans.

November 17 -

The possibility that Congress may fail to pass a spending bill by the end of this month or not raise the debt ceiling had no bearing on the Federal Reserve Boards decision to maintain its accommodative monetary policy, Fed Chair Janet Yellen said Thursday.

September 17 -

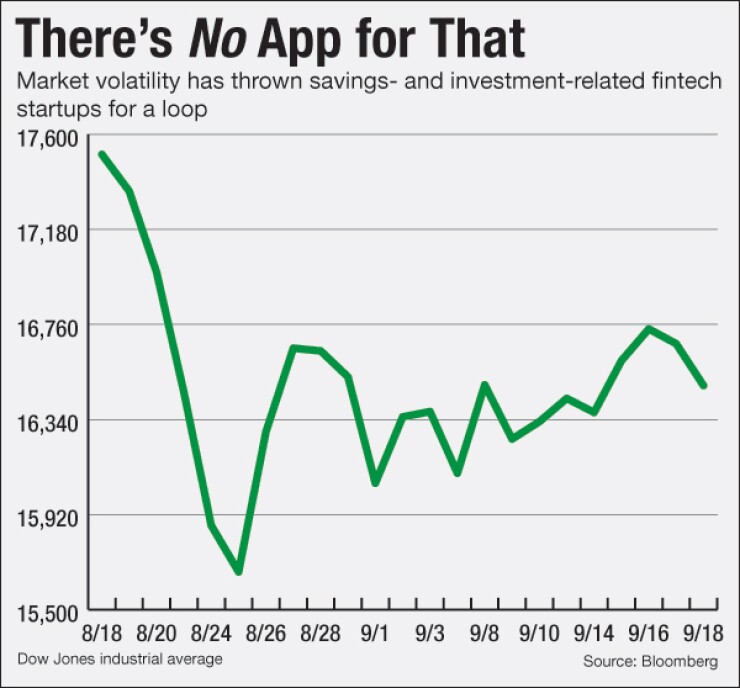

Stock fluctuations will fuel investment banking fees in the short run, but a prolonged shock would complicate bank M&A and could tighten margins, crimp wealth management fees and present other risks.

August 24

Investing in the market for the first time can be thrilling — it can also be terrifying when the market goes on a roller-coaster ride.

Companies that provide apps that help consumers save money or invest amounts typically too small for investing are one of the hottest areas of fintech these days. But when the

"Don't panic" became the theme for many of them, as they sought to quell fears. More seasoned companies, however, say experience has taught them that few things send people into a tizzy like telling them not to panic.

Whatever the approach, market volatility is an example of a special challenge for all fintech companies that connect consumers with digital products: how to handle a highly emotional event with a product that

"When mixing emotions and money, it is one thing when the interactions are face to face, but limited interaction is part of the very design of these sorts of digital platforms," said Mark Schwanhausser, director of omnichannel financial services at Javelin Strategy & Research. "There are ways to win and ways to lose."

Acorns declined to say if the message was prompted by increased traffic to its website or if users were withdrawing their money. In an emailed response, a spokeswoman said that users "generally become more interested in financial education after spending time with our app, so this email provided tips for what customers can do at this time."

SparkGift, a microinvesting platform that sells stock in companies like Google, Apple and Tesla via gift card, took to Twitter. "Now is a good time to take a breath," the company wrote as it also looked to put the drop in historical context.

Peggy Mangot, chief executive of SparkGift, said she was expecting some panicked sellers, but they didn't materialize. But there was an increase in logins, meaning that people wanted to know what was going on with their stock. The gifts are often to kids, so long-term investing is part of the allure. Still, Mangot said, the volatility is a hands-on course.

"We are trying to teach kids about the market, and there is no better way to teach than to have an account and experience it firsthand," Mangot said.

Communicating with their customers and trying to put the drop in context was the right move, Schwanhausser said. That's what traditional advisers were likely doing with their clients, too, during the volatility.

While the overwhelming message to investors from Acorns, SparkGift and likely advisers worldwide was to stay the course, Schwanhausser said the follow-up might be to encourage users to consider their risk appetite.

"If you picked your allocations in rosy times, were you overconfident with how much of a drop you could handle?" Schwanhausser said.

Schwanhausser returned to the same point several times — in times of volatility, the digital investing companies ought to mimic what traditional advisers are doing.

Daniel Egan, director of behavioral finance and investments at Betterment, disagreed. Egan says that the customer base is too different. What works for people who work with a traditional adviser doesn't work with someone who is using a digital option.

"If a [traditional] adviser would have called me on that Monday I would have said, 'Why are you bothering me with this?'" Egan said last week in an interview at the Too Big to Evolve conference at Baruch College in New York. "There is a bit of misextrapolating from the way it works with traditional advisers to the way it works with us."

Egan added that Betterment has been through four market cycles where drawdowns totaled at least 10%. From that, it has learned some things. For instance, it advises against emailing all customers. Instead, during the volatility in August, it had a pop-up window for those who did log in that explained what was happening in markets and Betterment's viewpoint.

"Starting on that Friday, where things started to crash, 83% of our customers didn't log in over the week. People hire us so that they don't have to deal with this," Egan said. "If we emailed 100% of our customers, we would have caused 83% of them to have to deal with something that they didn't want to deal with."