Banks make more money when consumers know where their money is going.

Quite a lot of money, actually, according to Intuit Inc., which dominates the market personal financial management software.

The Mountain View, Calif., vendor popularized this technology with its Quicken application, and has been leading the charge to get banks to offer financial management tools through their Web sites. About 400 banks and credit unions are offering the FinanceWorks software Intuit introduced a year ago, and this week Intuit shared some key results from these early users.

One major finding: Online banking users who have signed up for FinanceWorks deliver six times more annual revenue to their bank than people who use online banking services alone.

Sasan Goodarzi, the senior vice president and general manager in charge of Intuit's financial institutions business, said financial management software is more interactive than most other online banking tools.

Paying bills or checking balances online does not typically lead to subsequent interactions with a bank, but Goodarzi said that using PFM tools to evaluate spending habits and keep track of various accounts can often encourage people to change their practices. And if customers are using financial management software at their bank, they are likely to look to their bank to help them resolve any problems they may have found, he said.

Financial management software offers "relevant services solving important problems for users in such a way that it makes the financial institutions far more relevant," Goodarzi said in an investors day presentation Wednesday.

FinanceWorks users have been receptive to cross-selling efforts as consumers try to rein in their spending and earn more from their deposits, Goodarzi said. Ninety-four percent of the consumers using FinanceWorks also receive their paychecks through direct deposit to accounts at the same bank, a clear sign that people consider it their primary banking relationship, he said. (Intuit also offers a version of FinanceWorks aimed at small-business owners.)

Mark Schwanhausser, a research analyst for Javelin Strategy and Research of Pleasanton, Calif., said that implementing PFM tools makes it less likely that users will move their accounts to another bank and more likely that they will purchase additional banking products.

Financial management software is most useful to people with a variety of accounts — checking, savings, high-yield savings, brokerage, Schwanhausser said. These people will generally have more assets on deposit, making them especially valuable bank customers.

"The cross-sell is a key piece," Schwanhausser said. PFM tools offer banks "the advantage of being able to draw in assets" from other places, increasing deposits and spending activity.

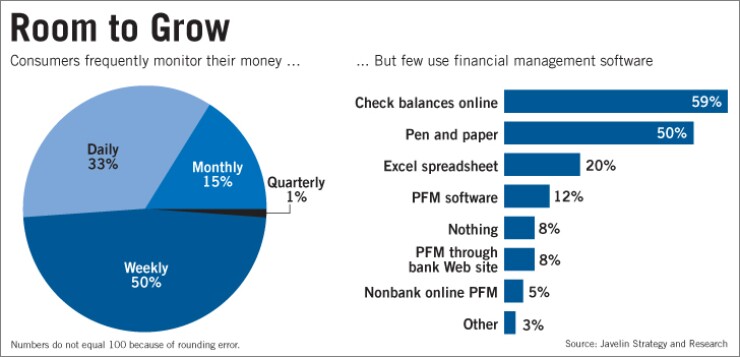

However, according to a report Javelin released this week, few people are using PFM technology. Schwanhausser, who wrote the report, said that 12% of consumers use financial management software installed on their home computer, 8% are using applications offered by banks, and 5% manage their money through nonbank Web sites, such as the site operated by Mint Software Inc., which Intuit has agreed to acquire.

Most people — 59% — check their balances individually at their banks' Web sites.

Schwanhausser said that "one of the main methods for people to manage their money is simply to say, 'How much have I got?' … they look for snapshots to figure out what their life looks like."

Even though most people have developed this habit, they are not content with it, Schwanhausser said. "They're really interested in something more automated, but the banks don't provide it." Javelin surveyed 2,019 online consumers in August.

PFM technology is an untapped market for banks, he said. "Consumers are saying, 'Make it simpler for me, consolidate my life,' … and so far the banks seem to have a deaf ear for that," he said. "To me, it's a screaming opportunity."

Intuit's $170 million deal for Mint, also of Mountain View, was announced last week and is expected to close in the fourth quarter. It would solidify Intuit's place in the market. According to the Javelin report, among people who use online PFM tools, 48% use Intuit's Quicken Online and 31% use Mint.

Two of Mint's rival providers of online financial management tools, Wesabe Inc. and Geezeo Inc., also began offering PFM software this year that banks can deliver to customers, though they do not have Intuit's reach.

Marc Hedlund, Wesabe's co-founder and chief executive, said the company has signed two clients to date.

Though Intuit is much larger, there is still room for Wesabe to thrive, he said. "Intuit definitely has advantages when selling to their current customers, but that's not the whole market," Hedlund said, "and really it's not even where most of our requests are coming from."

Peter Glyman, a co-founder of Geezeo, said "it's apparent most banks and credit unions are allocating 2010 budget dollars to PFM — no longer a matter if needed, simply a matter of when."