Carrie Jenkins has been working to improve the way reports are generated at Centra Credit Union in Columbus, Indiana.

“When I joined Centra [five years ago], the business analytics department didn’t exist, and to generate a report of any kind you had to have our chief information officer build one,” said Jenkins, who is currently assistant vice president of business analytics for Centra. “Now, we've adopted so many database-oriented solutions that we can't maintain all the physical servers needed to support them all.”

The

Centra is part of a growing number of credit unions looking to cloud providers for lower-cost and lower-maintenance software not only to improve preexisting functions, but quickly develop and adopt new products and services.

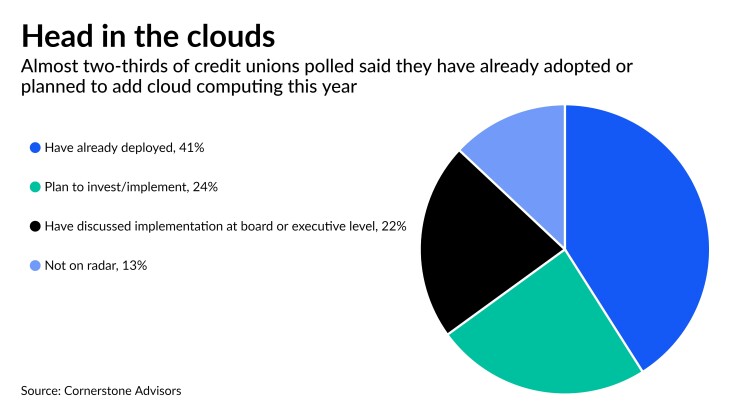

For example, 41% of credit unions recently surveyed by Cornerstone Advisors said they have already deployed cloud-computing technology, and 24% said they were poised to do so.

Currently, the credit union is using a version of Trellance’s software that runs on-site. It is working with the company to integrate M360 with its core platform, DNA from Fiserv, which will allow a full move to the cloud platform.

As existing contracts with service providers conclude, each time the credit union begins the request-for-proposal process anew, Centra is considering cloud solutions, Jenkins said.

“It's going to be much easier for us to move to cloud-based operations wherever we can, and wherever it's secure and reliable … and it just helps with the ‘care and feeding’ of that application if we don't have to also maintain the hardware that goes with it,” Jenkins said.

Trellance says credit union clients use its data-analytics software to examine trends in consumer lending behavior, member credit card transactions and more so they can provide members with tailored offerings.

“In partnership with our credit union clients, we work side by side to gain access to their data and analyze the trends contained within. … Once done, we can provide them with an indication of what they can expect in the future and help them take action to improve their member experience by offering services that will be needed in the time to come,” said Paolo Teotino, chief product officer at Trellance.

The potential benefits of cloud computing, such as streamlined information technology management and lower costs, always have to be weighed against the potential risks of security breaches and data leaks.

Addressing these risks, IBM, Google, Amazon and others recently

Brad Smith, a partner at Cornerstone Advisors, said credit unions are looking to lower the costs of software purchases and continuous maintenance.

“When people begin to think about the benefits of credit unions moving to the cloud, the top of the list is the lower cost of ownership long term. … Sometimes there are upfront costs to deal with, but they’re typically much less than the sizable costs to be paid every time an upgrade is needed,” Smith said. “There’s a future-proofing component within many of these platforms because they’re continually maintained and upgraded at a rate that would be difficult for a typical credit union to maintain.”

And because cloud providers typically have large teams of full-time IT professionals, they can provide a higher level of security, he argued.

Centra is considering wider use of cloud software, including in loan origination and credit card processing, Jenkins said. Her goal is to reallocate the credit union’s IT resources to focus on growth-related initiatives.

“We have lots of talented people, but we have grown so quickly that we've really tapped out the that resource that we have internally … and I'm looking forward to the time when I can free them up to work on new projects, instead of taking care of my existing infrastructure all the time,” Jenkins said.