If you launched a bank in 2006, it was your rotten luck to open for business on the cusp of a severe recession. Or, depending on how you look at it, you stood a good chance of being part of the problem by joining a crop of institutions built on brokered deposits and real estate lending that produced a costly string of failures.

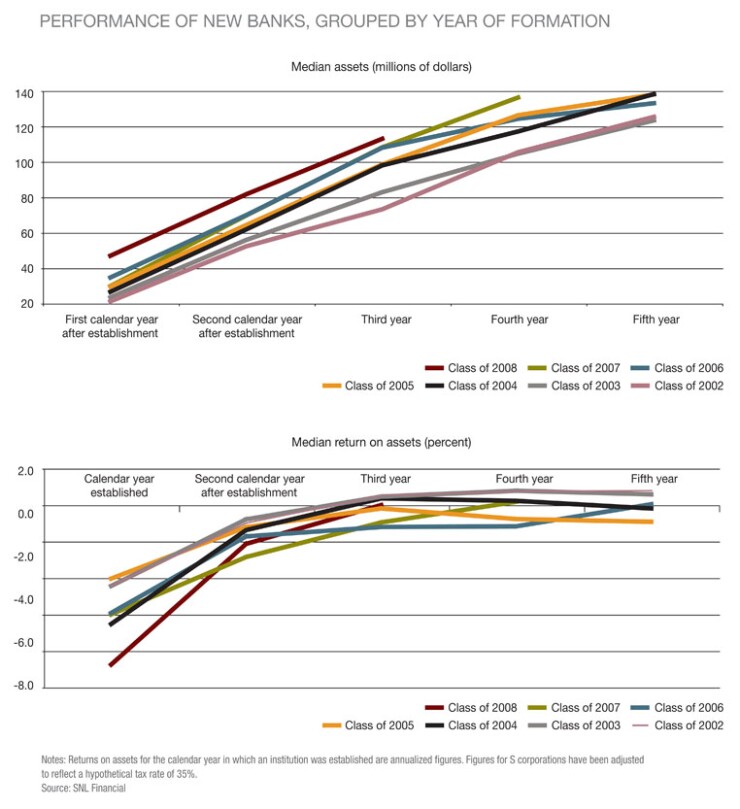

Either way, across the roughly 800 startup banks established since 2002, the class of 2006 has had one of the toughest runs. The median institution in the group had just barely crossed into profitability as of 2010, the fifth calendar year after establishment, with a return on assets of 0.02 percent, according to data from SNL Financial.

The results were similarly uninspiring for banks launched in 2007, among which the median ROA was 0.16 percent in 2010, or the cohort's fourth calendar year of operation, and for banks launched in 2005, whose median ROA has failed to reach positive territory in six calendar years of operation. By comparison, banks established in 2002 and 2003, as the economy was emerging from the previous recession, posted median ROAs of 0.76 percent in their fourth calendar year of operation, though profitability for those groups has been sapped by the recent slump. (See charts. For underlying figures and additional data on deposit and loan ramps in an Excel spreadsheet,

In all, bank startups since 2002 have accounted for nearly a fifth of the roughly 400 failures since 2007. The dismal record prompted the Federal Deposit Insurance Corp. to extend the period during which new institutions are classified as "de novo" banks, subjecting them to

There was a "herd mentality" among many of the startups, says Randy Dennis, the president of DD&F Consulting Group in Little Rock, Ark. "All of these banks went out and hired key people from other banks who brought their portfolios over. Almost all of them were construction lenders."

Chip MacDonald, a partner at Jones Day, says that new banks in the greater Atlanta area—an epicenter of the de novo boom and bust—wound up competing for the scraps left over by the region's dominant lenders, SunTrust Banks, Wells Fargo and Bank of America. "They had great intentions. They were going to provide better, more personalized, local service that was going to attract customers," he says. But they failed to create "solid franchises built on deposits and customer relationships because they were selling mostly interest-bearing deposits that you can sell over the Internet or through brokered channels. They didn't build up lots of customer relationships that would have better met their business plans."

Whatever the lessons offered by the startups of the past decade, there likely will be few opportunities to apply them for some time to come. Only two community banks have been founded since the beginning of 2010.