WASHINGTON — Recent steps allowing more lenders to skip outside appraisals are seen as removing a key hurdle to closings, but appraisers say they could be collateral damage from the deregulatory policies.

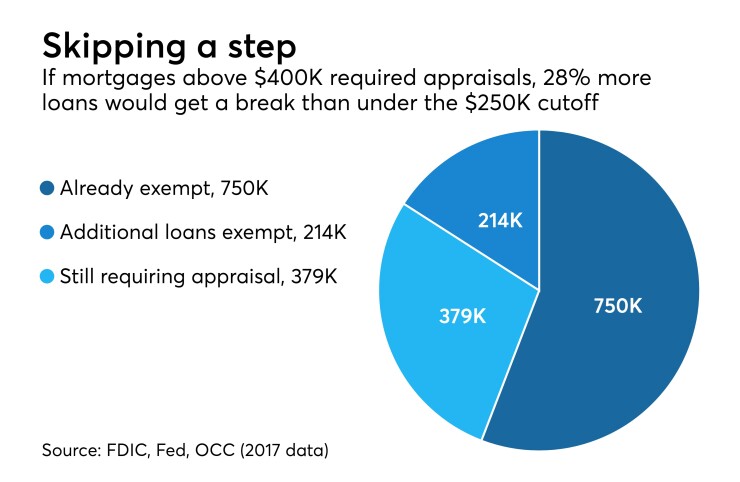

The Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency

But appraisers are raising concern that the proposal would not only hurt their business, but also leave consumers with a less viable method for verifying home values. Evaluations don’t adhere to the rigorous standards that appraisals do, and have become increasingly automated.

“The appraisal is the one aspect of a transaction where the appraiser is the independent, objective and impartial participant in the transaction,” said James Murrett, the president of the Appraisal Institute. “They don’t have a dog in the fight, so to speak, the way that the broker who wants to try and get the deal closed and the banker wants to try and get the loan approved.”

The recent proposal, which the regulators issued under their authority to eliminate outdated or unnecessary rules, follows other policy steps to ease appraisal requirements. In April, regulators

Banks had long been concerned that appraisal exemptions were not keeping pace with home values. Smaller banks reacted positively to the CRE-related measure, saying it

But whereas appraisers did not object to those earlier steps, they say the latest proposal on residential mortgage transactions could significantly lower the standard on property valuations.

Appraisers must meet strict credential requirements, but almost anyone with knowledge of the real estate market can perform a less rigorous "evaluation," said Tony Pistilli, the chief property appraiser at Computershare Property Solutions.

Those performing evaluations "have absolutely no risk of being disciplined for improper methodology or even fraud,” he said. “Appraisers would lose their license, so there’s that standard of care that is commensurate with the license that they have, but not in individual preparers.”

The Dodd-Frank Act codified the uniform standards and independence of appraisers following the 2008 financial crisis, and even made it possible for appraisers who violated certain requirements to be prosecuted and fined.

“A huge part of the housing and then economic meltdown in 2008 was impacted by very, very terrible abuses done in the appraisal field — people getting false appraisals and appraisals that were intentionally inflated that gave consumers a false sense of security on what the value of their home was,” said Yana Miles, the senior legislative counsel at the Center for Responsible Lending.

There is some concern among appraisers and consumer advocates that exempting more loans from an appraisal requirement could lead to a down cycle in the housing market that Dodd-Frank sought to avoid.

“The crack of the door is open and as they start to open the door a little bit more and a little bit more, all of a sudden the significant portions of the transactions out there are not going to have the requirement to have an actual physical body looking at the property, which is so important,” said Murrett.

An appraisal exemption like that proposed by the banking agencies would also be much riskier for lenders, said Miles.

“I would think that lenders would want assurances that there’s adequate collateral for the loans that they’re lending,” she said. “That plays a huge role into what you get back as a lender.”

Murrett agreed that appraisal requirements help lenders identify borrowers that might be overleveraged.

“It’s important for the lender to recognize what their loan-to-value situation is at the outset and whether or not they have a high-risk loan in terms of a high loan-to-value, or they have a lower-risk loan,” Murrett said.

However, the appraisal exemption — which would not apply to loans sold to or guaranteed by Fannie Mae, Freddie Mac, the Federal Housing Administration or the Department of Veterans Affairs — could help address an ongoing lack of appraisers, especially in rural areas of the country.

“The appraiser population has been shrinking and the shortage is particularly acute in rural areas, which can make it much harder to lend there,” said Ben Olson, a partner at Buckley Sandler.

This was partly addressed in the regulatory relief bill President Trump signed in May, which included an exemption for certain loans under $400,000 made in rural areas.

To be sure, appraisers do recognize how a shortage in their ranks, particularly in rural areas, can make the process more difficult.

“You’re starting to see growing areas where there’s pockets of no or very low coverage of appraisals, so [evaluations] are seen as a viable alternative for people in those situations in particular,” said Pistilli.

In fact, the Appraisal Institute along with dozens of other real estate valuation groups applauded the Senate’s efforts to modify appraisal policies in a March letter to Banking Committee Chairman Mike Crapo, R-Idaho, the bill's principal author. Under the new law, a lender in a rural area qualifies for the exemption if they first attempted to contact three appraisers to perform a valuation but finds that none are available.

“Thank you for including several clarifying provisions relating to rural residential appraisals to Section 103 of S. 2155, the Economic Growth, Regulatory Relief, and Consumer Protection Act,” the group said in the letter. “These provisions will help ensure that banks make a good faith effort to place the appraisal with local market appraisers, consistent with the bill’s intent.”

When the regulators increased the threshold required for an appraisal on commercial properties, appraisers commended the agencies for maintaining the current threshold for residential property appraisals.

“We applauded them for not increasing the residential [threshold], and now, less than three months later, they’re coming back and proposing raising that same threshold,” said Murrett.

The new proposal also goes further than the reg relief law, by not requiring a good-faith effort by lenders to seek appraisers for loans under the proposed higher threshold.

The three bank regulators cited the cost and the time an appraisal takes to complete as the primary reason to expand the scope of exempted loans. They issued the proposal under the Economic Growth and Regulatory Paperwork Reduction Act, which requires regulators every 10 years to conduct a review to identify outdated rules.

“Reducing regulatory burden by increasing the appraisal threshold for residential real estate transactions may provide both transaction cost and time savings for both regulated institutions and consumers,” the agencies said in the notice of proposed rulemaking.

The National Association of Realtors backed up the agencies’ reasoning behind the proposal.

“NAR agrees with the effort to limit the time and cost associated with completing residential real estate transactions while increasing market efficiency,” said Shannon McGahn, the group’s senior legislative counsel, in a statement.

Although an appraisal can be more expensive in rural areas where appraisers may be spread thin, the cost and time it requires is insignificant in an overall home transaction, said Murrett, who noted that an appraisal usually costs between $300 and $800.

“The different regulators or lenders are saying that they need quicker and cheaper appraisals,” he said. “Well, it’s interesting that they use the ‘quicker’ and the ‘cheaper’ but they don’t talk about quality, and that’s where the concern comes in that there’s a loosening too much of credit standards that ultimately could be a risk to the creditworthiness of the institution and the safety and soundness of the institution.”

Still, real estate transactions are a lengthy process by itself even without appraisals, said Miles.

“Changing this one requirement will not make the home-buying process easier or go faster,” she said. “I can say that with confidence.”

But the agencies argue the exact opposite, claiming that proper evaluations would provide the same level of protection to a consumer as an appraisal. They also maintain that the higher threshold would keep pace with rising home prices (the appraisal threshold for residential transactions was last changed in 1994), and that consumers have more access to residential real estate documents — such as property records — through the internet.

Pistilli understands that argument and acknowledges that "a consumer would never complain about getting charged less ... and having [the process] done quicker." But he said a real danger is if Fannie, Freddie and other backers of government-guaranteed loans decided to waive their property inspection requirements.

Murrett said the expanded exemption will likely not lead to significant headwinds in the mortgage market.

“The appraisal is just one spoke in the wheel of an underwriting transaction, and so to say that increasing the threshold for appraisals would be the reason why there would be concern of a recession is probably giving the appraisal a little too much credit, as much as I would like to give it a lot of credit,” he said.

But he suggested the proposal could breed ignorance about true property values.

“Maybe the consumer needs to know that they’re overpaying compared to the marketplace,” Murrett said. “If they still want to overpay, that’s their call, but the bank needs to know that the value of the property isn’t what someone is paying for the property. In a way, the appraiser is the eyes and the ears on the ground.”

Miles warned about a return to conditions that led to the 2008 crisis.

“It essentially opens an entire door for predatory actors to turn to that practice of inflated home prices and false appraisals and prospective homeowners not having an accurate picture of what their equity is and what the value of their home is,” she said.