Customers are increasingly banking on their mobile phones, but not signing up for accounts with them. That’s a problem for banks.

Mobile banking is clearly an area where banks are investing heavily given

That makes the state of

“Financial institutions are pouring digital investment dollars into advanced servicing and marketing, while account opening — the single digital feature most clearly tied to return on investment — is left broken at most banks,” said Daniel Van Dyke, senior research analyst at BI Intelligence. “It's bizarre."

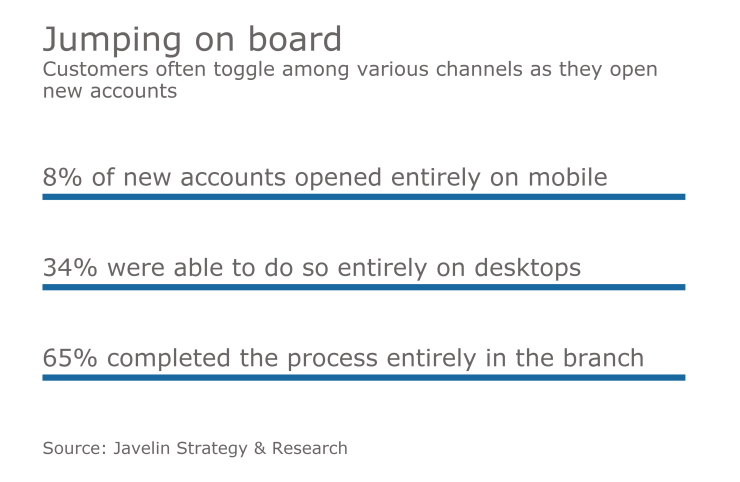

Although the branch remains the primary place where people originate new accounts, there is a desire to open accounts from mobile devices, said Mark Schwanhausser, director of omnichannel financial services at Javelin Strategy & Research.

There are several critical phases of opening an account, including researching options, starting an application, seeking help or advice, providing documentation and completing the application, Schwanhausser said. That means there are numerous points when consumers might initiate an application in one channel but switch to another out of necessity or preference. The documentation aspect may be the biggest hindrance of all, he said.

“Submitting documentation is a big piece that’s taking people off of the mobile device and into another channel to complete the process,” he said.

BMO Financial Group says it may have solved the thorny issue.

Last year the Canadian bank engaged in a larger project with the vendor GMC Software around the digitization of documents. Part of that project included introducing a new mobile onboarding functionality that enables its Canadian consumers to open a BMO Personal Banking account on a smartphone in eight minutes from start to finish, said Abe Karar, director of business process and integration and personal and commercial banking at BMO.

“We created this platform, but it’s not just about nifty technology; it’s about what does the process look and feel like to the customer,” Karar said.

According to Karar, the technology detects when a customer is on a mobile device and puts them through a journey tailored to that channel. It asks the customer for information, then generates documents and the customer fills out newly designed, mobile-optimized digital forms, Karar said, which are then pushed to a private cloud. Once the process is completed, it automatically signs the customer up for online banking and sends out a debit card; the customer never has to go into a branch.

Since BMO launched the service last June after an eight-week implementation period, about 40,000 total new accounts have been opened up through a completely digital, single channel experience, Karar said. (The vast majority of which were through a mobile device, though that figure includes some desktop users, he noted.) BMO opens about 60,000 new accounts a month in its branch network, and Karar expects a good portion of those will move to the mobile channel as more customers take advantage of this new capability.

Karar added that the new mobile onboarding feature has proven to be not just popular with stereotypical tech-savvy millennials, but also with rural customers who may not have immediate access to a branch, for example.

With the success of the mobile onboarding process for personal accounts, Karar said BMO is looking to bring it to other types of products, such as wealth management services, as well as launching it at its BMO Harris unit in the U.S.

“The U.S. is even more paper-based" than Canada, "so we think it would do great there,” Karar said.

Offering such services is important for banks, not to make the digital channel the dominant one but to enable a great experience for whatever channel a customer chooses, Schwanhausser said.

“Some people still do like to go into a branch,” he said. “In whatever channel a customer chooses, it should be a straight-through experience.”

But offering an end-to-end digital experience is important because, in general, customers that use digital channels frequently tend to be more profitable, Schwanhausser said.

“They usually have more than one product” with the bank, he said. “And people turn [to digital] to research products. The digital channel is a sales channel.”

Karar agreed. He said that thinking played a big role in deciding to pursue the digitization project.

“Customers onboarded through mobile have a higher propensity for additional products, and tend to be low-touch customers,” he said. “But our previous process was archaic; it was extremely paper intensive, very cumbersome and created a bad experience for both the customer and the employee.”

That’s a very common theme in the industry, said Marc Butti, a senior client executive for financial services with GMC Software.

Most banks "have a long history of manual processes due to inflexible legacy systems, that involve a lot of paper,” he said.

For Karar, offering the mobile account-opening capability is important not only to compete with other banks, but to meet customer expectations in a digital world.

“We’re in an environment where we’re not just competing against companies in the financial industry,” he said. “It really boils down to the experience, and customers are used to great mobile experiences.”