To understand why Huntington Bancshares Chairman and CEO Stephen Steinour is so bullish on consumer lending, it helps to look at his bank’s book of loans to boat and recreational vehicle owners.

Though the portfolio is small, accounting for less than 4% of total loans, it has been the fastest-growing category in Huntington’s $37.1 billion consumer loan book over the past year. The reason: With unemployment low and wages rising, consumers feel confident in buying big-ticket items like speedboats and mobile homes.

Throw in two recent cuts by the Federal Reserve — with more likely to follow — and it’s not hard to see why consumer, not commercial, lending could drive profits at Columbus, Ohio-based Huntington in the fourth quarter and beyond, said Steinour.

“You have a labor constrained recovery with the consumer benefiting broadly and that’s only magnified with the incremental disposable income they get from refinancing mortgages,” Steinour said in an interview Thursday.

Over the years, the $108.7 billion-asset Huntington has invested a great deal in its retail products and services, like its Fair Play banking and

The third quarter was a tough one for banks as two rates cuts by the Federal Reserve challenged revenue growth. That was particularly true in commercial lending, as rate cuts forced banks to reprice floating-rate loans. Many bankers and analysts are warning that the next several quarters could be even more trying if the Fed continues to cut rates in an effort to keep the economy strong and stave off a recession.

At Huntington, earnings per share of 34 cents beat the mean estimate of analysts surveyed by FactSet Research Systems by a penny, but overall net income declined 2% to $372 million from the year ago period. Net interest income declined 1% to $805 million, and the net interest margin narrowed 12 basis points to 3.20%.

Total loans did increase by 3% to $75 billion, led by a 6% increase in commercial and industrial loans to $30.6 billion and a 10% increase in residential mortgages to $11.2 billion.

Steinour said commercial loan pipelines have thus far been strong in the fourth quarter, but trade worries and labor costs are also giving business clients reason to think twice about borrowing. He said that he’s not “bearish” on commercial lending, but he is warning investors that the pace of growth could slow in the year ahead.

Credit quality is also starting to weaken. Nonperforming assets rose 19% to $482 million from last year, which Huntington said was led by the C&I portfolio. Net charge-offs rose to $72 million from $29 million a year ago, mainly because of two energy credits.

Brian Klock, an analyst with Keefe, Bruyette & Woods, said Steinour is doing what many bankers are doing this earnings season: managing investor expectation amid business clients’ unease over trade policy and business conditions. Credit quality is still good, but nonperforming assets have ticked up — albeit off historic lows.

“He’d probably just rather be cautious knowing all that stuff’s adding up,” Klock said of Steinour.

Consumer loan growth was actually pretty modest in the third quarter, as demand for home equity and car loans declined, but the double-digit growth in residential mortgage and boat and RV lending were bright spots. Overall, loans for purchases of boats and RVs climbed 17% year over year to $3.5 billion.

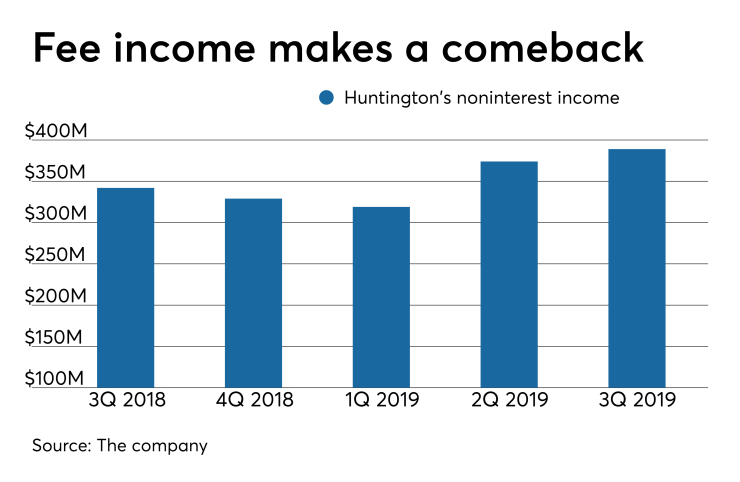

The surge in mortgage volume, driven by the decline in interest rates, boosted fees from mortgage banking by 74% year over year, to $54 million. Overall, noninterest income increased 14% to $389 million, thanks also to growth in deposit service charges, card and payment processing income and capital markets fees.

Still, the revenue challenges banks are facing are real, and many will have no choice but to cut expenses to hit their profit targets.

Huntington is one of at least three regional banks that

“As you start eating into margins, you should expect that [bankers will] react as prudent businesspeople and that will mean layoffs,” he said.