When stock markets go haywire, you never have to look too far to find casualties or near casualties in bank M&A.

Take the deal between Univest Corp. of Pennsylvania in Souderton and Fox Chase Bancorp in Hatboro, Pa. The $2.9 billion-asset Univest

But it almost didn't happen.

-

Univest Corp. of Pennsylvania in Souderton has agreed to buy Fox Chase Bancorp in Hatboro, Pa., for $244.3 million.

December 9 -

Fox Chase Bancorp in Hatboro, Pa., has won permission to ditch its federal charter.

October 3 -

Thomas Petro discusses how proactive changes might have kept the Pennsylvania company from failing.

February 21

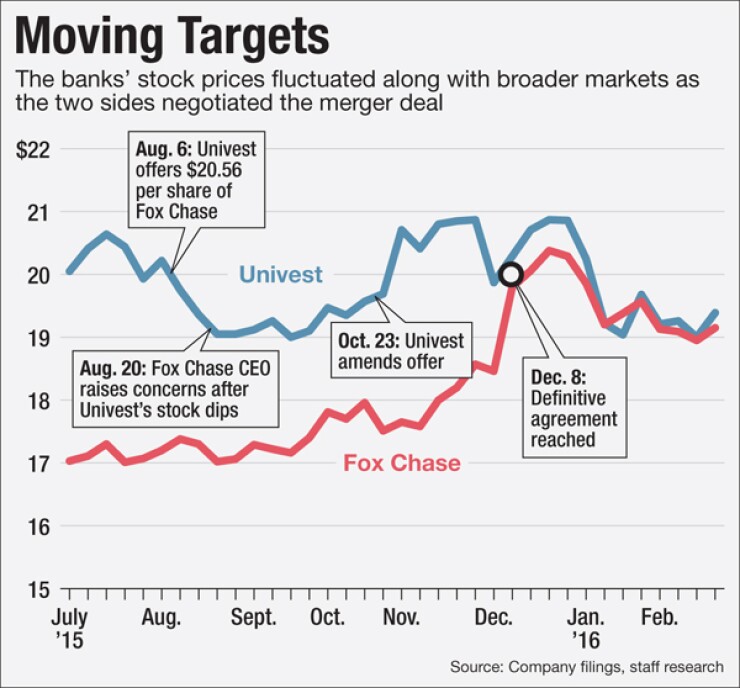

Informal talks between the companies began last July, resulting in Univest offering $20.56 a share in early August,

Univest's preliminary due diligence as a result was limited to a comprehensive credit review and a discussion over cost savings.

An ill-timed slide in Univest's stock price — it fell nearly 5% in August as the Dow Jones and S&P averages also tanked — spooked Fox Chase to the point that Thomas Petro, Fox Chase's chief executive, shared his concerns with Univest CEO Jeffrey Schweitzer during an Aug. 20 conversation.

By mid-October, the value of Univest's initial offer had fallen by 2.6%, to $20.03 a share, and Univest agreed a week later to amend its proposal to return the overall value to a level close to its first offer.

However, Fox Chase authorized its investment bank to contact five other institutions to gauge their interest in a deal, though the primary motive was to "confirm that the transaction with Univest was in the best interests of the shareholders," the filing said.

The institutions were contacted in late October. While four banks signed confidentially agreements, none submitted a written indication of interest. Around that time, a large, unnamed bank expressed an interest in buying Fox Chase, but the board determined that the suitor would be unable to compete with Univest's amended offer.

As a result, Fox Chase agreed to exclusive negotiations with Univest, which led to the definitive agreement that was announced on Dec. 8. The stock markets would slide again early this year, but the deal is still expected to close in the third quarter.

Petro will join Univest's board, along with two other Fox Chase directors. Roger Deacon, Fox Chase's chief financial officer, will become Univest's CFO, filling a post that had been vacant since Michael Keim was promoted to CEO in October.

The recent filing disclosed that Fox Chase had previously explored selling itself, hiring an investment bank in the second half of 2013 to gauge its market value. The investment bank contacted eight parties; four submitted written indications of interest that valued Fox Chase at $17 to $19 a share. Three institutions conducted due diligence, but none of them were willing to move forward.

Fox Chase was also approached in April 2014 by a bank CEO who was interested in a deal, but talks ended after Fox Chase decided it was better to stay independent than to accept the suitor's offer of $17.50 to $18 a share.

Moreover, the filing disclosed that Fox Chase explored an acquisition of its own in late 2014 and early 2015, performing due diligence and submitting a nonbinding indication of interest. "Such efforts were ultimately not successful," the filing said.