At first glance, it looks like a recipe for damaging, rather than bolstering, Americans’ household finances.

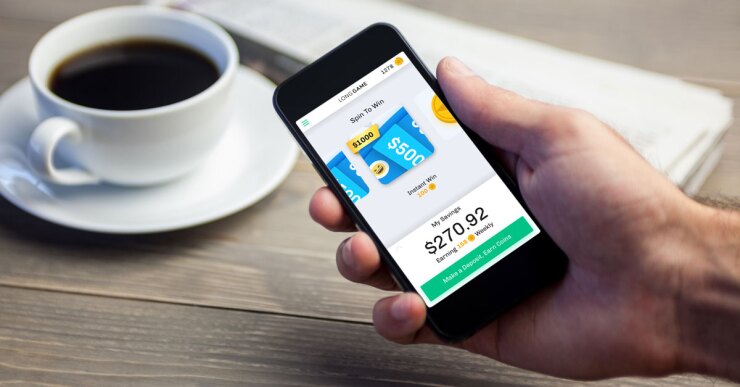

Long Game is a mobile phone app that features casino-style games. Its users play again and again, completing 24 games per week on average.

But Long Game is not Caesars Palace in your pocket. To play the games, you move money into a federally insured savings account that’s linked to the app. And if you win a cash prize, those funds get added to your savings. Unlike in Las Vegas, your cash balance cannot go down.

Long Game is designed to harness some of humanity’s more damaging impulses and put them to more productive use. It is part of a new crop of apps that aim to make savings more fun, and which could provide a blueprint to banks for how to engage more with customers who spend hours each day on their phones.

“Our vision for the company is that you feel proud and in control of your finances,” Lindsay Holden, Long Game’s CEO, said in a recent interview.

Long Game, which has raised $6.6 million in seed funding, launched in November. Holden said that the app now has more than 70,000 users, who are growing their accounts by about $60 per month.

She argued that Long Game is helping its users develop a more positive emotional association with their personal finances, which is often an anxiety-ridden topic. “People are very avoidant of their finances,” Holden said.

Today, the specific games available in the Long Game app are repetitive and a bit humdrum — users can spin a wheel, play a slot machine, or flip and match cards. But the San Francisco company, which has 10 employees, is currently working to create better gaming experiences. Holden expects those to start in the next few months.

Long Game generates revenue through a partnership with Blue Ridge Bank, a $400 million-asset institution in Martinsville, Va. The bank, which holds users’ deposits, pays an acquisition fee to Long Game. Most of the money gets passed back to the app’s users as cash rewards.

![Lindsay Holden - Long Game CEO [3].jpg](https://arizent.brightspotcdn.com/dims4/default/bdc8301/2147483647/strip/true/crop/3691x5168+0+0/resize/740x1036!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F6f%2Fba%2F3367e5fd4976affbb7e6eff54834%2Flindsay-holden-long-game-ceo-3.jpg)

Over time, Holden envisions other ways to raise revenue, including by offering sponsored games. The app maker could also start offering investment products, which would complement its current focus on savings accounts.

Because Long Game has an engaged user base, which is made up mostly of highly coveted millennials, it is not hard to imagine the firm eventually being bought by a bank. “We think that is something that a bank might be interested in,” Holden said.

One big-bank executive

Long Game is part of trend in which companies borrow techniques from the gaming industry in an effort to change people’s real-world behavior. One of the most prominent examples is Fitbit, whose users compete against their friends to see who has walked the furthest distance each week.

Gamification is also being used

The question for the banking industry is: Will financial products, over time, also begin to bear a closer resemblance to video games?

“My opinion is that it’s going to catch up to financial services firms sooner rather than later,” said Nick Maynard, senior vice president at Commonwealth, a Boston nonprofit organization that works to improve Americans’ financial security.

Commonwealth has been experimenting with game-like experiences as a way to encourage people to save more, after concluding that traditional financial education workshops have significant weaknesses.

“Video games address some of the shortcomings of traditional financial education by acting as appealing, low-stress entryways that motivate users to engage with educational experiences,” Maynard and one of his colleagues

The designs of the saving games available today vary considerably, and those differences can have significant effects on users’ behavior.

For example, Long Game encourages its users to set an automatic contribution, which gets withdrawn from the person’s checking account as frequently as each week. But Commonwealth opted not to include an auto-save feature in its SavingsQuest game, based on a concern that financially vulnerable consumers might feel like they were losing control of their money.