A small Pennsylvania bank is expanding a lucrative fee business that seems largely overlooked by other institutions.

Quaint Oak Bancorp in Southampton recently bought Premier Choice Real Estate, then merged the Bethlehem, Pa., firm into an agency it formed in 2009.

“It surprises people when I tell them we’re in the real estate business,” said William Gonzalez, the $229 million-asset Quaint Oak’s senior vice president for business development. “Our planning and execution has been years in the making. We didn’t just throw a dart at the wall.”

Few banks have significant dealings in real estate sales, industry experts said.

One factor might be a misunderstanding about a 2009 law that barred nationally chartered banks from offering real estate brokerage and property management services. State-chartered banks, however, remained free and clear to own and operate real estate brokerage firms.

The National Association of Realtors, which lobbied Congress for the law in an effort to keep money-center banks out of real estate brokerage, has no objection to smaller, state-chartered institutions offering such services, a spokesman said.

Another factor that could be keeping banks out of real estate is a fear of regulatory scrutiny of affiliated relationships, said Ron Haynie, senior vice president of mortgage finance policy at the Independent Community Bankers of America.

“Regulators are worried about companies steering clients into an arrangement that benefits them more than the consumer,” Haynie said, adding that those concerns could be addressed by carefully documenting the relationship.

While few banks are active in real estate brokerage, more agencies are offering mortgages as traditional partnerships with lenders have been eroded by compliance strains and new incentives to control more of the home buying transaction.

Remax

Casey Crawford, CEO of Movement Mortgage in Charlotte, N.C.,

The overall view is that it makes sense to combine banking and real estate brokerage operations, industry experts said.

“There are a lot of natural synergies,” Haynie said.

While real estate brokerage is worth a look, banks interested in the business should “pedal lightly,” cautioned Tom Hall, CEO at Resurgent Performance, an Alpharetta, Ga., consulting firm.

“It’s a good idea if you can figure it out,” Hall said. “The cost of running [real estate agencies] isn’t high and they expose you to more transactions.”

That’s certainly the thinking at Quaint Oak, which aims to become a one-stop shop for home sales. The company added a team of 15 agents from Premier, including Tom Fox, who ran the firm and has more than $40 million in gross sales under his belt.

Fox will manage the combined agency.

The hope is that, by being involved with home listings, Quaint Oak will be able to leverage those relationships to offer mortgage and insurance products.

“It all culminates with a banking relationship,” Gonzalez said.

Quaint Oak, figuring that success in the residential arena should translate to commercial real estate, also has a long-term plan to hire a team of CRE brokers.

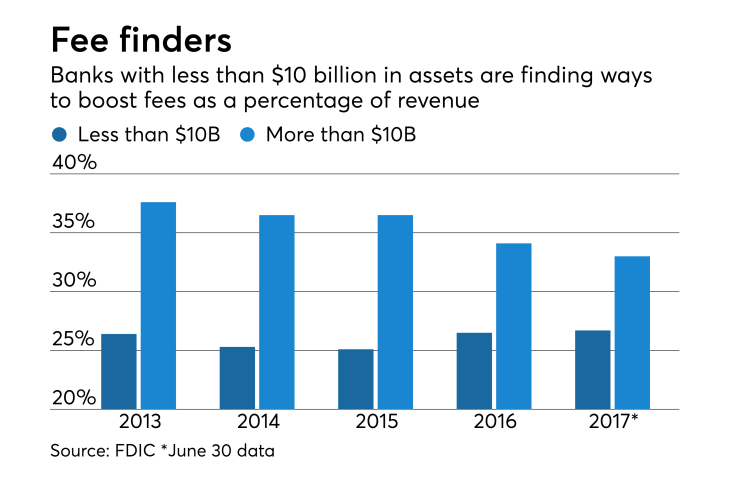

The ultimate goal is to juice a fee income total that already outperforms similar-sized institutions.

Noninterest income made up about a third of Quaint Oak’s revenue in the second quarter, largely due to mortgage and insurance fees. The average ratio at banks with $100 million to $1 billion in assets in the same quarter was 19%, according to the Federal Deposit Insurance Corp.

Execution will depend on all Quaint Oak employees working together. That has historically been problematic at bigger banks that have looked at cross-selling as a means of boosting revenue.

“When we pass referrals among our companies we have to trust each team member to pick up the ball and run with it,” Gonzalez said.

The move also has the support of Quaint Oak’s biggest outside investor.

“I’m not a rocket scientist, but it seems to make so much sense I can’t understand why everyone else isn’t doing it,” said Phil Lifschitz, a retired Wall Street executive who owns about 9.4% of the company’s stock.