-

Weak sales of home mortgages and business loans mean big banks are paying fewer bonuses and commissions, and that helped reduce high expenses across the industry.

May 2 -

The past few years have been rewarding for bank employees. OK, maybe not the rescues, stagnant loan books, layoffs and litigation. But none of these disasters hurt pay at banks.

March 30

Banks have vowed to cut costs, find efficiencies and tighten belts. But they haven't yet tipped their hands as to how.

At a conference hosted by RBC Capital Markets on Thursday, the leaders of several major banks expanded on a theme from earnings season — how to keep expanding profits in the face of stagnant loan books, low-yielding securities and slowing reserve releases.

The lead speaker, Chief Financial Officer Tim Sloan of Wells Fargo & Co., expressed confidence that the company's "Project Compass" initiative would succeed in finding $600 million of reductions and promised further details by the time it reports second-quarter results.

"The reason we want to do it very thoughtfully is that when you have a big company, it's not difficult to go in to say to everybody reduce your costs 5%," Sloan said. "The problem with doing that and what we've seen historically with many of our customers and other competitors is if you do it that way, you may be cutting expenses that are very important to revenue growth. And that is a mistake."

Though strengthening commercial lending is picking up slack, it has not come close to counterbalancing the weakness in residential and consumer loans. That mismatch left Wells Fargo and other banking companies to walk a line between convincing investors that the company is taking every possible step to keep costs down and reassuring them that top-line growth will soon return.

Analysts at the conference and elsewhere appeared curious about whether the cuts would come from banks' retail banking operations or elsewhere. Brian Foran, an analyst for Nomura Securities, said staffing levels and branch offices would likely come under greater scrutiny. But banks including Wells Fargo are still reluctant to contemplate significant cuts to retail, he said.

"They just spent the last ten years building branches — it's kind of hard to turn around to your board and say, 'By the way, that was a mistake,' " Foran said. About 9% of Wells Fargo's 5,800 freestanding branches have fewer than $15 million of deposits, according to data from Nomura and SNL Financial. That is the amount generally considered necessary to break even.

At First Horizon National Corp., which also pledged expense cuts at the RBC conference, 27% of its 180 branches have less than $15 million of deposits.

"It's been a little bit surprising that we haven't seen more branch closures," Foran said. There are "a lot of branches with low numbers. It would seem like banks have more opportunity to rationalize their branch networks."

A recent article in American Banker found that bank compensation rose steadily through the crisis, especially among the biggest banks. Average full-time employee compensation has grown 35% in eight years, twice the rate of inflation.

Asked by an audience member whether the company would be willing to rein in its frontline retail banking operations as former CEO Carl Reichardt attempted to do two decades ago, Sloan said it would not.

"Carl made a lot of great decisions at Wells Fargo, but in hindsight, that was not one of them," he said, citing the retail network's foundational role in recruiting new clients and fostering cross sales.

"We thought at that time that customers were going to place much less value on a branch network and were going to move very quickly to an online business, which is why we invested at that time so much in online banking and ATMs," he said. "[W]e were wrong."

B.J. Losch, the CFO of First Horizon, said expenses will come down as the Memphis banking company works its way through mortgage-related costs.

"We've got what we call wind-down costs, the bulk of which are mortgage repurchase related," Losch said at the RBC conference. "Those are steadily continuing to come down. We would hope that they'd be largely gone by 2013."

William Schwartz, senior vice president of U.S. financial institutions for the ratings agency DBRS, said a lot of banks' expenses are unusually inflated because of the amount of money they are spending to deal with foreclosures and delinquent borrowers. That expense is easing, though perhaps not as swiftly as banks and investors would like. But it will naturally fall over time.

Of First Horizon's roughly $270 million of "wind-down" costs in 2010, $190 million was mortgage repurchase expense, he said.

Losch reiterated the bank's commitment, laid out during its first-quarter conference call, to achieving cost savings of as much as $125 million by next year. Some of the ways the bank hopes to reach that goal are simplifying business processes, streamlining information technology functions and reducing procurement expenses.

So far, First Horizon has been able to cut out about $50 million of expenses in its annual run rate through the closure and consolidation of branches and a 5% reduction in full-time employees.

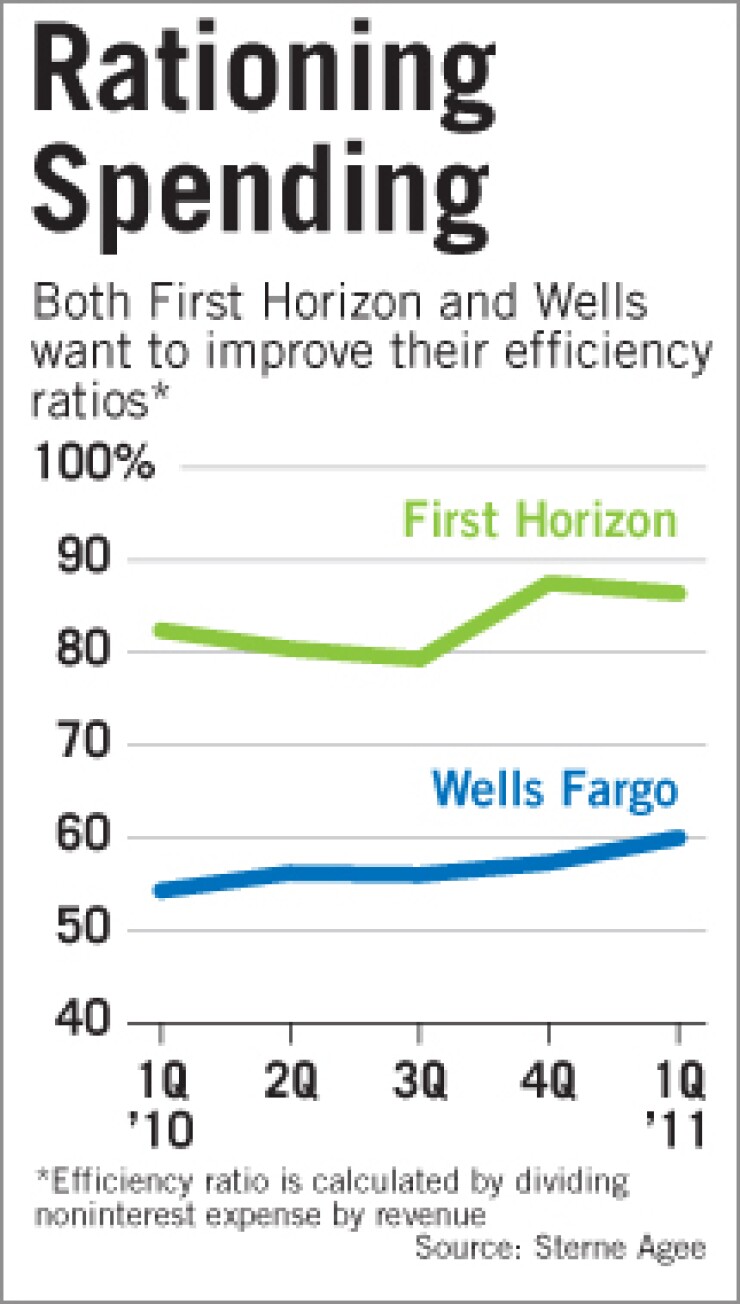

Losch said the bank hopes to have the remainder of the expense cuts completed by yearend. A decline in revenue has left First Horizon with an 86% efficiency ratio, but noninterest expense has declined steadily over the last few years. Expenses have dropped 23% since 2007, to $1.37 billion in 2010. In the first quarter of this year, expenses were down 4% from the fourth quarter, and 11% year-over-year.

Still Losch's comments at the conference are reason to believe that continued shrinkage will be hard. Losch said the bank has added between 30 and 40 bankers in the last 12 to 18 months "that brought good knowledge of client relationships, and so we've been able to take some share from other markets."

That's about the only way the bank expects to see growth in its loan portfolio for the foreseeable future.

"What we're seeing from borrowers is willingness to look at new banking relationships," he said. "That's where we're seeing some opportunity."

Other institutions appear to be seeing similar competition. JPMorgan Chase & Co. and KeyCorp, among others, are building new branches and making over old ones. That puts pressure on competitors to keep theirs open.

Wells Fargo, for one, is in the early stages of fighting a market share grab by JPMorgan Chase on its home turf of California. JPMorgan Chase, of New York, is hiring business bankers and opening new branches after entering the state through its purchase of Washington Mutual Inc.

There are other ways to save money other than closing branches, especially for a company like Wells Fargo. The San Francisco company had not needed to pay as much attention to controlling expenses as other banks have, Foran said, because it had been good at making money by growing revenue.

On Thursday, Sloan said that Wells Fargo's management could find new revenue, arguing that the it should still be considered capable of high growth given how well it handled industry challenges in 2006 and 2007. "Which management team do you want to bet on?" he asked the audience.

Matthew Monks contributed to this story.