Credit-related costs could weigh on banks’ bottom lines into at least early next year.

That was one of the key takeaways from banker presentations at a virtual investor conference hosted by Morgan Stanley this week.

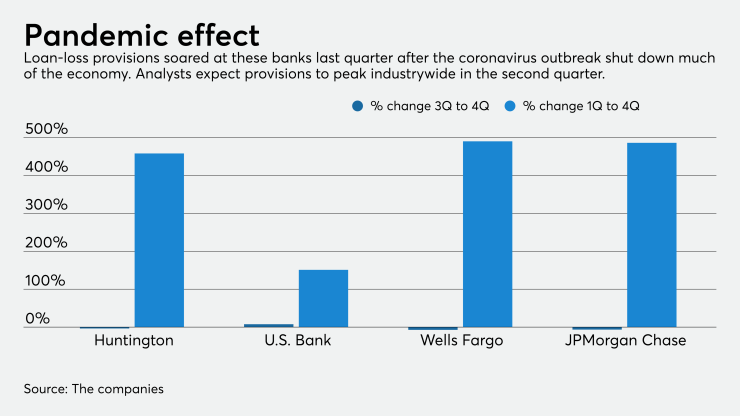

Banks set aside billions in loan-loss provisions in the first quarter to cushion the economic blow dealt by the coronavirus pandemic. With the end of the second quarter less than three weeks away, executives warned that the buildup isn’t over.

“Fundamentally, our credit remains sound. However the economic outlook has deteriorated since quarter-end and remains highly uncertain,” Huntington Bancshares Chief Financial Officer Zach Wasserman said Wednesday. “This will result in elevated provisioning and additional reserve building in the second quarter and most likely for the next few quarters.”

Investors got the message. Huntington shares dropped more than 5% on Wednesday, a day when the overall market was off about 1%. Shares of Wells Fargo fell nearly 9%, and U.S. Bancorp’s declined 6.6%, after they issued similar outlooks.

Despite a rosier than expected unemployment report for May and the reopening of local economies around the U.S., internal forecasts that banks are using to map out the rest of the year are still indicating trouble ahead, said Brian Klock, an analyst at Keefe, Bruyette & Woods.

“The cadence has been that the second quarter will be the high water mark” for provisions, Klock said in an interview.

Yet banks are expected to continue tacking on provisions even into 2021 as the economy tries to pull out of this monthslong standstill. Banks may not start taking off reserves until 2022, Klock said.

Klock added that loan charge-offs are expected to peak in the fourth quarter when forbearance periods granted in recent months run out and emergency loans to small businesses come due. Throw in the possibility of a second wave of COVID-19 cases this fall, and

“It’s a lot more complicated for sure,” Klock said.

Wells Fargo: Economic forecast worsens

Wells Fargo expects its reserve build in the second quarter to be even bigger than in the first quarter, when the San Francisco bank added $3.1 billion to its reserves, CFO John Shrewsberry said Wednesday. In explaining the bank’s current outlook, Shrewsberry pointed to negative changes in the forecast for unemployment and GDP since April.

“The severity of the economic forecast is a big part of it,” he said at the conference.

Shrewsberry also expects Wells Fargo’s net interest income in 2020 to be at least 11% lower than it was the previous year. That projection means the bank’s forecast for the last three quarters of this year is significantly worse in aggregate than its performance in the first quarter, when net interest income declined by 8% on a year-over-year basis.

Credit cards are one area where Wells’s interest income has been suffering. In the first quarter, more than 50% of the quarter-over-quarter decline in consumer loan balances came from the card business.

On Wednesday, Shrewsberry said that credit card spending at the bank, which declined by more than 35% in the midst of pandemic-induced lockdowns, is still down by close to 20%.

Wells expects a stronger performance in the second quarter from its mortgage business, where rock-bottom interest rates have fueled both home purchases and interest in refinancing existing loans.

Shrewsberry also suggested that concerns about the spread of coronavirus in cities is leading some city dwellers to shop for homes in less dense places.

“You’ve got people now moving out of cities into suburbs,” he said.

U.S. Bancorp: A 2Q peak?

U.S. Bancorp in Minneapolis will continue to build its reserve for loan losses in the second quarter largely because unemployment has been worse than executives anticipated in March, President and CEO Andy Cecere said Wednesday. He said he expects the reserve build to peak in the second quarter, but that it’s difficult to be certain what the third or fourth quarters could look like.

“Our expectation at this particular point of time is that that would be the peak of the reserve build based upon the information that we have currently today,” Cecere said. “There may be a reserve build in the future quarters, but it’s hard to know at this particular point in time.”

U.S. Bancorp reported a $993 million provision for credit losses in the first quarter, up from $395 million set aside during the previous three months, according to its latest financial filing.

Consensus estimates show the company could add another $1.1 billion in reserves for the second quarter, Keefe, Bruyette and Woods analysts said in a note Wednesday.

Executives also said they anticipate the net interest margin will narrow by about 30 basis points in the second quarter, compared with the first, before leveling off for the rest of the year.

Net interest income, however, should be even with the first quarter for the $543 billion-asset U.S. Bancorp, Cecere said. He painted a mixed picture of fee income: Mortgage banking and capital markets are likely to be stable, while certain types of payments income and card revenue probably will decline on a yearly basis.

Huntington: Adding provisions beyond 2Q

Huntington is expecting not only to add more to its buffer for credit losses in the second quarter but could continue doing so throughout the year if the economy struggles to get back on track, its CFO, Wasserman, said Wednesday.

The Columbus, Ohio, bank reported a $441 million provision for credit losses in the first quarter, up from $79 million in the fourth quarter, largely due to the potential for problems in its oil and gas business.

The economic forecasts the bank has looked at in May and even in early June have not reflected the kind of economic rebound needed to release reserves beyond the second quarter, said Richard Pohle, chief credit officer for Huntington. But there could be hope that outlook improves as more government stimulus winds through the hardest hit sectors of the economy.

“To the extent that we do see improved economic scenarios, we will certainly incorporate that into the provision in the back half of the year and that will frame whether or not we're building or releasing reserves at that point,” Pohle said. “It’s too early to tell, I guess is the short answer.”

Pohle said the $113.9 billion-asset Huntington will continue to work with borrowers to stem any losses, even in its beleaguered book of hotel loans, which is mostly tied up in large corporate names like Marriott and Hilton properties and could take more than a year to get back into the black.

“Now you know certainly the hospitality sector is going to be a longer road back to where it was pre-COVID than others,” Pohle said. “I mean we're thinking it's an 18-month or so return to breakeven, and you know we're prepared to work with the borrowers here.”

Discover: Unemployment ‘stays up there for a while’

In remarks at the same conference on Tuesday, Discover CEO Roger Hochschild said that the credit card issuer is contemplating a reserve build in the second quarter that is around the same size as its $1.1 billion build in the first three months of the year.

Discover’s first-quarter provision was based on economic forecasts at the end of March that the U.S. unemployment rate would rise to 9%. Those forecasts quickly became outdated, as Hochschild acknowledged.

“So it does point to one of the challenges in how we do reserve and how the whole industry does,” he said.

But how long Americans remain out of work is a critical factor in how much money needs to be set aside for losses, Hochschild noted.

“Unemployment that spikes to 17% and then has a quick recovery can require less in the way of reserves than unemployment of 10% that stays up there for a while,” he said.

JPMorgan: Preparing for ‘all the eventualities’

JPMorgan Chase is taking into account the possibility of a second wave of coronavirus cases this fall that could mean a higher provision before then.

The largest U.S. banking company by assets reported an $8.2 billion loan-loss provision in the first quarter, dwarfing the less than $1.5 billion set aside at the end of last year, according to its financial reports.

Gordon Smith, co-president and co-chief operating officer at JPMorgan, said Tuesday that delinquencies are coming in lower than the unemployment picture would typically show. But the bank is wary of being caught off guard if the economy has to shut down again, Smith said.

“I would want to be reserved for all the eventualities, and so you're much more likely to see us be more on the conservative side as we move into the second quarter, and by the end of the third quarter we'll have a much better view of how this pandemic is really going to play through,” Smith said, adding that certain sectors like entertainment and travel are very problematic.

“The question is going to be how quickly will consumers begin to start to travel, stay in a hotel and go to restaurants — and all of those things will have a factor of what losses ultimately look like over the course of the next months or quarters,” Smith said.