Whether a Bank of Facebook is months or years away from happening (if it ever does), it’s never too soon for banks to gird themselves against a competitive assault from big tech.

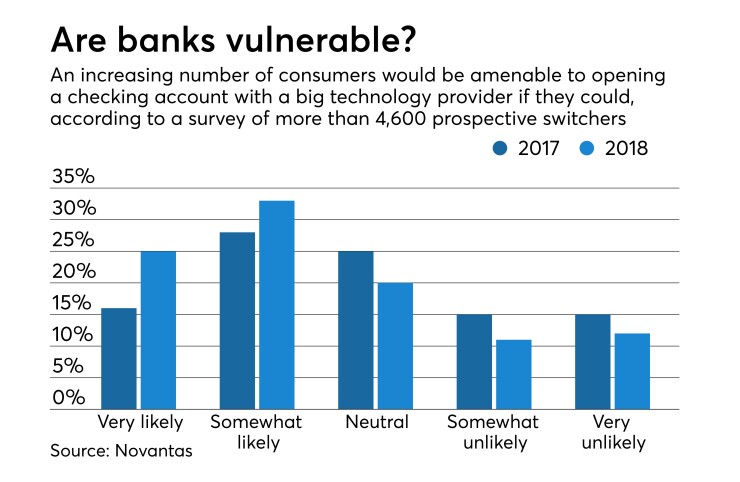

The bad news for banks is that customers would be more tempted than ever to make the switch: 58% of people who are open to, or actively mulling, a change of banks told Novantas in a recent survey that they would consider banking with a tech company like Facebook, Google or Amazon if they could. Only 44% had said the same thing last year.

“That’s a real threat that banks have to be cognizant of and prepared for” even if they offer an online-only product, said Matt Sharp, the firm’s head of research. “They would certainly be at risk for losing customers who are technology-minded and have chosen [an online-only] bank in part because of that. A tech company would be able to start picking off those types of customers fairly quickly.”

The past few years have seen the rise of digital-only banks such as Ally and Chime. Many established financial institutions have also launched their own digital banks to keep pace, like JPMorgan Chase’s Finn, MUFG Union Bank’s PurePoint and Citizens Financial Group’s Citizens Access.

The good news for traditional players is that participants in the survey dropped hints about how they could be persuaded to stick around. Cash incentives made a difference for many consumers who had opened a checking account in the last few years, and so did a previous relationship with the bank they ultimately chose.

Aside from surveying more than 4,600 prospective switchers, Novantas studied a second group: more than 7,600 consumers who had opened a checking account with an online bank in the past three years. There was some overlap between the two groups, Novantas says.

More than 60% of the second group — so-called recent purchasers — were born after 1980, and 87% earn less than $100,000.

More than 40% of those who had recently opened a checking account were influenced by some kind of incentive, with 25% saying it was a cash incentive specifically that swayed them. Two-thirds of those cash offers were under $200, Novantas found, and they were most likely to come from banks that operate nationwide.

Almost a third of recent purchasers said they previously had a savings account with the bank they chose.

While respondents who embraced the idea of banking with a tech company skewed younger, the group spanned generations. Nearly three-quarters of customers who shop online at least once a week — a population that ranges widely in age — said they would be likely to bank with a tech company.

Jeff LeBlanc, head of deposit operations for Citizens Financial, in Providence, R.I., said he was not surprised at the sharp jump in consumers open to banking with a tech company. He said that generally lines up with what the bank has found in its new digital offering, which has roughly the same number of 30-something and 60-something customers.

“You see a lot of this growth in consideration of digital offerings, and they’re not necessarily people who’ve been doing their banking digitally for five or 10 years,” said LeBlanc, who is also the chief operating officer of Citizens Access. “We’re trying to not only speak to folks that are digitally savvy, but also folks who are just savvy savers and may have no digital accounts at all. We want to be the first that they try.”

At the end of the third quarter, Citizens Access had gathered about $1 billion in deposits, putting it halfway to the company’s stated goal of $2 billion in deposits by year-end. Currently, Citizens Access offers just savings accounts and certificates of deposit.

Yet, those savings products could be a valuable hook if Citizens Access decides to offer a checking product, judging by Novantas’ findings.

Sharp said he thought that the one-third of savings customers was still a relatively low share of new customers. But that metric could continue to shift upward as more consumers flock to digital banks in search of better rates.

“The [online-only] banks that are winning primary checking relationships were first winning high-yield savings relationships as a result of that rising rate environment,” he said. “That then gives them the ability to cross-sell or offer checking accounts to those same customers.”