Square's $29 billion deal to acquire the installment lender Afterpay provides new muscle — and a powerful buy now/pay later product — not only to Square's sellers, but to its popular consumer-direct business as well.

While there are many lenders in the global BNPL market, Square's biggest rival in this space is PayPal, which has benefited heavily from its merchant reach and brand recognition. Square is best known to merchants, but has had a lot of success adding consumer-facing services to its Cash App, which contributes

The Melbourne, Australia-based Afterpay is one of the few firms to control more than 10% of the U.S. buy now/pay later market. At Square, Afterpay will be the key driver in offering cross-border omnichannel BNPL that can serve both Square's consumer-facing and merchant services businesses.

"Afterpay rounds out Square with a comprehensive feature," said Brian Riley, director of Mercator's Credit Advisory Service. "Integrating Afterpay allows Square to reach a wide range of buy now/pay later merchants at checkout. At the same time, Afterpay is a perfect match for Square's Cash app."

As the U.S. market

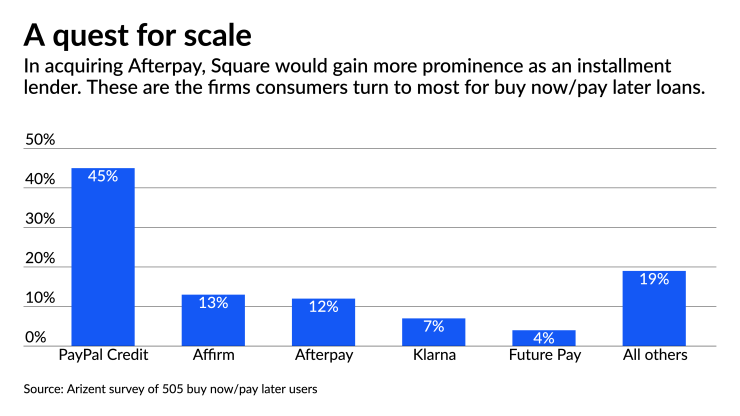

PayPal is at the top of the list of firms providing BNPL in the U.S., controlling 45% of the American market, according to research from

Square and Afterpay did not return requests for comment on the

Afterpay's

Afterpay has added technology as it has grown in North America. Near the end of 2020, Afterpay added support for

Afterpay also reports its U.S. business has multi-generational support, drawing users from Gen Z to Boomers, according to Arizent's research. Afterpay's growth has been substantial enough for it to reportedly consider a

The deal "starts to position Square as more of a three-party network akin to PayPal, where Square increasingly becomes a player that can bring consumers to merchants," said Jordan McKee, principal analyst for digital payments at S&P Global Market Intelligence. Acquiring Afterpay, he said, will catapult Square into one of the most prominent positions in BNPL globally while presenting synergistic potential, particularly in connecting Square services for consumers and businesses.

"One of the most significant is the opportunity for Square to begin connecting its seller and consumer ecosystems," McKee said. The ability for Square to meld its merchant and consumer businesses is in the early stages of exploration, he said.

The acquisition would allow Square to be a major competitor in BNPL without Square having to build out its own service. Square's Cash app, a peer-to-peer feature that Square uses for bitcoin trades and other merchant payment needs, has about 70 million users, while Afterpay serves 16 million users and 100,000 merchants.

Among the major installment lenders,

At PayPal, BNPL is an extension of a financial services strategy that includes payments, merchant lending, crypto support and its Venmo peer-to-peer payment subsidiary, which is part of PayPal's overall strategy to extend its merchant network. Affirm has added a

Afterpay will gain access to a broad reach of financial services by being part of Square. The combination would create new connections to consumer bank accounts using merchants as the distribution channel, according to Rick Oglesby, president of AZ Payments Group. "This will fuel the P2P business and the rest of the consumer financial ecosystem."

There are dozens of other companies pursuing BNPL.

With Afterpay's addition, Square can offer consumer loans, adding a business line on top of the lending Square does through its industrial bank license and its merchant credit product.

"If you're a bank you've got to be worried that there are big tech players that are building out customer-facing ecosystems to merchants," said Sanjay Sakhrani, an analyst with KBW. The competitive concern for banks is the ability of the Afterpay-Square combo and the technology-heavy BNPL market to boost engagement between merchants and consumers, he said.

"The play here is you're getting to the customer in a different way," he said.

As fast as BNPL has grown, it also has challenges. BNPL lending is drawing attention from regulators out of concerns that consumers are accumulating debt. The

"There's a potential risk here given the BNPL industry has not gone through a real credit crisis," and Square's diverse revenue streams could provide some protection from that, Sakhrani said. "The value proposition" for Square and Afterpay, he said, "is finding another means to improve engagement inside Square's ecosystem."