Consumers are usually hesitant to buy a product, stay in a hotel or ride in an Uber rated fewer than four out of five stars.

Call it the Amazon effect, where shoppers will immediately regard sub-four-star items with apprehension. And banks are not immune.

The top three reasons that customers switch banks are they're moving to a new area, have tired of paying high fees or are dissatisfied with customer service, according to data from Javelin Strategy & Research. That means star ratings and snippets of commentary that pop up in online searches don’t typically make or break these decisions.

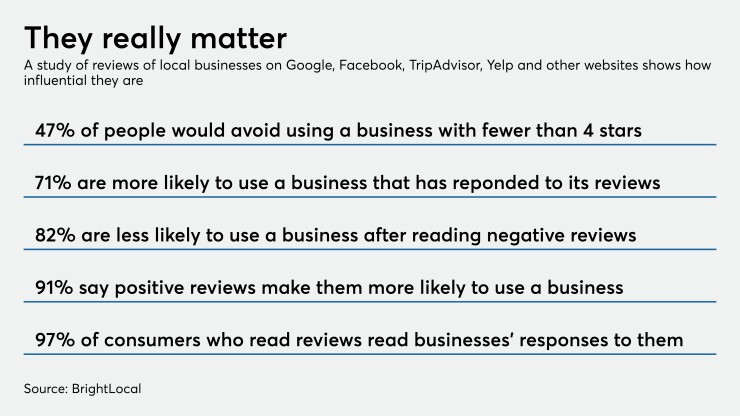

But what customers say in online reviews does affect an institution’s reputation. By monitoring and responding to consumer reviews, banks can gather important feedback, rise to the top of online searches, and bolster their image among prospective customers who are shopping around.

Lincoln Parks, marketing director at Heritage Bank in Jonesboro, Ga., tracks reviews for his seven-branch institution using marketing software from BrightLocal and says he responds to each one. Keeping Heritage’s online image sharp has been especially important during the pandemic. Parks has noticed a jump in search traffic leading to the $1.3 billion-asset bank’s website.

“If people are searching for your bank online and they see a bunch of negative reviews, they will most likely base your reputation on those reviews,” he said. “But I think a lot of people don’t realize that even if a customer leaves a positive review it’s good to respond to that.”

Reviews and reputation

The more reviews — especially positive ones — a bank has, whether on its own website or on third-party services such as Google, Facebook or Yelp, the better its chance of ranking well in Google searches. When an institution is more “discoverable,” more consumers are likely to click on the website, place a call or search for driving directions, said Shane Closser, head of industry for financial services at Yext, whose Yext Reviews service helps companies monitor and respond to online reviews.

“Google is constantly changing its algorithms,” said Closser. “We’re seeing the more stars and more reviews you have, that really helps you rank higher.” Google has stated that relevance, distance and prominence are important factors in search ranking, and Yext’s testing reveals that reviews contribute to prominence.

Parks stressed the same idea. “Reputation is a big factor" for search engine optimization, he said. “If you optimize these local directories it’s not just good for showing up online, but it enhances your brand reputation and makes you more trusted by your customers.”

To encourage new customers to write a review, the bank will send them a link to a page on Heritage’s website about 30 days after onboarding. There, they can click on a link to a review site and describe their experience.

Visible responses matter, too.

According to Yext, the average company achieves a 0.35% increase in star ratings by responding to reviews, but financial institutions see a 1.48% star improvement.

Parks gets an email from BrightLocal every time a new review appears online — typically six or seven per week. He regularly monitors Google, Facebook, Yelp, Foursquare and several other directories.

He tries to address each review, whether it’s positive or negative, within 24 to 48 hours. Dealing with negative reviews takes a little longer than positive ones, because he will research the incident mentioned and report his findings to the compliance department to ensure his reply is appropriate.

“We respond to show we care and that we will take every review out there seriously no matter what it is,” Parks said. He nudges a potentially contentious conversation to a private channel as soon as possible.

Dime Community Bancshares in Brooklyn, N.Y., places a similar weight on reviews and responses. The $6.5 billion-asset company uses Yext to track online commentary in one spot, and observes several new entries each week. Google and social media sites — especially Facebook — are the most popular channels.

“The review process is a way to get input on our services and products as well as the experience customers have with Dime,” said Steve Miley, Dime's senior vice president of strategic marketing. “It’s critical for us.”

Members of the marketing team share positive and negative reviews with Dime’s retail banking team and senior management, so they can ensure retail staff members have proper training. The team also has a rule to respond to all feedback within 24 hours. Like Heritage, Dime employees will guide negative communications to more private channels.

A third reason to monitor reviews is to enhance marketing materials. Incorporating reviews into emails, paid advertisements and elsewhere improves click-through rates, Closser said.

When customers dislike an app

According to analysis by the digital consultancy Mobiquity, customers are about half as likely to download a bank’s app that is rated three stars as one rated five or even four stars.

This matters for the segment of a bank’s customers that are slow to try new technologies. “Early adopters will use the app no matter what, but others may decide to stick with online banking or call,” said Brian Levine, Mobiquity's vice president of strategy and analytics. “They think, ‘Should I start using it when this is telling me the app isn’t that good?' ”

Poor reviews may be even more meaningful to the bank itself.

For example, a low-rated app may signal a lag in other digital tools. Mobiquity is currently working with a bank client to determine how a subpar digital experience and customer attrition are connected.

Levine has also noticed a disconnect between app developers and bank management that can lead to a misleadingly rosy view of the bank’s app. If customers are only prompted to write reviews after they have had a successful experience, that can tilt the balance of reviews on the app store more favorably — but not necessarily match up with broad customer experience.

Emmett Higdon, director of digital banking at Javelin, says app store reviews can be a valuable form of quality control for banks.

“Is the average consumer going to go to the app store and compare ratings to make a bank decision? No, definitely not,” Higdon said. “Most banks take app store ratings with a grain of salt.”

But patterns among disgruntled reviewers can signal when a new feature isn’t working properly or a beloved feature has changed for the worse — which is useful to know, considering that “there are so many different mobile phones and versions of mobile operating systems that something will break with every release you put out there,” he said.

Dime took negative reviews to heart when upgrading its mobile app last spring. Before the change, Dime’s rating hovered around two stars out of five. Now, it rates 4.7 in Apple’s App Store.

“We saw the usability of our mobile app was less than desirable,” Miley said. “Those reviews, as well as reviews across other platforms in reference to the app, counted very heavily when we did our user experience upgrade.”

This type of unsolicited feedback may be even more valuable now, when the pandemic has pushed late adopters to download their bank’s app to complete tasks they normally might have done in a branch.

“These people were still going to take three years before they used the app, but they are doing it now,” Levine said. “As you get more customers using these tools, you can make it better and appeal to them. You want to keep these people in digital channels because customers like self-servicing once they’ve tried it.”