Hotels are having a hard time finding banks that will help keep them afloat as travelers are abandoning their reservations across the country.

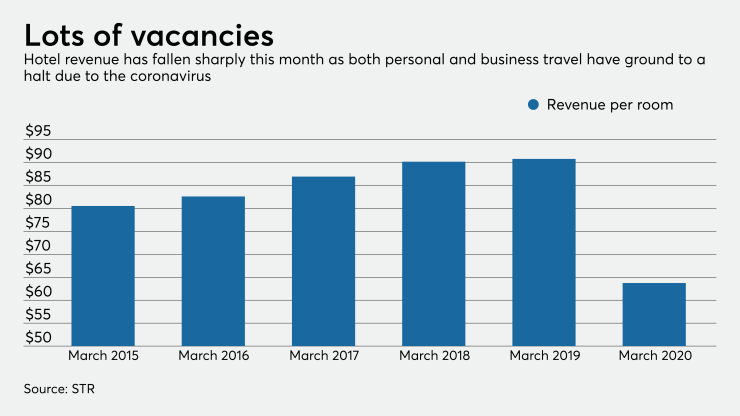

Revenue per available room, a key metric watched by the hospitality industry, plummeted to an average of $63.74 for the week ending March 14, the data firm STR reported on Wednesday. That is down 32.5% from the same week last year. Average occupancy of 53% is down from more than 68% one year prior, STR said.

The once highly profitable business of lending to hotels has ground to a halt, according to banking executives and research analysts. Banks already facing a liquidity pinch as corporations scramble for cash are shunning the risk.

“There are very few loans being done,” said Chris Nichols, chief strategy officer at the $17.1 billion-asset CenterState Bank in Winter Haven, Fla.

Banks are already rushing to underpin

The issue with hotel credits is that no one has any idea when it will be safe to travel again and empty rooms can be refilled as new cases of COVID-19 are reported each day. As of Wednesday, there were 7,038 confirmed and presumptive cases in the U.S. and 97 deaths tied to the virus.

“Banks are stuck between a rock and a hard place on this,” Nichols said. “Banks want to do the right thing and support their borrowers and communities as much as possible. The flip side is some of these hospitality companies aren’t going to make it.”

Big corporations tried to get ahead of the problem earlier this month. Hilton tapped the remaining $1.5 billion from its $1.75 billion credit line on March 6 to give it some cushion as cancellations mounted, according to a regulatory filing.

“It’s clear hotel demand will be down significantly, but for how long remains uncertain – I believe this uncertainty regarding timing is why Hilton drew down its line of credit,” said Michael Bellisario, an analyst at Baird.

The hotel industry’s standstill is not just a big-bank problem. Beyond the large operators, most hotel loans are carried by smaller banks. Nearly half of the $164.9 billion in hotel loans tracked by the data research firm Trepp were held by banks with less than $20 billion in assets.

“Hotel lending should cease for the time being as occupancy levels drop because it's cash flow that drives lending,” said Crocker Liu, professor of hospitality financial management at Cornell University.

CenterState’s Nichols said that since the recession, the banks that had been competing with other kinds of private financiers were underpricing their hotel loans. The spread, or premium charged on these loans to account for the natural volatility in hotels, had fallen from as high as 350 basis points in recent years to below 250 basis points in some cases, Nichols said.

Liu at Cornell said that is reversing. Spreads on existing hotel debt have steadily climbed since January when the new coronavirus began breaking out of China and accelerated in the past two weeks to 255 basis points.

Most lenders require hotels to have net operating income of at least 1.25-times their debt payments, and the drop in revenue is making it harder for operators to get by. Many hotels are expected to reduce staff to a “skeleton crew,” Liu said to keep their expenses down.

The American Hotel and Lodging Association, the industry’s main trade group, has lobbied Congress for assistance and met with President Donald Trump at the White House earlier this week.

“Since hotels are the canary in the coal mine with respect to commercial real estate, this is a signal that unless this virus is a short-term phenomenon, which I think is unlikely given that the federal government looks like it's punted responsibility to the states at least for the time being, real estate is in for a rough ride the longer this phenomenon lasts” Liu said.