WASHINGTON - Maneuvering has begun among Republicans to succeed Rep. Michael G. Oxley as the chairman of the House Financial Services Committee.

With the Ohio Republican's six-year term at the head of the panel set to expire in January 2007, "there is a lot of jockeying" behind the scenes, said Robert Rusbuldt, the chief executive of the Independent Insurance Agents and Brokers of America and a friend of Oxley's.

"Everyone knows it. It's not a state secret, but anyone who is trying to predict the winner is either making it up or it is wishful thinking."

Four committee members are expected to make a bid: Reps. Richard Baker, Deborah Pryce, Spencer Bachus, and Bob Ney. An outside challenge could come from House Rules Committee Chairman David Dreier.

Rep. Baker is first in line for the top post because of his seniority, and he is considered by most to be the leading candidate. However, many believe Rep. Pryce would become the front-runner if she declares her candidacy. Some pundits are discussing more complex scenarios that range from an extension for Rep. Oxley (such extensions are rare) to naming Rep. Pryce the Rules Committee chairman and Rep. Dreier the Financial Services chief.

Republicans' six-year limit on chairmanships has been a source of drama in the committee before.

In 2001, House Republican leaders surprised many longtime observers by combining the Banking Committee and the financial services jurisdiction of the Commerce Committee to form the Financial Services panel. To resolve a dispute over control of Commerce, the leaders named Rep. Oxley chairman of the new committee - and in the process bypassed committee veterans such as Rep. Baker and then-Rep. Marge Roukema, R-N.J.

Rep. Baker has paid his dues as a long-term, active member of the committee. However, the Louisianan does not have a lock on the chairman's seat. House Republicans do not look solely at lawmakers' tenure on a panel to select the chairman. They also take into account party loyalty, fund-raising prowess, leadership skills, and even geography and gender.

"Seniority is far from the only factor," said an aide to a senior House Financial Services member, who did not want to be named. "Leaders are looking for members who can advance the committee agenda forward and get along with other members. That is, a chairman who will get things done."

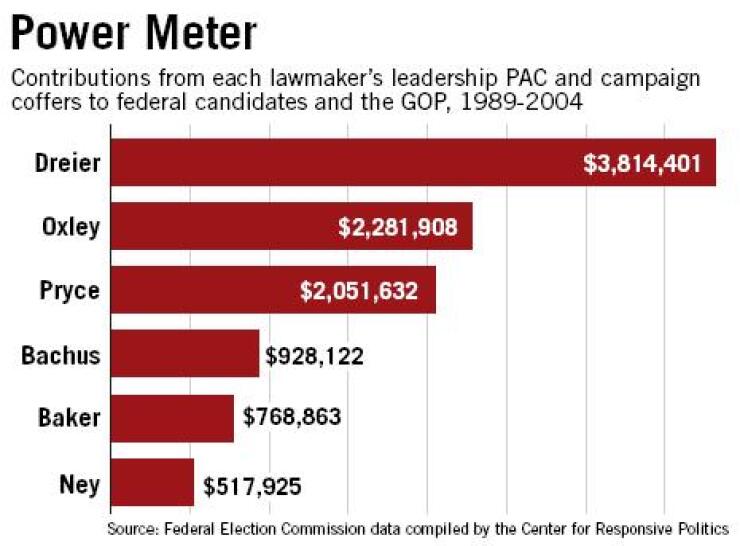

Steve Weiss, a spokesman for the Center for Responsive Politics, a nonpartisan organization that tracks campaign finance trends, said that "giving money to other candidates can be an effective measure of a lawmaker's chances of getting a key committee chairmanship."

Rep. Baker, 57, the former owner of a real estate company, is respected for his intellect and understanding of the minutiae of financial services policy. But sources close to leadership say he is not guaranteed to get the nod, because he is not as prolific a fund-raiser as other contenders and they are seen more as team players than he is.

Supporters praise him for championing issues he believes in and sticking with them, even if they are politically unpopular.

The primary example is Rep. Baker's focus on overhauling the regulation of the government-sponsored enterprises long before it became fashionable. Even his critics say recent revelations of accounting problems at Fannie Mae and Freddie Mac show that his long-held concerns were prophetic.

And Rep. Baker could threaten to retire from Congress if he is not given the chairmanship, which would leave his competitive district vulnerable to a takeover by Democrats.

His main challenger, most observers believe, would be Rep. Pryce. She would have to give up her Republican Conference chairmainship - the fourth-ranking position in House GOP leadership - to take the Financial Services Committee chairmanship.

Rep. Pryce of Ohio, 53, began positioning herself for a possible run at the committee chairmanship in January, when she left the powerful Rules Committee to join House Financial Services. The attorney and former prosecutor was made chairwoman of the domestic and international monetary policy subcommittee.

Most observers took her surprise move to House Financial Services as a signal of her interest in the chairmanship. Rep. Pryce sat on the former House Banking Committee from 1993 to 1995 and retained her seniority; she now ranks just behind Rep. Baker.

Because of her position in House GOP leadership and close relationship to House Speaker Dennis Hastert, some believe the chairmanship is hers if she wants it.

Asked if Rep. Pryce moved to the committee because she was interested in the chairmanship, her spokesman said: "This is nothing more than a rumor. She has no interest at this point in making any moves from where she is right now. She is very happy serving in House leadership."

Another contender is Rep. Spencer Bachus, 57, of Alabama. He is the fifth-ranking Republican on the panel and chairs the financial institutions subcommittee. An active legislator and former lawyer, he worked with Rep. Oxley in 2002 to reauthorize a key section of the Fair Credit Reporting Act. This year he focused on deposit insurance reform and regulatory relief.

Rep. Bachus is a well-liked party loyalist and an effective fund-raiser. He was picked to chair the National Republican Congressional Committee's March 15 spring fund-raising dinner and raised more than $8 million - beating the goal by $1 million.

The longest shot is Rep. Ney of Ohio. The House Administration Committee chairman is said to want the House Financial Services post, but has just an outside chance, ranking only 10th on the seniority ladder. He chairs the Housing subcommittee and is best known for sponsoring a bill to set federal regulations for subprime lenders.

Rep. Ney, 50, a former lawyer, has a strong fund-raising record, too. When he hosted a GOP fund-raising dinner in 2004, he raised $14 million - $1 million above the goal.

The wild card is Rep. Dreier, a longtime House member and former real estate developer. The 52-year-old Californian had served on House Banking from 1981 to 1990 and retained his seniority. He would rank ahead of Rep. Baker if he rejoined the committee.

Rep. Dreier's term as Rules chairman expired last year but was extended through 2006, which would coincide with the vacancy atop House Financial Services. That move immediately fueled speculation that the extension was granted to allow him to take over the committee in two years, though other speculation has him retiring from Congress when his term ends.

Rep. Dreier was a staunch ally of banks when he served on House Banking, taking the industry's side in fights with real estate agents, credit unions, and insurers.

His spokeswoman would not comment on Rep. Dreier's plans beyond 2006. "He's focused on his job right now as chairman of the Rules Committee," she said.

No one has publicly announced interest in the post, and the rumored candidates are downplaying the palace intrigue.

"Sure, at the appropriate time in the future, should the opportunity be presented, Congressman Baker would like to be considered someone who can and will effectively lead the committee, but what he's concentrating on right now is tackling some very important issues before the committee and, together with Chairman Oxley, accomplishing major reforms," Rep. Baker's spokesman said in an e-mail response to a request for comment.

Still, the contenders for the chairmanship are trying to raise a lot of money and shepherd key legislation through the House to demonstrate their leadership skills.

Rep. Baker has his signature bill to overhaul the regulation of the housing government-sponsored enterprises, which cleared the committee by a vote of 65 to 5 on May 25. Rep. Bachus brought his deposit insurance reform bill through the full House on May 4 by a vote of 413 to 10, and Rep. Ney is pushing for committee action on his subprime lending bill.

Though Rep. Pryce has made only rare appearances at full-committee hearings, she is a player on the hottest issues of the day. Rep. Oxley assigned her and Rep. Michael Castle, R-Del., to draft a data-security bill, and she held her second subcommittee hearing on the Bush administration's top domestic issue, Social Security reform. She represented the committee on the House floor in April in an attempt to clarify a provision in an energy bill that banks worry could restrict their marketing.

Many view the battle over GSE reform as the ultimate proxy for the committee chairmanship race.

By unveiling a bill that was substantially toned down from proposals he offered in previous years, Rep. Baker showed an ability to compromise and work with other members of the committee - characteristics party leaders look for when selecting panel chairmen. "He was demonstrating that he could behave like a committee chairman, stepping out of his usual role of trying to get attention on an issue that's nowhere near anyone else's radar screen," said a lobbyist who did not want to be named.

For example, Rep. Baker surprised many by not including in the bill a provision pushed by the Federal Reserve Board that would have significantly limited the mortgage portfolios of Fannie and Freddie. The bill he introduced gave the GSE regulator broad power over the portfolios but included no specific limits or call for them.

Many believe Rep. Baker got a real boost when Rep. Oxley threw his weight behind Rep. Baker's bill.

Meanwhile, the speculation on Rep. Oxley's future is wide ranging.

Some say they think he is ready to move on and will seek a lucrative lobbying job, but others see him seeking a 14th term.