Buildups of precautionary cash as the federal government approaches the debt ceiling appear to be adding to already swelling levels of deposits.

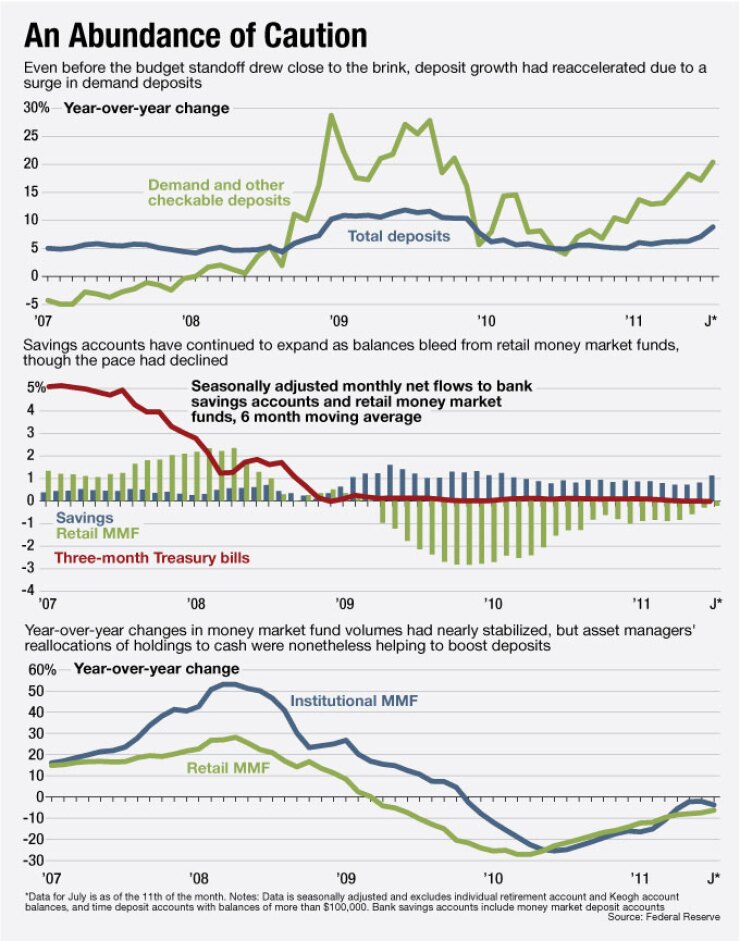

Demand deposits were up more than 17% from the previous year, to about $1 trillion in June, according to data from the Federal Reserve. Total deposits rose more than 7%, to about $7.5 trillion, excluding accounts with balances in excess of $100,000 (see charts). That magnitude of increase is approaching the pace set during the onset of the financial crisis; year-over-year growth in demand deposits peaked at almost 29% in December 2008, when year-over-year growth in total deposits broke above 10%. (The data has been seasonally adjusted.)

Businesses likely account for much of the increase — nonfinancial firms held about 40% of demand deposits at March 31, more than any other sector.

One force that was

Savings balances have continued to grow at a strong clip (about 1% a month on average during the first half of the year) as retail money market funds have generally continued to lose balances.

But the fund outflows had diminished. In fact, year-over-year changes in both retail and institutional money market fund volumes had nearly stabilized, despite anxiety over their

Still, the interplay between the shadow system and banks helped to boost deposits. Money market funds are large holders of deposits, which were about a fifth of their assets at March 31, and fund managers have been lifting cash positions, in part to brace for a potential flood of investor redemptions.

Indeed, seasonally adjusted balances in money market funds have fallen $46 billion from May, based on the estimate for July 18, the most recent data available.