Sunwest Bank had some explaining to do after it pulled away from construction lending about five years ago. Glenn Gray, the president and chief executive of the $688 million-asset Sunwest, said regulators questioned why earnings looked anemic compared to other banks.

"Relative to our peer group, we didn't seem to be growing the bottom line strong enough," Gray recalled. "We said, 'You are right. We want to be around in the next few years.'"

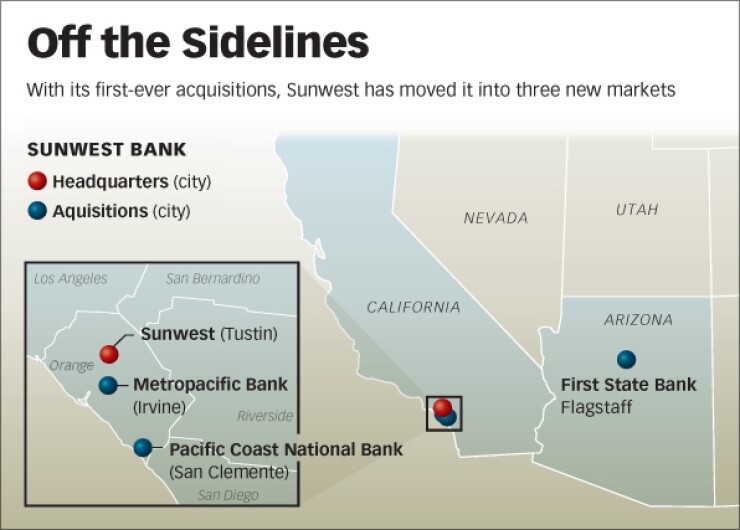

Now the Tustin, Calif., company's patience is paying off. After years of mediocre earnings and sticking to a strict vanilla lending strategy, Sunwest is on a growth tear. It has picked up three failed banks since the end of June, nearly doubling its asset size and increasing its profits significantly.

And it is not done. Gray said Sunwest continues scouting for failures in California, Arizona, Nevada and Utah, and it could double in size again within a year.

Industry observers endorse the strategy, saying it should prove lucrative as long as Sunwest can bring on enough bankers experienced in working out problem loans. Still, "it isn't for the weak of heart," said Randy Dennis, the president of DD&F Consulting Group in Little Rock.

Sunwest opted to do whole-bank acquisitions through the Federal Deposit Insurance Corp., without any loss-sharing agreements. It put in a negative bid each time, so essentially it gets paid up front to take the failed banks, Dennis said.

But nearly all of the assets are included, however iffy they might be, he said. Gauging their value quickly and properly becomes more important in such deals, to avoid getting hurt later.

"You have to bid to account for all the losses," Dennis said. "To do a whole-bank walkaway, you have to be able to do due diligence in four days and get a good idea of losses in the portfolio."

So far Sunwest has had only upside. In June it absorbed the failed $80 million-asset MetroPacific Bank in Irvine, Calif., marking the first acquisition for Sunwest in its 40-year history. Its third-quarter profits, which included a one-time extraordinary gain from the Metro deal, swelled to $5.4 million, up from $1.5 million three months earlier.

The exact amount that Sunwest ended up gaining from the FDIC payment was not immediately clear, and neither would discuss the issue. However, its third-quarter noninterest income grew by $7.6 million from a year earlier, largely because of the payment.

Sunwest did two more deals in the fall, for the $105 million-asset First State Bank in Flagstaff, Ariz., in September, and the $134 million-asset Pacific Coast National Bank in San Clemente, Calif., in November. Both took the bank into new markets.

Gray would not estimate how many banks Sunwest could absorb or how big it might get, though he said it's unlikely to go after banks with more than $300 million of assets. He also would not speculate at what point it would be done with government-assisted deals. "We will keep doing them as long as we can," he says.

Keeping pace with rapid growth wasn't much of a concern for Sunwest a few years ago. In 2005, its return on equity was a paltry 6.7 percent, compared with an average of 13.34 percent for all California banks. But more recently Sunwest has been able to shine, because its performance has held steady as competitors faltered. In the second quarter, before the impact from its acquisitions, Sunwest's ROE was 7.51 percent, compared with a state average of negative 5.36 percent. And in the third quarter, its ROE jumped to 36.11 percent.

"We are in this position because of what we did and didn't do back in the heydays," Gray said. "We stuck to our consistent, somewhat conservative underwriting standards. We didn't touch subprime and we didn't get involved in what subprime was driving in speculative construction."

The deals have dented Sunwest's previously hefty capital cushion, and Gray said the bank intends to raise money next year so it can keep buying. At June 30, the bank reported a total risk-based capital ratio of 20.52 percent, double the level needed to qualify as well capitalized. But after accounting for the acquisitions, this ratio would be 11.6 percent.

Observers speculated that attracting capital would be easy for Sunwest, even though its shares are thinly traded. Its chairman and largest shareholder is Eric Hovde, founder of Hovde Financial LLC and Hovde Capital Advisors LLC, and a specialist in raising capital and evaluating acquisitions. "He is good at deciding if it is a deal that is going to work, and if Sunwest needs capital, I think they could come up with sources of capital." said Richard Levenson, the president of the San Diego investment bank Western Financial Corp.

Marissa Fajt is a reporter at American Banker.