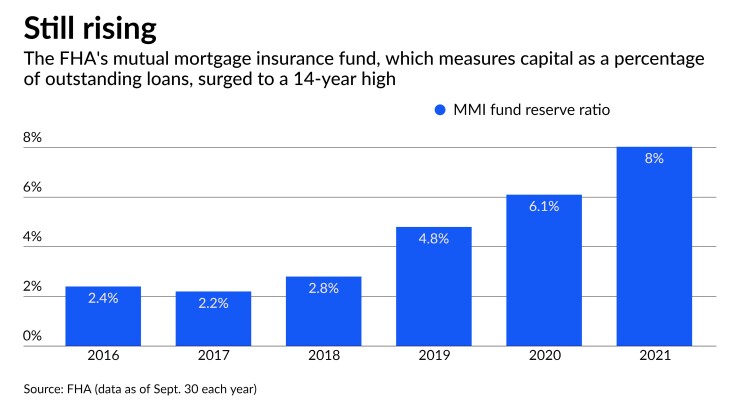

WASHINGTON — A key indicator of the finances of the Federal Housing Administration reached a new high for the fiscal year ending Sept. 30, thanks to strong home price appreciation in spite of the ongoing COVID-19 pandemic.

But despite a 14-year high of 8.03% for the capital ratio of the agency's mutual mortgage insurance fund — stoked by the recovery of the reverse mortgage program — the FHA did not signal immediate plans in its annual actuarial report to cut insurance premiums. The FHA is taking a "cautionary approach" to pricing in light of delinquencies and uncertainty about loans in forbearance, officials said.

"The effects of the pandemic on the FHA Single Family insurance portfolio continues to unfold, with over 660,000 loans that remain delinquent," Marcia Fudge, secretary of the Department of Housing and Urban Development, said in a foreword for the report.

The MMIF's capital ratio was 31.6% higher than

“Managing the strong fiscal health and performance of the FHA program is a top priority, and I am encouraged to see the MMI Fund remain resilient through the events of the past year,” Fudge said in a press release.

However, even though senior HUD officials said they were pleased with the strength of the MMIF on a call with reporters, they stressed that the capital ratios did not convey the full picture.

Nearly half of the more than 660,000 loans in the FHA's seriously delinquent portfolio were held in forbearance at the time. The value of seriously delinquent loans as of Sept. 30 was $110 billion, a reduction from the $158 billion in value recorded a year earlier, but still higher than before the COVID-19 pandemic.

Senior HUD officials said that it’s unclear what the outcomes will be for the borrowers that are currently in forbearance programs. Those borrowers might not know their ability to resume making payments until early next year.

Additionally, there is significant uncertainty about inflation, interest rates and how home prices might appreciate in the coming months, officials stressed. And there is still uncertainty about the leadership of the FHA; Julia Gordon, the Biden administration's nominee to oversee the agency, is

Nevertheless, various mortgage industry trade groups called on the agency to cut mortgage insurance premiums given the health of the MMIF.

“With the combined fund capital ratio now at 8.03%, it is appropriate for HUD to expeditiously examine reductions in FHA mortgage insurance premiums, which have been at their current levels for nearly seven years,” Robert Broeksmit, the president and CEO of the Mortgage Bankers Association, said in a statement.

Scott Olson, the executive director of the Community Home Lenders Association, said the annual report made it apparent that it is “long past time” to cut premiums, as well as end the FHA’s life-of-loan premium policy. That policy requires borrowers to pay annual premiums for government insurance over the entire term of a loan.

"These actions are two of the most important steps the administration could take in the area of homeownership to carry out its racial equity agenda,” Olson said in a statement.

But the Housing Policy Council commended the decision to hold off on cutting premiums until “more is known” about the status of the FHA’s seriously delinquent loans.

“Secretary Fudge has demonstrated effective leadership during a time of tremendous challenge, directing the agency to respond quickly and appropriately to the financial hardship faced by consumers and to work closely and collaboratively with key stakeholders, including mortgage servicers and consumer advocates, to assist homeowners in need,” the group said in a statement.

Despite warning about its seriously delinquent portfolio, the FHA also highlighted several positives in its report. Senior HUD officials said that the FHA served almost 1.5 million borrowers in the 2021 fiscal year, the largest number since 2010, and that almost 85% of the agency’s endorsements for forward mortgages were for first-time homebuyers.

In particular, the rebound of the capital ratio for the agency’s reverse mortgage program was encouraging, although it was mostly due to “strong national home price appreciation,” HUD said in a release.

The FHA also indicated several plans the agency is looking to pursue going forward, including “options to increase the availability of small-dollar mortgages.”

“Purchasers and owners of properties in low-cost markets often face difficulties in accessing mortgage credit, resulting in yet another barrier to homeownership for low- and moderate-income borrowers,” the report said. “Therefore, FHA will explore opportunities to address the financial and operational barriers that prevent the origination of these loans.”

Fudge suggested in the foreword to the report that the FHA would seek to build on the goal of the Trump administration to bring a wider swath of lenders into the agency’s fold, highlighting community banks, credit unions and community development financial institutions in particular. Currently, nonbank mortgage lenders dominate FHA lending.

“We recognize that the key to expanding access to credit is greater availability and affordability of FHA-insured mortgage financing,” Fudge said. “FHA must continue to attract and serve lenders of all types and sizes, particularly those who are working in, or are themselves part of, underserved communities.”

The agency also said it plans to examine its underwriting policies to see if there are any elements that needlessly prevent low- and moderate-income borrowers as well as borrowers of color from obtaining FHA-insured mortgages. The FHA will explore “potential enhancements” in order to better reach those borrowers, the agency said.

The FHA will also look at what it can do to help increase the supply and development of affordable housing, the report said. To that end, the agency plans to develop and improve financing options for manufactured housing units, and to identify policy changes that facilitate the construction of condominiums, shared equity homeownership programs and accessory dwelling units.