Banks' old problems kept easing in the first quarter. Their new problems didn't.

That's what analysts expect to hear from JPMorgan Chase & Co. and Bank of America Corp. this week as they kick off quarterly results.

The country's two biggest banks by assets are a good measure of the overall health of the country's commercial banks because they are involved in just about every facet of banking, from home lending to securities trading.

The mixed showing they're expected to report in those two areas alone shows how banks — like the economy — are stuck in a holding pattern until companies begin hiring in droves and home prices stabilize, experts say.

Fewer consumer and business loans are going bad, which means these two big banks and others should have been able to reclassify as profits some of the rainy-day funds they've set aside to cover loan losses. That's the old problem that's going away.

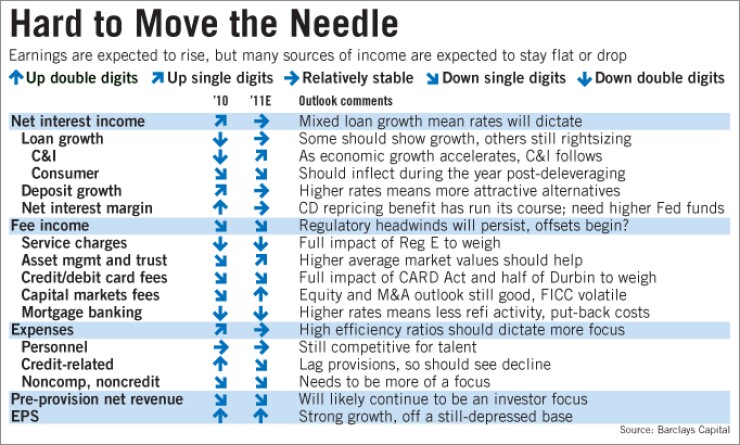

But things remain spotty when it comes to finding borrowers and clients to charge for loans and services. That's the new problem that isn't going away. It may be magnified by a volatile quarter for mortgages and investment banking, two of the few areas where big banks made money last year. When they stall, that leaves the industry relying on paper profits.

"The forward-looking stuff has been pretty moribund," said Thomas Mitchell, an analyst with Miller Tabak & Co. LLC who covers midsize banks. "You have companies that, except for improvement in their credit metrics, are not showing any underlying growth at all. And I think that is likely to continue to be the case."

JPMorgan Chase is scheduled to report earnings on Wednesday. The consensus of eight analysts polled by Bloomberg has it earning $1.17 per share, up from 96 cents per share in the fourth quarter. B of A should earn 28 cents, up from a loss of 8 cents, according to a Bloomberg poll of 15 analysts.

Weighing on both banks' results: A slowdown in mortgage originations as suggested by data tracking home sales and home loan applications through the quarter. JPMorgan Chase said in its annual report that mortgage fees were on track to decline by as much as 38% in the first quarter. A rebound in the capital markets during the first two months of the year appears to have been disrupted in March by the Japan tsunami and military action in Libya — events that rattled investors.

Barclays Capital, citing data from Dealogic, said in a research note on Friday that capital markets revenue at U.S. investment banks was more robust than in the first quarter of 2010, but softer than in the fourth quarter, due in part to fewer advisory fees and less equity underwriting. It estimates a quarter-to-quarter decline of 5% at JPMorgan Chase and 9% at Citigroup Inc.; B of A's rose 11%, Barclays estimates.

Outside of trading and credit quality gains, B of A is expected to report that bread-and-butter businesses were hit by offsetting forces. The costs of repurchasing bad mortgages from investors likely fell or remained flat. But originations of new mortgages probably slowed, analysts say. High-cost certificates of deposit likely ran off the books, easing the cost of funds. But deposit fees are believed to be falling, as are credit card fees, thanks to new regulations.

Things are just as mixed in the industry's few good-news areas, like a modest uptick in demand for auto and business loans. Banks can't add nearly enough of them to offset the construction and business mortgages that keep running off their books, hurting margins.

As of the end of March, Federal Reserve data showed overall loan balances dropped 3% quarter to quarter at large U.S. banks, despite a 1% increase in commercial and industrial loans.

Even banks like U.S. Bancorp and PNC Financial Services Group Inc. that have been able to steal business customers from other banks said they'd been having problems getting them to actually borrow during the quarter.

William Demchak, vice chairman of PNC, said during a conference in February that utilizations on its commercial credit lines were hovering at 20%, down from 40% to 60% in normal times. The Pittsburgh company added some 1,100 new business customers in 2010.

"We have not really seen changes in utilization," he said. "If anything they're still trending down."

Andrew Marquardt, head of research at Evercore Partners, said the top line of bank balance sheets — income from fees and loans — remains under pressure. There are also questions about how long falling problem loan costs can keep adding to the bottom line.

"Revenue is still going to be a challenge near term but credit is going to be the driver of earnings growth," Marquardt said. "What could surprise on the upside is probably credit quality still being good and reserve release coming in greater than people anticipate."

A number of analysts say credit quality gains likely slowed at big banks. Barclays said in Friday's note that releases of credit reserves at 27 big banks likely declined $3.1 billion from the fourth quarter, to $7.5 billion. It also predicted that provisions fell by just 13%, quarter to quarter, after a decline of 16% and 20% in the last two preceding quarters.