-

A federal appeals court has dealt the retail sector a setback in the ongoing fight over surcharges on credit card purchases.

October 20 -

In a victory for small retailers, a federal court in New York has ruled that merchants in the state may add swipe-fee surcharges on purchases made by credit card instead of cash.

October 3 -

Lawyers' private emails reveal just how much a pair of 2013 interchange-fee settlements favored the credit card industry. But those suits could be headed back to square one, giving retailers the chance to fight for better terms.

August 5 -

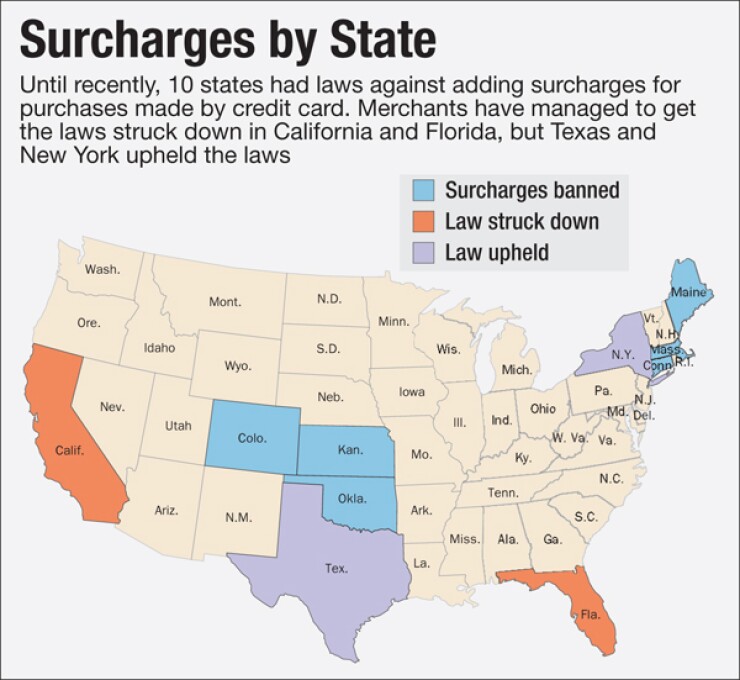

Retailers have been able to get credit card surcharge bans in California and New York thrown out by using an unusual legal argument based on the First Amendment. The wins are significant, but merchants still need to fight through a legal thicket before card surcharges become practical.

March 27

Merchants continue to chip away at rules against credit card surcharges, and they won their latest victory with the help of the First Amendment.

On Wednesday a Florida court struck down a state law against credit card surcharges on the grounds that it violates merchants' freedom of speech. The ruling by the U.S. Court of Appeals for the 11th Circuit reversed a district court's decision and opened the door — in theory, at least — for Florida merchants to pass on to their customers the cost of accepting credit cards.

Florida law prohibits merchants from charging fees to customers using cards, but it permits them to offer discounts on cash purchases, even if the discount and the charge result in the same cost for the customer. A group of small businesses argued that distinction controlled not their conduct but their speech, and therefore violated the Constitution.

The appeals court agreed, writing that under the surcharge ban, a merchant "runs the risk of being fined and imprisoned" over "a simple slip of the tongue" — calling a price difference a surcharge rather than a discount.

"The First Amendment prevents staking citizens' liberty on such distinctions in search of a difference," the court wrote.

Laws banning surcharges became a contentious issue following the 2012 antitrust settlements between merchants and major card networks. State surcharge laws were passed in the 1980s but for decades were more or less irrelevant, because all merchant contracts with the card companies also forbid surcharges. But the card settlements got rid of surcharge bans in merchant contracts, making the state laws relevant again.

The legal strategy of invoking the First Amendment was devised by Deepak Gupta of the law firm Gupta Wessler in Washington, D.C., who has used it to challenge bans in four of the ten states with surcharge laws on the books.

Gupta, whose background is in consumer advocacy, calls interchange fees a "massive wealth transfer" that hurts both merchants and consumers. Shortly after the card settlements were reached, he started looking at state surcharge bans and realized that they are based on "the difference between 'glass half full' and 'glass half empty.'"

The Florida appeals court echoed this language in its decision siding with him.

"If the same copy of Plato's Republic can be had for $30 in cash or $32 by credit card, absent any communication from the seller, does the customer incur a $2 surcharge or does he receive a $2 discount?" the opinion read. "Questions of metaphysics aside, there is no real-world difference between the two formulations."

Despite the success in Florida, Gupta's strategy has had mixed results. In New York, the first state where it was tried, it

Some lawyers who work on swipe fees consider Gupta's challenges to state laws a minor issue compared to the ongoing fight over the settlements, but Gupta believes that his suits and the settlements are interconnected.

When the settlements took effect, "it made state laws spring back to life. They were the only thing standing in the way of surcharging," he said. "The settlements won important benefits for merchants, and this litigation helps protect that relief."

Merchants still rarely, if ever, apply card surcharges. The settlements reached in 2012 permitted the practice but imposed so many restrictions and conditions that few, if any, have found it practical to do so.

Gupta thinks that state surcharge bans are another big barrier.

"Even if the settlement allows surcharging, what big merchant is going to do it if it's illegal in Texas and California? We have a national consumer economy," he said.

Surcharging rules could be in for even more flux, depending on the whether the 2012 settlements survive merchants' latest challenges to them. That is anybody's guess, after

Merchant attorneys argued that the lawyers' misconduct tainted the settlements and have asked them to be tossed out. The U.S. District Court for New York's Eastern District quickly complied,