Investment in fintech remains strong, and banks are increasingly getting into the game.

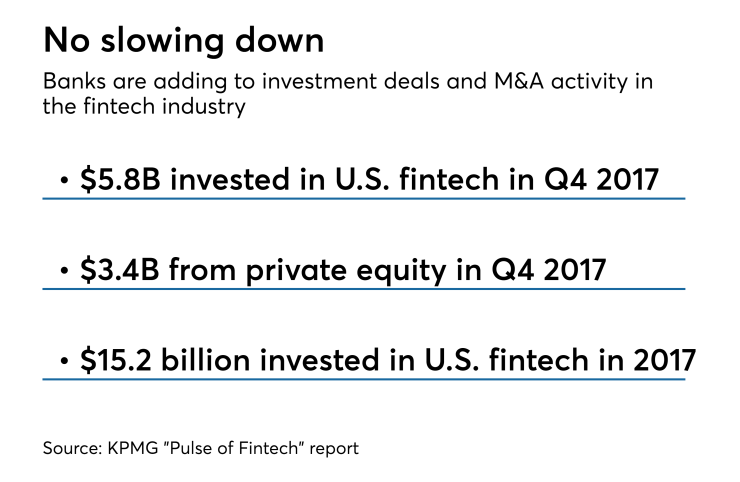

According to KPMG’s “Pulse of Fintech” report released this week, U.S. fintech investment reached $5.8 billion in the fourth quarter, the third straight quarter that figure increased.

While venture capital funding remains significant, the strong uptick in the number of fintech investment deals during 2017 can be attributed to financial institutions prioritizing digital innovation, said Anthony Rjeily, digital and fintech practice leader for KPMG.

“Right now there’s a high level of interest on both sides when it comes to the marriage of fintech and banks,” he said. “Both sides bring value propositions that are very complementary: Fintechs bring an innovation culture, new business models and new methodologies that banks struggle with due to legacy infrastructure. On the flip side, banks have the consumer trust and distribution channels" that many fintechs lack.

This year has already produced a number of examples.

“You’re seeing more partnerships because there is more interest on both sides in collaborating, and bringing two different sets of values to the table,” said Luis Valdich, managing director of venture investing at Citi Ventures.

When it comes to seeking fintechs to invest in or acquire, Valdich said Citi Ventures looks for firms that solve major pain points in the industry; that’s a big reason it was attracted to HighRadius, which aims to streamline the

“We look at how significant value can be created in an existing process, or something that can deliver a much better product for a customer,” Valdich said. “We look to work with [startup] founders that have unique insight with respect to addressing a certain problem, and are in fact ahead in solving that problem.”

This year, Citi Ventures is putting a major focus on “

“The key is, how do we use these to deliver superior financial services to clients?” Valdich said. “That’s a very important theme we are exploring over multiple investment opportunities.”

Similarly, BB&T is looking to invest in artificial intelligence, chatbots, cybersecurity and fraud detection and prevention with the $50 million it has earmarked for fintech. Areas of focus include payments and “better ways to provide actionable financial advice,” according to chief digital officer Bennett Bradley.

“For BB&T, it all begins and ends with the client experience,” Bradley added. “Things are changing rapidly, and it’s critical that we remain relevant and meaningful in the lives of our clients.”

When it comes to investing in new technologies like AI, KPMG’s Rjeily expects banks to set aside resources not only to help create consumer-facing products such as chatbots and virtual assistants, but also to pursue automation and efficiency in back-end processes.

“AI is very hot, and a lot of the interest is driven by customer experience, but also as it relates to efficiency plays in their internal organization,” he said.

Another relatively new trend KPMG research found is that larger fintechs are also starting to acquire startups to enhance their overall capabilities.

“We are seeing the more mature fintechs, the ones that have achieved a certain scale, now looking to branch out into new service areas and to complement their core offerings through inorganic growth,” Rjeily said. “They are starting to invest in and acquire small fintechs themselves. This is a new dynamic in the fintech funding space, but one we will continue to see moving forward.”

“There are great opportunities for collaboration," Valdich said, "but at the same time there are a number of fintechs that are very interested in competing with banks. Fintechs are building businesses in their own right, too.”