With each succeeding bank to jump into the robo-advisory game, a couple of questions grow louder.

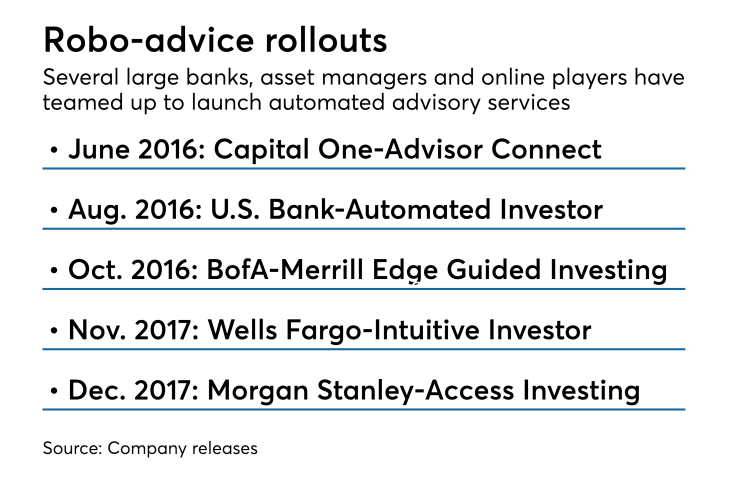

The team-up announced this week between Fifth Third Bancorp's securities unit and Fidelity is one of about a half-dozen partnerships in the last two years involving big banks, asset managers, online-only players and others.

Among the key questions are how will the late arrivals stand out from the firms that had a head start, and will any of their services be good enough to compete in a quickly evolving wealth management industry?

There are plenty of sound ideas behind what Fifth Third is doing, said Doug Fritz, principal of the consulting firm F2 Strategy, but there is a potential downside if it neglects its traditional high-end clients and doesn’t get good enough at reaching the mass-affluent audience this partnership is aimed at.

“I’m not 100% sure Fifth Third is paying as much attention to their legacy wealthy clients,” he said. The underlying technologies “won’t scale up to the complexity needed to address the high-net-worth clients as well. I would hope that they have similar tools in the works for their top-paying clients.”

The bank said it was following the trends compelling banks of all sizes to add digital advice components and pair them up with personal finance management apps and digital-only bank options.

Robo-advice is expected to top $4 trillion in assets in four years. Additionally, consumers are becoming more comfortable with an algorithm guiding their portfolios. In a study published last year, Accenture reported that 78% of consumers are open to signing up for automated investing advice.

“Investors increasingly want options when they seek out investment advice. We have a responsibility to provide choices so they can engage with us however they prefer,” Brian Lamb, executive vice president and head of wealth and asset management for Fifth Third, said in a press release.

Other banks have already made digital services live.

Some banks have tried to address concerns about digital offerings by raising the threshold for entry: Wells Fargo and U.S. Bank have digital advice account minimums double that of Fifth Third's. And by blending human service with digital platforms, other firms have sought wealthier clients. Schwab’s Intelligent Advisory service has a $25,000 account minimum, while Vanguard’s Personal Advisor Services (the largest digital advice platform, with over

Online-only startups actually are ahead of banks in attempting to bring digital advice to a wealthier client. Betterment, for instance, offers a

Partnering with Fidelity is Fifth Third’s latest move in

In 2016, it launched Life360, which combines human advice with a digital platform that gives customers a full overview of their financial life, including accounts and investments that aren’t held at Fifth Third.

“Fifth Third is doing a great job bringing mass affluent and emerging wealthy clients into their wealth group,” Fritz said.

For the custodian, Fifth Third is its first bank partner to adopt the technology powering its own digital advice platform, called Fidelity Automated Managed Platform, or AMP, which it co-developed with its financial planning software arm eMoney.

With their built-in client scale, banks have the best opportunity to push automated advice to the general market, said Tim Welsh, head of the wealth management consulting firm Nexus Strategy.

“They have millions of accounts and they can't reach all of those people,” Welsh said. “So creating an automated platform makes a lot of sense. They are not going to build it themselves. They outsourced it to someone who has got a really compelling system or platform that really built out that has all the nuts and bolts and you just need to put your logo on it."

The banking industry at large also has the opportunity to overcome past hurdles to enter wealth management, Welsh added.

“It makes sense that they would outsource an online platform," he said. "They are just not skilled in these areas. Branch brokers will try to sell you an annuity or a mutual fund. That's all they got. That's why it never took off. People don't usually view those brokers at a branch as wealth managers.”