-

LenderLive Network is expanding its correspondent lending channel by offering to buy jumbo mortgages from members of the Independent Community Bankers of America.

June 11 -

Some regional and large community banks are retaining more mortgages for investment because better-than-average deposit growth has given them extra cash they need to deploy. However, they are selective about which mortgages they keep.

June 11 -

Despite the risks, lenders have calculated that certain loans that fall outside of QM are worth making and holding on their balance sheets.

January 7

Smaller banks wary of holding jumbo mortgages may soon have access to a new buyer, thanks to an unusual move by the Federal Home Loan Bank of Chicago.

The government-chartered cooperative last week agreed to a partnership with Redwood Trust, a real estate investment trust in Mill Valley, Calif., that buys and securitizes home loans, to

The deal could be a boon for community banks and Redwood. It would give banks a new option for jumbo loans, aside from keeping them in their portfolios exposing them to interest rate risk or selling them to bigger banks. Fannie Mae and Freddie Mac do not buy these high-balance loans, which limits the choices for community banks.

The conduit would allow the roughly 1,500 community banks, thrifts and credit unions that participate in the Mortgage Partnership Finance program to sell Redwood mortgages with value of up to $729,750, the REIT said. The deal requires approval from the Federal Housing Finance Agency.

"This allows members of Federal Home Loan Banks to expand into higher-balance loans in all communities across the country," says Eric Schambow, senior vice president at the Chicago FHLB and the program's director. "We believe it is in line with our strategy to bring more liquidity to Federal Home Loan Bank members across the country."

Jumbo loans are fiercely coveted because they tend to have very low default rates and offer banks the chance to cross-sell products to a wealthier group of borrowers. Bank of America (BAC), JPMorgan Chase (JPM) and Wells Fargo (WFC) have all said they are

Because big banks are keeping their jumbos, REITs like Redwood are turning small and midsize. Redwood bought $7 billion of prime jumbo loans last year from 124 sellers, about half of which are community banks.

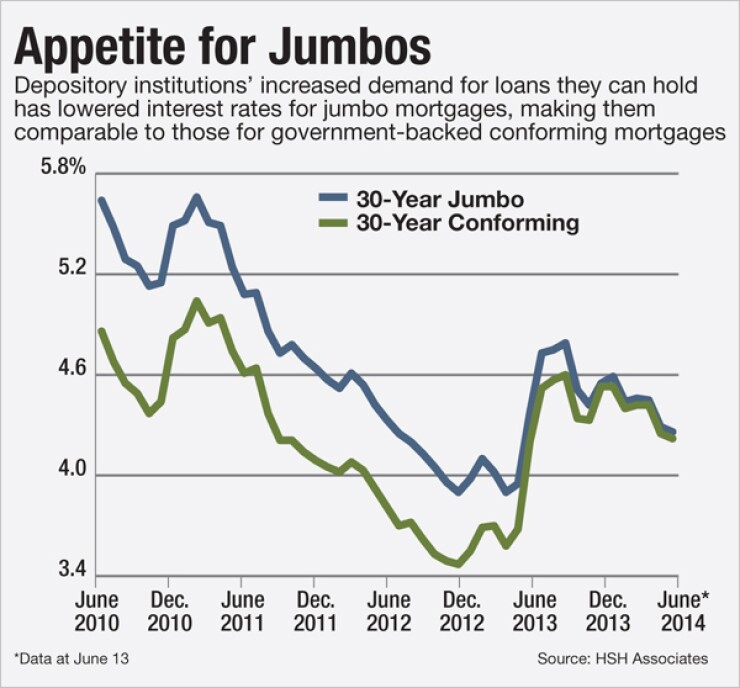

Increased appetite for jumbo mortgages has lowered their average rates to a point that they are almost identical to those for conforming mortgages.

For smaller banks, the conduit will let them sell nonagency loans without risking customer relationships, says Mike McMahan, a Redwood managing director. The biggest banks generally buy jumbos along with the servicing rights, which gives an inside track at poaching borrowers. "A community bank doesn't want to sell their client to a competitor," McMahan says.

"We're not a bank, we don't have other products or services to sell, and banks know that we're not going to steal their client," he adds. "We're providing private capital to the banking industry in a nonthreatening, noncompetitive way."

In what could be a coup for Redwood, the FHLB will give the REIT exclusive access to the conduit for the first three years. The FHLB may let other investors participate after that period, Schambow says.

The three-year exclusivity period is a perk for helping set up the conduit, McMahan says. "Nobody would spend the time and effort that was required to set up the program without being assured of some period of exclusivity," he says.

The FHLB would not comment on the Redwood negotiations, or whether it considered competing offers from other investors.

The deal comes amid some controversy about the FHLB's decision to allow REITs membership, which provides the real estate firms with low-cost funding and the implicit backing of the federal government. Redwood's captive insurance company was awarded FHLB membership earlier this month, making it the fourth REIT with access to FHLB advances.

Allowing loosely regulated REITs membership may heighten the risk for the FHLBs, which are cooperatively owned by their members but operate with the taxpayer support. FHFA director Mel Watt said last month that he would look into issues surrounding REIT membership in FHLBs. A spokeswoman for the Chicago FHLB declined to comment on the policy.

For the FHLBs, real estate investment trusts are valuable new customers at a time when traditional lenders have pulled back their use of credit from the cooperatives. FHLB advances have been in decline since the financial crisis, when they were a crucial lifeline for troubled members.

"The FHFA is going to be very closely watching this, but from a public-policy standpoint, it does fit in the spirit of the charter of the FHLBs," says Clifford Rossi, a professor at the Robert H. Smith School of Business at the University of Maryland and former risk-management executive at Freddie Mac and Fannie Mae. "My take on it is that the charter really is about promoting liquidity."

The Redwood arrangement is a win for all parties, Rossi says, giving smaller banks a new outlet for loans while offering Redwood a key leg up in the competitive market for jumbo mortgages.

"The FHLBs are looking for ways to tweak their business model to stay relevant and evolve within the charter that they have," Rossi says. "This is a really creative way to do that."