-

Citigroup (NYSE: C) and insurance company Assurant (AZ) have agreed to pay $110 million to settle charges that it forced thousands of homeowners to purchase expensive property insurance in order to profit from kickbacks and commissions.

February 6 -

JPMorgan Chase said it would stop accepting commissions from Assurant under a settlement reached Friday. The two firms have also agreed to pay up to $300 million to resolve allegations that they overbilled homeowners.

September 9 -

Wells Fargo and insurer QBE have agreed to pay $19.3 million to settle claims that they overcharged homeowners in Florida on lender-placed insurance policies.

May 14 -

The directive bars banks that do business with Fannie and Freddie from receiving commissions from insurers, but still lets insurers provide services for free or at a reduced cost.

November 5

The Federal Housing Finance Agency should sue force-placed insurers and large banks for inflating prices and generating losses for Fannie Mae and Freddie Mac, the agency's inspector general says.

Fannie and Freddie suffered $158 million in "financial harm" in 2012 alone from reimbursing servicers for "excessively priced" force-placed insurance, according to a report set for release Wednesday by FHFA's inspector general. The government-sponsored enterprises reimbursed servicers for $327 million in force-placed insurance premiums last year and for $587 million in premiums from 2009 to 2011, the report found.

The 24-page report by the inspector general recommends that the FHFA assess whether to sue insurers and banks to recover damages. The FHFA has agreed to complete an assessment on whether to litigate within a year.

The prospect of yet

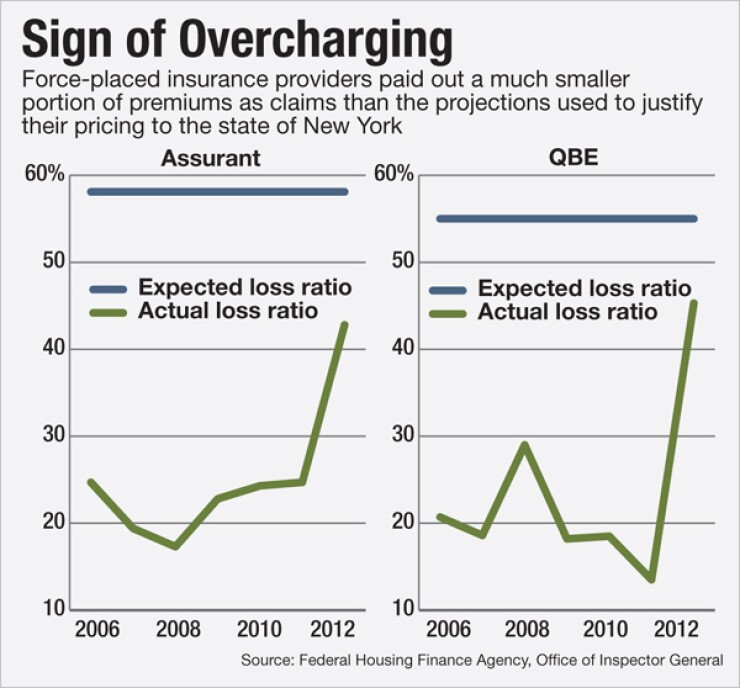

Two insurers, Assurant Inc. (AIZ) and QBE Holdings, write more than 90% of force-placed insurance coverage. They priced premiums paid by the GSEs that were 79% above what was considered "reasonable" to cover claims, the inspector general's report found.

Yet the FHFA, as the conservator of Fannie and Freddie, never determined whether to sue to recover damages. FHFA officials "cited competing priorities, such as finalizing other financial settlements, as the reason for not completing such an assessment," the report found.

Force-placed insurance made headlines in 2011 when mortgage borrowers were hit with hefty premiums, usually after they defaulted and went into foreclosure. The hazard insurance is purchased by the servicer or creditor when a struggling homeowner fails to maintain coverage on the property.

American Banker detailed the pattern of

Wells Fargo (WFC), JPMorgan Chase (JPM) and Citigroup as well as the insurers Assurant and QBE have agreed to pay at least $674 million in out-of-court settlements with borrowers since 2011, the FHFA report found.

Though Fannie and Freddie paid inflated premiums as well, and the costs ultimately were passed on to taxpayers, the FHFA has been faulted for failing to assess whether to sue to recover damages. The inspector general's report says the GSEs "may be able to benefit from lender-placed insurance-related litigation."

"Our analysis indicates that such litigation could result in financial recoveries for the enterprises," states the report, which was signed by Richard Parker, the deputy inspector general for evaluations. "The potential recovery from lender placed insurance-related litigation may outweigh its costs."

The report examines how three states New York, Florida and California have held insurers accountable for the force-placed insurance kickback schemes and inflated prices. Assurant and QBE have entered consent orders, paid civil penalties and were forced to reduce premiums.