-

Atare Agbamu promised his elderly clients that reverse mortgages were regulated to protect them and their spouses and heirs. Then he came across a HUD letter to lenders indicating otherwise.

May 9 -

Texas, a big market for reverse mortgages, has approved a variation of the product that taps the equity in a senior's home to pay for a new, often smaller, dwelling.

May 1 -

Ginnie Mae is declaring its reverse mortgage securitizations off-limits for a new type of product that would require the servicer to take interest rate risk.

April 3

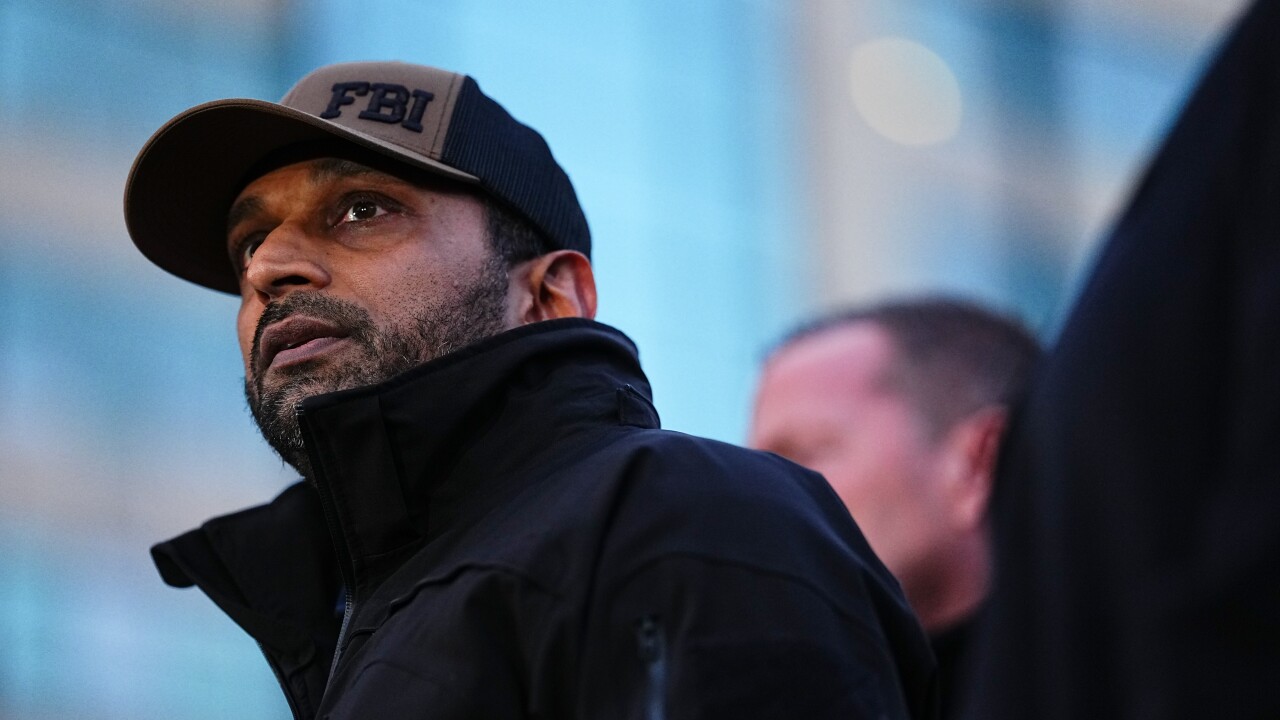

The Federal Housing Administration has issued guidance to lenders to prevent deceptive marketing of reverse mortgages to seniors.

The

It is intended to ensure "lenders know we're keeping a watchful eye on their marketing and advertising practices that might steer borrowers toward reverse mortgage options that limit their available choices," FHA Commissioner Carol Galante explained.

All FHA-approved lenders are required to clearly explain the HECM's requirements and features. Among other requirements, the lender must explain that: the FHA insures fixed and adjustable-rate mortgages; borrowers are allowed to change the ARM loan method of payment at any time; while fixed rate loans are limited to a single lump sum, ARM loans allow for five payment options and future draws; and that the age of the youngest borrower (or

"Lenders are prohibited from using any misleading or misrepresentative advertising or marketing materials in connection with the HECM program or from making any statement or representation that could mislead a mortgagor as to his or her rights under a HECM," the guidance letter notes.

In addition, all materials used must include "a prominently displayed" disclaimer "that clearly informs the public the information was not compiled or approved" by the Department of Housing and Urban Development or FHA.