Change is coming to one of the Federal Reserve's oldest policy tools, but as the central bank's No. 2 official said, that is nothing new.

In a two-part speech delivered Tuesday night and Wednesday morning, Fed Vice Chair Philip Jefferson delved into the history of the

"Today the discount window continues to be an effective tool, but it is important to acknowledge that economic and banking conditions continue to evolve," Jefferson said Wednesday.

The discount window has been a

During the past 19 months, the Fed has sought to head off similar problems at other institutions by

As a result of this effort, Jefferson said, 3,900 eligible banks — roughly 80% of all banks in the United States — now have contracts in place to be able to borrow from the discount window. Among those, 2,000 banks have already pledged assets to the window totaling nearly $2.6 trillion of discounted value.

"These figures are notably above their levels at the end of 2021 and 2022," Jefferson said. "Although I am pleased to see the improvements in discount-window readiness statistics, continued outreach is still important."

Last month, the Fed launched a

Jefferson said the ultimate goal is to determine the elements of the discount window that are "most costly or burdensome" for banks.

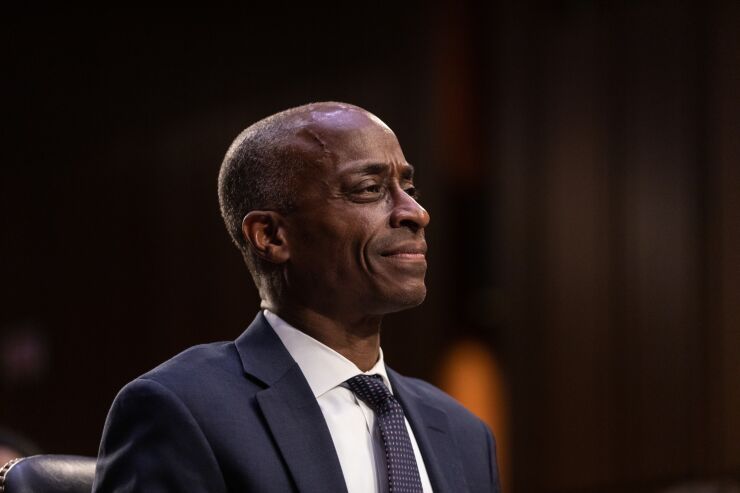

For the first part of the speech, Jefferson returned to Davidson College, a liberal arts college roughly 20 miles north of Charlotte, North Carolina. Before joining the Federal Reserve Board of Governors in 2022, Jefferson served as vice president for academic affairs and dean of faculty and the Paul B. Freeland Professor of Economics at the school. In these remarks, he discussed the history of the discount window from the Fed's establishment in 1913 through 2000.

Jefferson detailed how the discount window has played a role in smoothing financial market functioning and helped prevent shocks for more than a century. He also discussed changes made to the facility, including those aimed at ending the broad practice of banks borrowing from the Fed to fund day-to-day activities.

Jefferson said these efforts preempted moral hazard and brought needed discipline to the bank funding market but also sowed the seeds for the stigma that now surrounds discount-window usage.

"As a result, banks became more reluctant to borrow from the discount window," he said Wednesday night. "The greater reluctance to borrow from the discount window made it less effective, both as a monetary policy tool and as a crisis-fighting tool."

In his second address, Jefferson detailed how the Fed took efforts in 2003 to address this stigma by creating two categories of discount-window lending: primary credit to provide "no-questions-asked" liquidity to healthy institutions and secondary credit for those with solvency issues.

Jefferson said there are signs that those changes made banks less reluctant to borrow but noted that the banks' comfort with the discount window is hard to measure. Still, in light of changes in the banking system and in the economy more broadly, he said it is time the Fed looked to

"Since the 2003 discount-window reassessment, we have seen an increased focus on liquidity in banking regulation, including the advent of quantitative liquidity requirements for large banking organizations; technological changes in the banking system; a general trend toward faster and 24-7-365 payment systems; changes in the composition and posture of Federal Home Loan bank lending; and the move to an ample-reserves monetary policy implementation regime," he said. "In light of these developments, the Federal Reserve System has taken important steps to ensure that the discount window performs its functions successfully in the 21st century economy."

Jefferson's remarks on Tuesday was his first public speaking engagement in nearly five months and only his fifth of the year. Despite his prominent role on the Fed's board of governors — one that requires a presidential appointment and Senate confirmation — Jefferson has maintained a relatively low profile since being elevated to the vice chair seat last September. In all, he has given 10 total speeches, most of which have focused on the economic outlook.