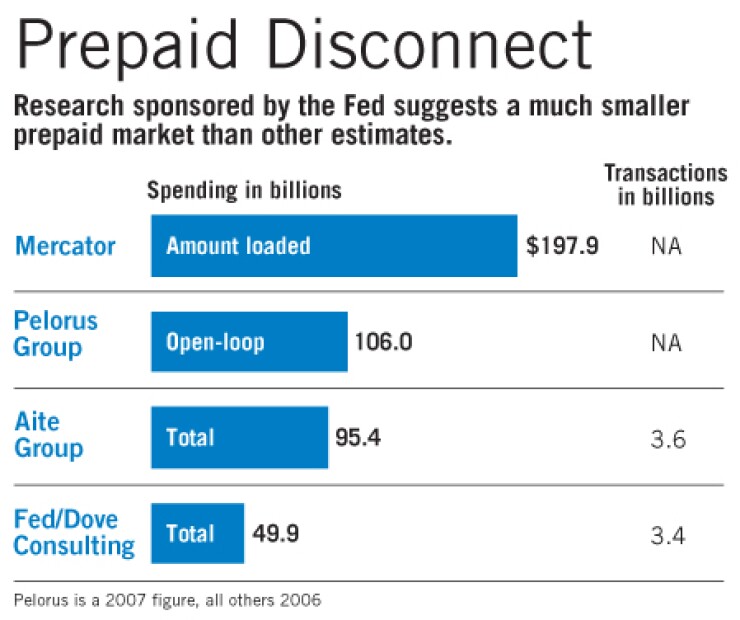

Though some researchers have estimated that purchases made with prepaid debit cards are worth hundreds of billions of dollars a year, new research from the Federal Reserve Board says the market may be much smaller.

According to a report the Fed issued last week, spending on prepaid cards was just under $50 billion in 2006. The authors said that the significant gap between their findings and earlier estimates could have resulted from some transactions being double-counted in the more bullish reports, or from ignoring the difference between when money is loaded on the cards and when it is actually spent.

Observers said the Fed's assessment could lead some prepaid debit card companies to rein in their expectations of the market and perhaps reconsider whether they want to be in certain segments of it.

However, the lower forecast could also come as a relief to some prepaid companies that may have been puzzled that their sales results did not seem to reflect the booming market the earlier reports described.

The study was conducted by the Dove Consulting unit of Hitachi Consulting as an update to the central bank's Federal Reserve Financial Services Policy Committee's larger 2007 payments study, released in December. It focused on 2006 transactions using closed-loop cards, which can be used only at a single retailer, and open-loop cards, that can be used at a wide variety of locations.

The report found there were 3.1 billion closed-loop transactions in 2006, worth $36.6 billion, and 321.8 million open-loop purchases, worth $13.3 billion.

It also cited previous reports that had found much higher totals. Aite Group LLC estimated in July of last year that in 2006 there were 3.6 billion prepaid transactions, worth $95.4 billion. In September, Mercator Advisory Group Inc. estimated that $197.9 billion was loaded on to prepaid cards in 2006. In August, Pelorus Group predicted that 2007's open-loop spending would be $106 billion.

Edward Bachelder, Dove's director of research and analytics, said his numbers show that the prepaid card market may not be the huge growth opportunity that some boosters have claimed, notably the companies that issue and process prepaid transactions.

The lower figures could have ripple effects in other fields as well, he said, such as private-equity companies and venture capitalists, which may be thinking of investing in prepaid companies.

"It's a big bucket of water we've dumped on them, and there are going to be a lot of furious people," Mr. Bachelder said.

Tony Hayes, a partner in Marsh & McLennan Cos.' Oliver Wyman Financial Services division, said the Fed report has debunked the "rosy estimates" from analysts and processors and could prompt banks to reconsider their strategies for the market. The smaller estimate is "going to force banks to ask the hard question, Do I want to be in this business?" he said.

"In order to answer that question, you have to ask what this business is," he said. The prepaid market has several varieties, all with their own characteristics.

"There is no prepaid card market," he said. "There are many sub-prepaid card markets." Some, such as payroll, may be good markets for banks, while others, such as gift cards, may not. "The reality is," the prepaid market "is far, far smaller than anybody believed," he said.

Some prepaid card companies, he said, may have cheered at earlier forecasts but privately wondered why their own results did not seem to measure up; to them the new estimate may provide some consolation, because they might conclude that "maybe everyone else is not doing so well either."

Gwen Bezard, an analyst at Aite, defended the Boston research firm's findings but noted that the July report had reduced its 2006 estimate from a similar report issued in 2005. The Fed's numbers "seem very low to me," Mr. Bezard said. "I still feel pretty good about our numbers. That's all I can say."

Tim Sloane, the director of Mercator's debit advisory services, said his research includes categories he did not see in the Fed's report, such as government benefit cards, phone cards, and campus closed-loop payment systems.

Moreover, he said, the Fed's report excluded such transactions as automated teller machine withdrawals from payroll cards.

Some of the discrepancies involved definitions, Mr. Bachelder said. Government benefit cards were included in the Fed's earlier study on electronic payments, and ATM withdrawals are not payments but conversions of value from one form to another.

Mr. Bachelder also noted there are many participants in the payment chain, and not all of them actually process transactions; researchers who include data from every participant could end up counting some transactions twice, he said. "We want to count the payment once and only once," he said. "There's a lot of double counting."

His report for the Fed noted that some other forecasts have measured the amount of money loaded on to prepaid cards, rather than the amount spent.

Paul Tomasofsky, an executive vice president and the acting chief operating officer of the Network Branded Prepaid Card Association, said that the prepaid card market is still at an early stage of its development and that many companies are reluctant to disclose their volume, making accurate forecasting difficult.

As a result, studies often rely on estimations, said Mr. Tomasofsky, who is also the president of Two Sparrows Consulting LLC.

Mr. Bachelder acknowledged that some of the largest providers of prepaid services decided not to participate in his study, and said that more than half of the closed-loop figures, and more than two-thirds of the open-loop figures, is based on unconfirmed estimates.

Mr. Bachelder said his firm contacted the providers repeatedly, and in some cases received guidance on adjusting the estimates.

Prepaid card companies greeted the findings with sangfroid.

Brett Rodewald, the president of the card processor Comdata Corp., said the Fed's estimates and any others were of no concern.

Comdata is one of the largest processors of gift cards, but he said gift cards are a small slice of retail spending. "The ultimate universe for that market is whatever the retail world is."

Daniel Henry, the president and chief executive of NetSpend Corp., a prepaid debit card company in Austin, said the study reinforced his belief that the prepaid market has ample room for growth.

Referring to open-loop transaction volume, he said, "I think it is going to be a lot easier for that $13 billion number to grow fivefold," than for NetSpend to make similar gains in the more saturated credit card market. "I like being in a space that has plenty of room to grow."