-

The Federal Reserve Board revised its findings to the closely watched Dodd-Frank Act stress tests on Friday, citing inconsistencies in the treatment of some figures during its calculations.

March 21 -

The Federal Reserve Board released its second annual round of stress tests mandated by the Dodd-Frank Act on Thursday, providing a glimpse into how the country's biggest firms would fare under a hypothetical economic crisis.

March 20 -

Banks are going to have to work harder next year if they want to continue to pass the Federal Reserve Board's annual stress test exercise.

March 19 -

In its second round of stress tests in two weeks, the Fed rejected two banks' capital plans — Ally and BB&T — while it found weaknesses in two others, JPMorgan Chase and Goldman Sachs.

March 14

WASHINGTON The Federal Reserve Board denied Citigroup Inc.'s capital plan on Wednesday, saying it had failed to make sufficient improvements to a number of deficiencies in its capital planning processes.

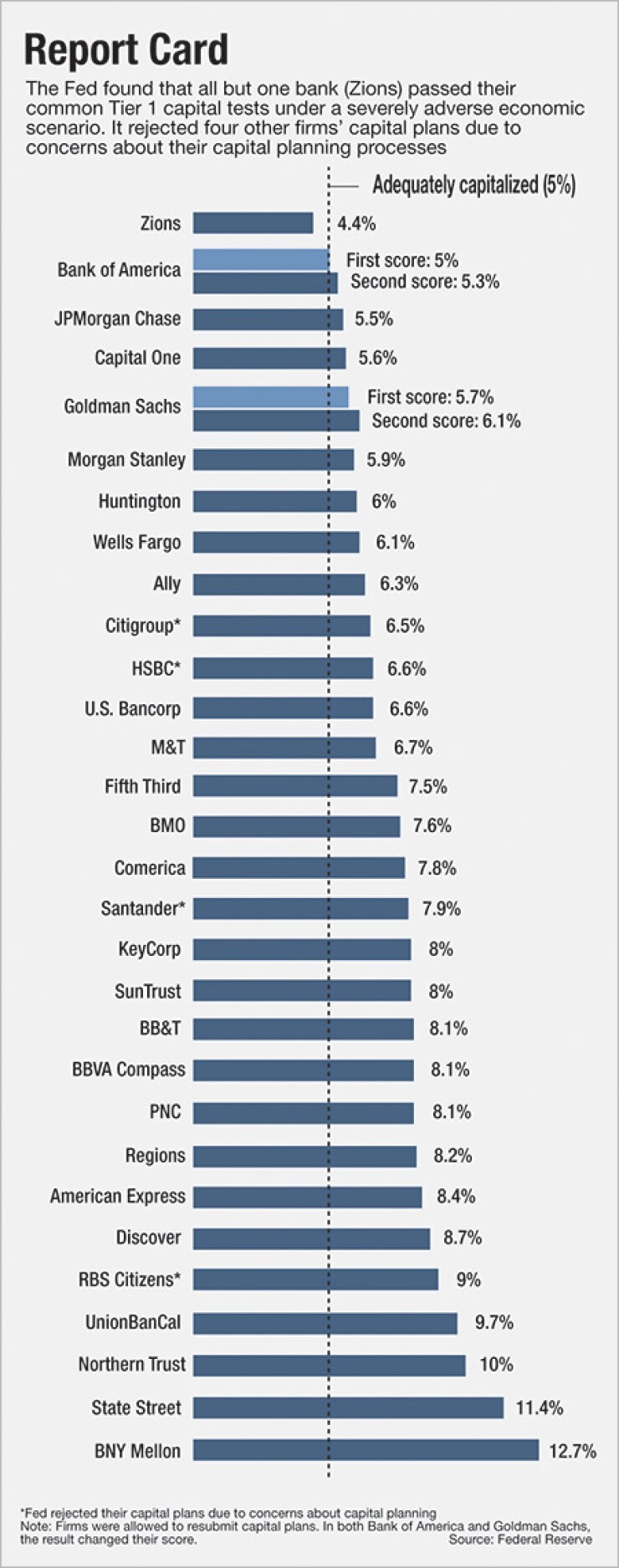

Citi was one of five firms to have its capital plan rejected by the central bank as part of the Fed's annual stress test exercise known as the Comprehensive Capital Analysis Review, or CCAR. Four banks HSBC North America, RBS Citizens Financial, Santander and Citi were rejected for "qualitative" reasons, while Zions Bancorp. failed to meet the Fed's minimum Tier 1 common capital ratio under a hypothetical severely adverse economic scenario.

The five firms will have up to 90 days to resubmit their capital plans, but can request additional time if needed.

The 25 other firms that were part of the stress test, which evaluates the individual capital plans of the 30 largest institutions, had their capital plans approved.

"With each year we have seen broad improvement in the industry's ability to assess its capital needs under stress and continuing improvements to the risk-measurement and -management practices that support good capital planning," said Fed Gov. Daniel Tarullo, in a press release. "However, both the firms and supervisors have work to do as we continue to raise expectations for the quality of risk management in the nation's largest banks."

Since the first set of stress test exercises in 2009, U.S. firms have more than doubled the aggregate Tier 1 common equity ratio to 11.6% as of the fourth quarter of last year.

The 30 institutions that participated in the CCAR exercise this year have a combined $13.5 trillion in assets, or hold roughly 80% of all U.S. bank holding company assets.

In the case of Citi, the Fed said the New York-based firm had not corrected a number of issues in its capital planning practices that had been previously identified by supervisors. Regulators cited Citi's inability to project revenue and losses under a stressful scenario and its inability to develop scenarios for its internal stress testing adequately.

"Taken in isolation each of the deficiencies would not have been deemed critical enough to warrant an objection, but, when viewed together, they raise sufficient concerns regarding the overall reliability of Citigroup's capital planning process to warrant an objection to the capital plan and require a resubmission," the Fed said in its results.

It was the second time Citi has failed the Fed's stress tests. In 2012, Citi did not hold enough capital under the Fed's severely adverse economic scenario, falling just shy of the 5% minimum.

That was not the issue this time. Under the Fed's worst case scenario, Citi's Tier 1 common ratio was 6.5%, well above the minimum requirement.

The annual exercise is meant to test the strength of firm's capital against severe stress scenarios, while also offering the Fed the ability to deny the largest banks' capital plans for the coming year based on the quality of their capital planning.

On a conference call with reporters, a Federal Reserve official said supervisors' expectations are rising each year, especially as they hope to see improvements in areas that had been previously identified or new areas of emphasis in the test.

Michael Corbat, Citi's chief executive, expressed disappointment over the Fed's decision in rejecting what it called a "modest" capital plan.

"We clearly are being challenged to meet the highest standards in the CCAR process," said Corbat in a statement. "Despite whatever shortcomings the Fed saw in our capital planning process, we have made tremendous progress over the past several years in enhancing our capital position and Citi remains one of the best-capitalized financial institutions in the world."

Analysts said the Fed's rejection of Citi and three others on qualitative grounds was significant.

"This is a very different experience than the ones in the past," said Karen Shaw Petrou, a managing partner at Federal Financial Analytics Inc. "Quality counts more than capital."

She called the Fed's rejection of Citi plan a "real smack in the face" given the growing critical importance of governance in these stress test exercises.

Although the Fed has conducted annual stress tests since the financial crisis, this was the first time the full board voted on the capital plan objections, passing them unanimously 4-0 with Fed Gov. Sarah Bloom Raskin abstaining.

A Federal Reserve official told reporters that regulators asked the board to vote on the qualitative reasons for denying firms' capital plan since it was akin to other supervisory actions the central bank would take.

Firms including HSBC, RBS, and Santander were among the dozen new bank holding companies that were included in the fourth round of stress test exercises undertaken by the Fed this year.

The Fed noted how new firms to the process may have faced challenges in trying to meet the Fed's "high expectations." Even so, the central bank still found "weaknesses" among some of the new firms that were "significant enough to warrant an objection."

Petrou said she was surprised the Fed was not gentler on the dozen firms which were first time test takers, especially among foreign banking institutions.

In the case of HSBC and RBS Citizens, the Fed objected to both firms' plans because of "significant deficiencies" in their planning process, including "inadequate governance and weak internal controls around the process."

Specifically, the central bank identified deficiencies in RBS Citizens' practices of estimating revenue and losses under a stressed scenario, especially across various business lines under specific scenarios. (RBS scored relatively high under the quantitative test of capital ratios, as it was projected to hold 9% Tier 1 common capital in a highly stressed scenario.)

In a statement, RBS emphasized its high capital and said it was working on addressing the Fed's concerns.

"RBSCFG continues to be one of the best-capitalized banks in the industry and we're pleased to be able to continue normalizing our capital structure, through dividends and subordinated debt exchanges with our parent at the same pace as last year," said Bruce Van Saun, RBSCFG Chairman and Chief Executive Officer. "We clearly have more work to do to meet the Fed's standards, and we're fully committed to doing that."

HSBC's practices, on the other hand, showed inadequacies for estimating revenue and losses for "material aspects" of the firm's operation under stress. (HSBC was just above Citi in its quantitative score, holding 6.6% tier one capital in the severely adverse scenario.)

A spokesman for HSBC released a statement noting that while the Fed objects to its capital plan, it scored well on the quantitative tests for various capital ratios, "an indication of the capital and financial strength of HSBC North America."

The central bank pointed to "widespread and significant deficiencies" in the case of Santandar across the firm's capital planning process, citing governance, internal controls, risk identification and risk-management, management information system, and assumptions and analysis that support the firm's capital planning processes. (Santander was projected to hold 7.9% capital in the Fed's worst case scenario.)

In a statement, Santander did not respond directly to the Fed's concerns, but said it had conducted an additional $1.75 billion capital increase in February after it submitted its capital plan to the Fed. It said it plans to resubmit its plan to the Fed shortly.

Zions was the only bank to have its capital plan rejected based on its capital ratio under the severe economic scenario. It held 4.4% Tier 1 common capital in the severely stressed scenario, below the 5% minimum.

It was the second time in a week that Zions had failed a stress test. Last week, the Fed announced the findings of its stress tests mandated under the Dodd-Frank Act. Those tests assume equal capital distributions among all 30 firms taking the test, while the CCAR takes banks' actual capital plans into account. Zions held 3.6% Tier 1 capital under the Dodd-Frank test, which also had a 5% minimum.

The bank attributed the results in a statement on March 20 to significantly higher commercial real estate losses, significantly greater risk-weighted assets and lower pre-tax, pre-provision revenue than anticipated. It plans to resubmit its capital plan.

In responding to the results, Zions said in a press release its proposed capital action included the issuance of roughly $400 million of common equity, which lifted its Tier 1 common ratio to 4.5% but was still well below the minimum threshold required.

Even though the Fed objected to Zions' capital plan, the agency is allowing the bank to proceed with its common dividend payment of 16 cents per share each year and continued dividend payment on preferred equity, according to the firm.

Two firms revised their capital plan distributions after undergoing the first round of CCAR tests this year. The central bank permits firms to reduce their capital plans in order to improve their score.

Bank of America and Goldman Sachs both notched higher in the second round. Bank of America initially failed to meet two regulatory thresholds: a minimum leverage ratio of 4% and Tier 1 risk-based capital ratio of 6%. The firm was able to surpass both after submitting their adjusted capital plan. Likewise, Goldman missed one minimum requirement: the 4% leverage threshold, but was able to go above it under its new capital plan.

Kevin Wack contributed to this article.