In a sign that the banking business is bouncing off the bottom of the economic trough, the Federal Deposit Insurance Corp. is ready to start insuring new charters.

It will be a trickle, not a torrent of approvals, but it is a significant shift considering the agency is widely viewed as the single biggest reason why just two banks have gained deposit insurance this year.

In an interview last month, FDIC Chairman Sheila Bair conceded the agency had let too many new banks open with business plans dependent on commercial real estate lending or on brokered deposits.

In an interview last month, FDIC Chairman Sheila Bair conceded the agency had let too many new banks open with business plans dependent on commercial real estate lending or on brokered deposits.

"We were not as scrutinizing as we should have been on deposit insurance applications in the past," Bair said. "We are going to be looking for banks that are committed to developing a core deposit base and a reasonably well-diversified business plan and good management and good capital.

"If they meet those kinds of requirements, there is no reason they shouldn't get approved."

Chris Spoth, senior deputy director in the FDIC's division of supervision and consumer protection, reinforced that in an interview this week. "We would encourage and we do expect, it's hard to predict when, traditional community bank proposals to come through," he said. "And we expect we would approve" applications pledging adequate capital, qualified management and diversified business plans.

Chartering new banks is the next natural step in the economic cycle, according to Lisa Arquette, an associate director in the division who handles applications.

"The economic recovery trends are similar to what happened during the last crisis," she said. "For example, the first thing we see is investment in failed institutions. Next is a shift toward private recapitalization on an open-bank basis, and finally we see an increase in de novo activity. I think we are in the midst of that."

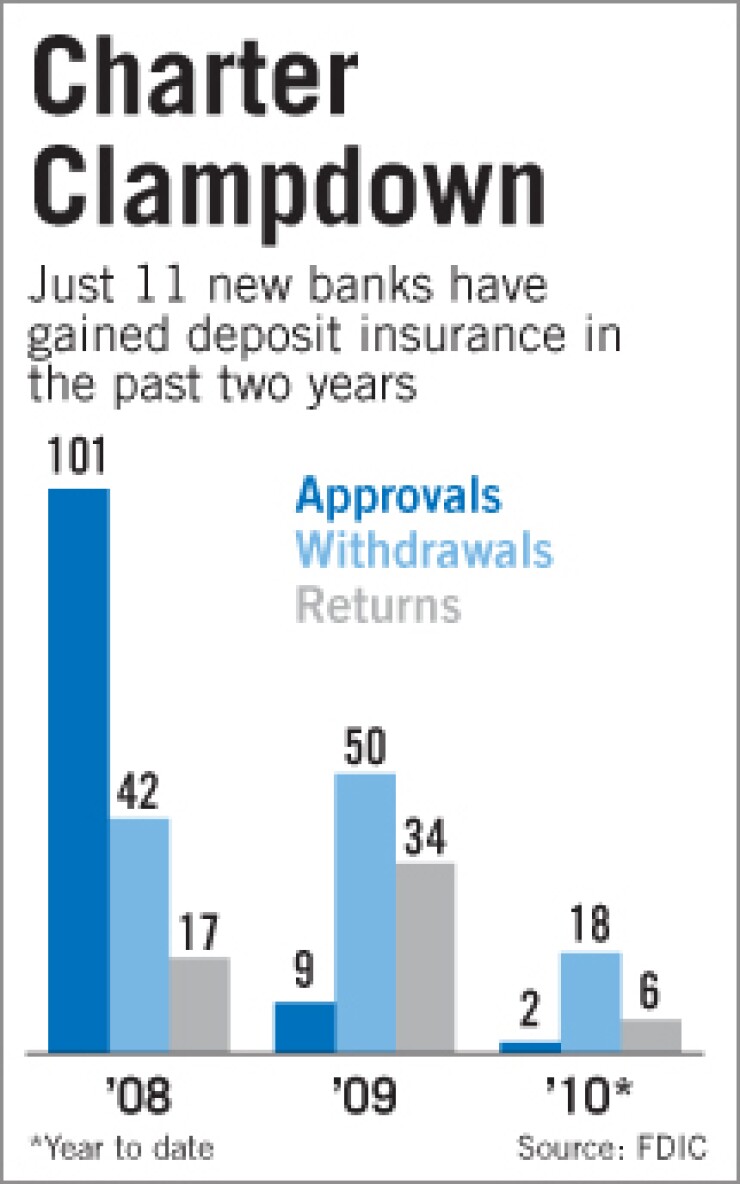

Insurance application approvals fell off a cliff last year, dropping to nine from 101 in 2008. Two banks have been granted deposit insurance this year: First Republic Bank in San Francisco, and just last week, Bank Midwest, a national bank in Kansas City, Mo. (A third bank opened this year, Lakeside Bank in Lake Charles, La., but its application for insurance was actually approved in October 2009.)

Applicants clearly got the message because volume dropped as well, from at least 160 applications in 2008 to at least 93 in 2009 to at least 26 this year. According to the FDIC, those are the number of applications that have been approved, withdrawn or returned each year. Some applications remain pending, and Arquette said there are a handful that are close to being approved, but the FDIC did not provide data on pending applications.

To all the skeptical investors frustrated by the FDIC's foot-dragging this year, both Spoth and Arquette said more than once that they "expect and welcome" applications for deposit insurance from "traditional community banks."

The FDIC defines a "traditional" bank as one that lends to local small businesses and gathers deposits from its community.

While the FDIC officials did not want to answer specific criticisms or discuss particular applications that dragged on for months or even years, Arquette noted that during the period when the FDIC has approved so few applications for deposit insurance, more than 300 banks have failed and the number of banks on the agency's "problem" list has increased tenfold.

That's largely why critics claim the agency simply stopped approving new charters — to force investors to put their capital into failed or weak banks.

Paul Allred, Utah's deputy banking commissioner, said he is sympathetic to the FDIC's position. "I understand why the FDIC has not been in a rush," he said in an interview Tuesday. "They are dealing with the problems that are already out there."

But Allred also said the FDIC nudged a group of businessmen who wanted to charter a new bank toward buying one in need of capital, Western Community Bank in Orem.

"They weren't looking for anything but a traditional community bank," Allred said of the investors. "Hopefully sometime the FDIC will get back to the business of approving de novo applications. There is still interest out there."

And there are benefits of starting fresh — no bad loans to work out, no legacy systems to update, no dysfunctional culture to correct. Just a clean balance sheet, primed to lend money.

William Isaac, a former FDIC chairman, came up with a couple more likely rationales for the FDIC's de facto freeze on new banks. "Why introduce new competition, strong competition, into markets where existing banks are struggling?" he said.

Still, Isaac, now chairman of LECG's global financial services, said the agency should shift its position. "It's a policy I could understand for the last two years, but the time has come to" start granting insurance to new charters, he said. "I'm not saying open the flood gates, but we've lost a lot of banks and we are going to lose a lot more, and if you don't have new entrants you're going to have more concentration."

Jim Chessen, the chief economist at the American Bankers Association, agreed.

"There shouldn't be an outright prohibition," he said. "You need an avenue for de novos to come in."

Nick Ketcha was a bank regulator for 36 years, including the FDIC's director of supervision. He is now executive managing director of FinPro, a financial institution consulting firm in New Jersey. Part of his practice is helping people form new banks. He is running out of patience. "The regulators are probably in the biggest CYA moment that I've seen in the 30 years I've been doing this," he said. "The FDIC board wants to see every application. It slows the process down unbelievably."

Two years ago Ketcha said FinPro was doing 20 de novos a year, with each requiring six to nine months of work. "Last year it took 12-15 months. Now it's at least a two-year process."

And the FDIC is requiring much more capital — from roughly $6 million a couple years ago to more than $20 million today, he said.

Jeff Gerrish, a lawyer with Gerrish McCreary Smith in Memphis, also works with investors trying to form banks and has seen the slowdown up close.

"I'm glad to hear that they are realizing it's time to take the foot off the brake," Gerrish said. "It's a great time to start a new bank."

Barb Rehm is American Banker's editor at large. She welcomes feedback to her weekly column at