-

Capital One, Discover and American Express all boosted their loss provisions in the third quarter. But there are also reasons to think the credit environment remains relatively benign.

October 24 -

A gradual improvement in consumers' financial situations has led to even lower delinquency rates in several consumer lending categories, the ABA said in its latest quarterly survey.

October 7 -

The percentage of U.S. consumers who are late on their loan payments remained at near-record lows in the first quarter, though a key figure rose slightly from the fourth quarter. Meanwhile, payments on home equity lines fell to their lowest level in five years, according to a new ABA report.

July 10

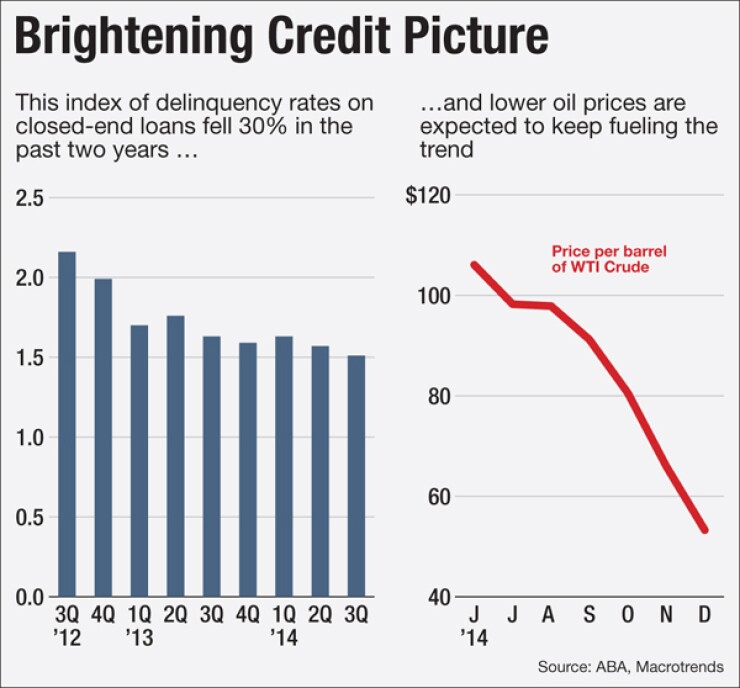

The sharp nationwide drop in gas prices is allowing more U.S. consumers to stay current on their debts, according to a new report from the American Bankers Association.

During the third quarter of 2014, delinquency rates fell in seven of the 11 consumer loan categories tracked in the report, continuing a broad trend of improvement that dates back several years. Also in the third quarter, gas prices began a decline that has since accelerated.

"The fact that gas prices are way down has to be a contributing factor in improving delinquency trends," said James Chessen, the ABA's chief economist. "The less money you have to put into your gas tank, the more money you have to do other things, and one of those is to pay back your debts."

Among the loan types where delinquency rates fell: car loans arranged through automobile dealers, personal loans and property-improvement loans. The delinquency rate for an index of eight closed-end loan categories dropped from 1.57% in the second quarter to a record low of 1.51%.

The delinquency rate for bank-issued credit card loans rose during the third quarter from 2.43% to 2.51%. Still, the credit card delinquency rate remained below the levels it reached in 2011 and 2012.

Every one-cent-per-gallon decline in gas prices saves U.S. consumers about $1 billion, according to the ABA. Retail gas prices reached a high of $3.77 in June before falling to $3.38 in October, according to the U.S. Department of Energy. By the first week of January, prices had dropped all the way to $2.31 per gallon.

That's good news for banks that are benefiting from the relatively low percentage of consumer loans going bad in the aftermath of the Great Recession. Still, Chessen believes that unusually low gas prices are simply delaying the eventual return to a more normal credit environment.

"It's likely extending that period where delinquencies can remain low," he said, pointing to third-quarter data that shows delinquencies on closed-end loans were 34% below their 15-year average.

But Amy Crews Cutts, the chief economist at Equifax, said that continuing improvements in the U.S. labor market may allow many consumers to keep paying their bills on time. She said that a falling unemployment rate is helping, and predicted that tighter labor conditions may lead to rising wages in the second half of 2015. Higher employment and higher wages make it easier for borrowers to stay current on their debt obligations.

Crews Cutts also said that many consumers were chastened by the financial crisis, and as a result are probably less likely to run into trouble again.

"I think that they have a new respect for debt," she said.

The ABA defines a delinquency as a late payment that is at least 30 days overdue. Its quarterly report on delinquencies does not include data on the largest category of consumer debt, first mortgages.

But the report does track delinquency rates for home equity loans and home equity lines of credit. In the third quarter, late payments on home equity loans fell from 3.36% to 3.24%. Delinquencies on home equity lines of credit rose slightly, from 1.50% to 1.52%.

In 2015 and beyond, many home equity loans will reset to higher interest rates, a long-anticipated development that has sparked concern about borrowers' ability to shoulder the heavier debt load.

Chessen said it's probably too early to determine how home equity borrowers will handle the larger monthly payments, but noted that lenders have been working with their customers to restructure loans in order to minimize payment shock.