The third most powerful representative in the House committed Wednesday to finishing work on stablecoin and crypto market structure legislation by the August recess, following President Donald Trump's request a few weeks prior at a White House crypto summit.

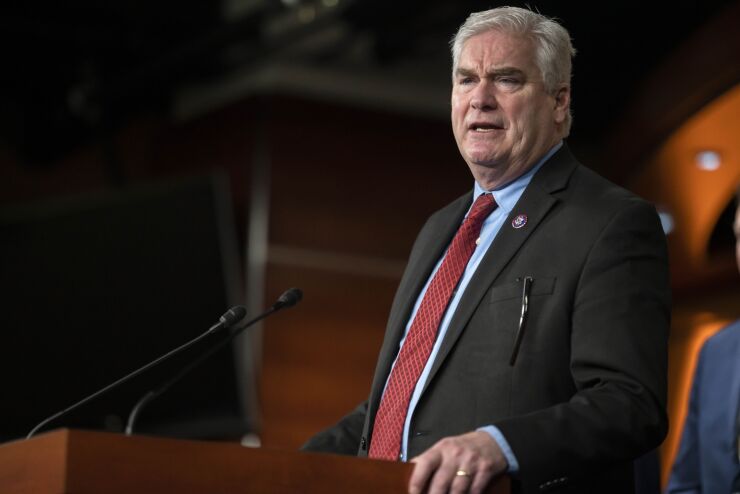

House Majority Whip Rep. Tom Emmer, R-Minn., speaking to a crowd at Blockworks' Digital Asset Summit in New York City, said he would honor the president's request.

"The president says he wants stablecoin legislation and market structure legislation done by the August break," Emmer said. "That's going to be what we're going to do."

Lawmakers in the Senate have made progress on advancing a stablecoin bill — the Guiding and Establishing National Innovation in U.S. Stablecoins, or GENIUS, Act — which was

As stablecoin regulation continues to make progress, banks have grown wary of the bill's potential impact. Some in the industry are concerned legislation like the GENIUS Act could disrupt traditional banking by allowing tech companies to issue stablecoins, which they argue function similarly to bank deposits. Widespread use of the digital assets could draw traditional deposits away from banks, reducing the funds they can circulate.

The American Bankers Association has warned that payment stablecoins could threaten the primary role of banks as financial intermediaries. Banks are also wary of the potential for regulatory loopholes that could allow stablecoin issuers to have a competitive advantage, operating under lighter regulation while still competing with traditional firms.

Emmer also committed to getting a regulatory structure for cryptocurrency in the United States done this year. The House

Policy experts have

One issue Emmer stressed was the need to prevent overreach by the SEC and the Federal Reserve. His concern is that without explicit jurisdiction baked into the law, these agencies could claim authority over certain digital assets, leading to regulatory overreach and uncertainty for businesses.

"I think the worst thing to do is give the Federal Reserve or the SEC more authority over this," Emmer said. "For any market structure bill … instead of just having language about the securities clarity act, actually have teeth in it that make sure that we don't have these agencies going beyond what their jurisdiction should be, making sure that the people that you represent don't have to go to five or six different regulators to figure out if they could do business in this country."

Speaking on the shifting landscape of crypto policy in Washington, Emmer emphasized growing legislative momentum. He highlighted Trump's evolving stance on digital assets, crediting the president with signing an executive order

Emmer has

"I think the prohibition comes at the same time as the other two," he said. "Warren Davidson's got some stuff that should probably go before the August recess."

He announced the formation of the Congressional Crypto Caucus, co-chaired with Rep. Ritchie Torres, D-N.Y., aiming to bring bipartisan lawmakers together in supporting digital assets. Emmer said the caucus would be an "advocacy group," voting for crypto-favorable policies while blocking restrictive legislation.

"I think it'll be a great tool for everybody who is pro-digital assets," Emmer said. "America is open for business … now is the time to lean in and do even more innovation, do even more investment. For those of you that aren't in, you may want to consider getting involved because this is where we're going, this is 21st century finance."