Small banks, already accustomed to letting vendors host most of their technology, are pushing the limits of their reliance on the cloud.

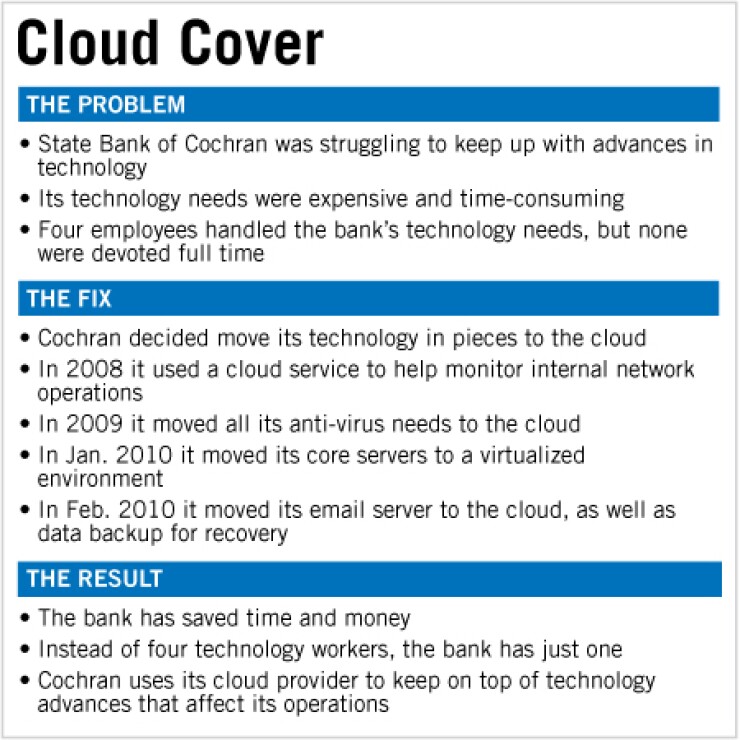

Take State Bank of Cochran in Georgia. Over the past couple of years the $226 million-asset, four-branch bank has eliminated every position in its information technology department except that of chief technology officer. Now even its anti-virus scans are handled by remote servers.

"What changed for us was a demand for newer technology and for more technology," said Leesa Anderson, the bank's chief technology officer. "For us to be efficient as a bank, we could not get by with just the basics."

Experts say more banks want to outsource IT functions to the cloud, a term used to describe the use of networked remote servers. And smaller banks are moving faster than larger ones.

The most common reasons for outsourcing today are cost savings and better efficiency, and most banks are currently outsourcing noncritical functions like the help desk, sales force activities and some desktop applications. Core applications and customer-facing applications, such as teller systems, are things that larger banks prefer to keep in-house.

Large banks "feel a lot more comfortable housing sensitive data within their own organizations as opposed to in the hands of a third-party IT vendor," said Christine Barry, a research director for Aite Group LLC of Boston.

By contrast, "smaller banks are more focused on cost savings," and they tend not to have a large number of IT workers place to manage complicated technology, Barry said.

This all rings true for Cochran, which began outsourcing in pieces to the cloud provider Safe Systems Inc. About three years ago, it turned to the Alpharetta, Ga., vendor to help monitor internal network operations.

About two years ago it decided to move all its anti-virus needs to the cloud, and Safe Systems now pushes updates and performs scans daily. Last year the bank moved its email server as well as data backup and recovery to the cloud, and it then consolidated its in-house server needs by moving to a virtualized environment. Its core operations are outsourced to Fiserv Inc. of Brookfield, Wis.

About the only thing that is not outsourced today is the bank's teller system, which Anderson said would not be cost-effective to move to a remote system.

"In the time that our assets size has grown from $105 million to $226 million, our staff size has only grown from 49 full-time employees to 53, which attests to the efficiency of our technology to enable us to do more with less," Anderson said.

Her bank, she said, has "the highest possible compliance rating in IT" and an efficiency ratio of 57.85. The peer average is 75.52.

Safe Systems has data centers in Georgia and Utah. It works with about 500 financial institutions ranging in asset size from $25 million to $3 billion.

"Financial institutions need to do more with less," said Zach Duke, executive vice president of business development for Safe Systems.

Jack Henry & Associates Inc. of Monett, Mo., said it is getting close to offering a 100% outsourced solution to its 11,000 bank and credit union clients, though it said it has long operated a cloud environment for the many small and midsize banks to which it offers core services.

Mark Forbis, vice president and CTO for Jack Henry, said that what appeals to banks about the cloud is the computing elasticity it offers, and many banks are now shifting away from using it merely to outsource applications.

"Instead of running research and development on [their] equipment, they can go to a large provider like Jack Henry that has an offering where we host this on our infrastructure," Forbis said.

When Sun National Bank of Vineland, N.J., decided it wanted to roll out a mobile banking offering in 2010, it relied on cloud computing.

Sun National declined to comment for this story, but in a case study the research firm IDC Financial Insights in Framingham, Mass., concluded that it simply wasn't cost-effective for Sun National, which has $3.5 billion in assets and 70 branches, to develop the platform on its own network.

"For a small bank to run mobile banking in-house, it has to balance the cost of overinvesting if adoption skyrockets compared with under-investing and risking scalability and reliability issues," the research note said.

Sun National contracted with mFoundry Inc. of Sausalito, Calif., in late 2009, and by March 2010 it had integrated mFoundry's platform into its own network and had completed a full launch of it mobile banking system. A third of the bank's customers now use its mobile banking channel.

Marc DeCastro, research director for IDC, said that within five years banks will widely use cloud computing services for core platform needs.

"All it will take is one successful example and one hell of a cost-benefit analysis to show [bankers] this is the way to go," he said.