-

Federal Reserve Board Gov. Elizabeth Duke outlined a number of factors — such as the mortgage servicer settlement, the huge number of underwater borrowers and the failure to reform the GSEs — that are working to limit mortgage credit to healthy borrowers.

May 15 -

Many banks reported strong loan production in the first quarter, but most bankers acknowledged that overall loan demand remains tepid and that the activity is largely a result of stealing business from rival banks.

May 11 -

Past reports on industry health showed limited, if any, loan growth, but that changed in the most recent Quarterly Banking Profile.

February 28

WASHINGTON — If Tuesday's bank earnings report by the Federal Deposit Insurance Corp. was the season finale of a hit TV series, viewers tuning in to get some insight on the state of lending were probably left unsatisfied.

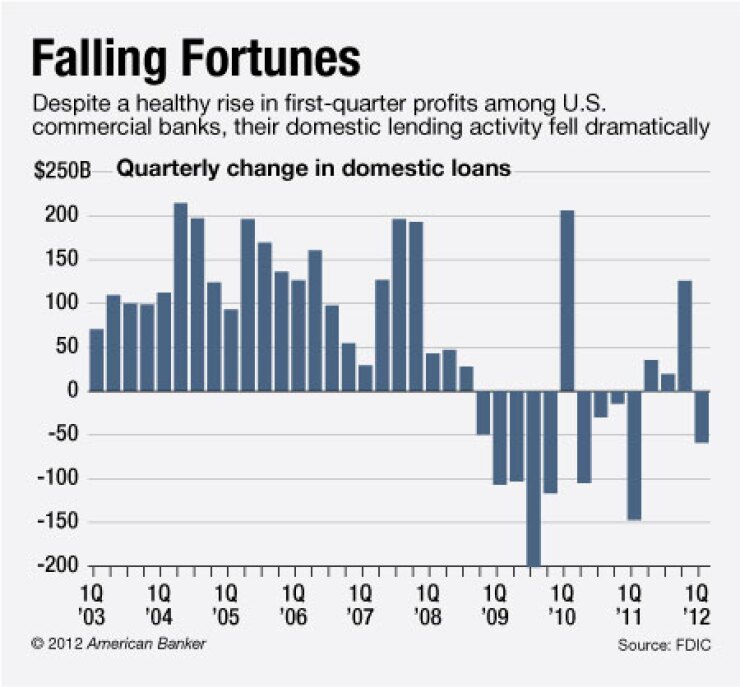

The previous report had showed real hope for sustained lending growth. In contrast, the Quarterly Banking Profile released Tuesday was less encouraging, with loans falling in the first quarter by 0.8%.

But under the surface, the numbers were inconclusive. Loans still grew year-over-year, commercial lending keeps growing and other categories continue to climb toward positive ground. Meanwhile, despite the lower balances, mortgage originations actually rose and loan-sale gains increased sharply.

The takeaway on lending indicators was basically "stay tuned."

"While most [loan] categories are still declining on a 12-month basis, the rates of decline have been diminishing," acting FDIC Chairman Martin Gruenberg said at a press briefing. "The overall decline in loan balances is disappointing after we saw three quarters of growth last year. But separating the components gives us more perspective on the change, and we should be cautious in drawing conclusions from just one quarter."

Moreover, bank profits continue to surge, and revenue seemed to make a comeback last quarter. Buoyed by the gains on loan sales — the $4 billion in gains was 130% higher than a year earlier — noninterest income rose 8% compared with the first quarter of 2011 to $63 billion.

The 3% growth in net operating revenue compared to a year earlier — to about $170 billion — was only the second such increase in five quarters. Overall, banks and thrifts earned $35.3 billion last quarter, their highest net income since the second quarter of 2007, and a nearly 23% increase from quarterly profits a year earlier.

The industry's profit, which was 34% higher than in the previous quarter, also was helped by 38% rise — from a year earlier — in income stemming from fair-value changes in certain instruments. Increased revenue from fiduciary activities and service charges on deposit accounts also provided a lift.

The industry's average return on assets rose above 1% for just the second time since the middle of 2007. Quarterly earnings for the industry have gone up, year-over-year, for 11 straight quarters. The FDIC said over 67% of all institutions had higher year-over-year income totals, and the 10.3% of institutions that were unprofitable was the lowest level since the second quarter of 2007.

"Revenue was higher in the first quarter than a year ago, while [loss] provisions were down. Both developments contributed to the increase in earnings," Gruenberg said. "The year-over-year improvement in revenue was due mostly to noninterest income, particularly income from loan sales. But it remains to be seen whether banks can continue to sustain revenue growth going forward."

Limits on what banks report for originations and loan sales also made loan activity hard to gauge. All institutions report gains from loan sales but only certain ones report originations and loan-sale volume, and even that data are limited to just home loans to be sold.

Still, the available data suggests that loan sales may have contributed to lower balances. Institutions over $1 billion of assets or that had more than $10 million in quarterly originations reported $476 billion in originations of closed-end mortgages to be sold, a 10% increase from the fourth quarter and a 35% increase from a year earlier. But sales on those loans were even higher, totaling $490 billion. (Origination data do not distinguish between new loans and refinancings.)

"The actual amounts … kept on balance sheet declined," said Ross Waldrop, the FDIC's senior banking analyst.

Officials also pointed to the tendency for credit-card borrowers to pay down their balances early in the year as a factor in the decline in total loans.

Meanwhile, other indicators were more encouraging. Total loans were still up 2% compared to a year earlier, and commercial and industrial loans rose 2% during the quarter to $1.37 trillion. Overall, total assets rose 0.3% compared to yearend 2011 to just under $14 trillion, as mortgage-backed securities rose 5% and investments in state and municipal securities increased 3.5%.

"Even with the decline in loans, bank balance sheets continued to grow. Total assets, deposits and capital all increased during the quarter and compared to a year ago," Gruenberg said.

But in addition to mortgages, construction and development loans, nonfarm nonresidential loans and other loans to individuals have still not achieved positive growth. Residential mortgage balances declined 1% during the quarter to $1.86 trillion, and construction loans fell 4.9% to $228 billion.

Loan-loss provisions declined for the 10th straight quarter, falling by 31.6% from a year earlier to just over $14 billion, the smallest quarterly provision since the second quarter of 2007. Loan losses declined from the year-earlier total for the seventh straight quarter. Net charge-offs fell 34.8% from a year earlier to $21.8 billion, the lowest quarterly total in four years.

Even though asset quality has improved dramatically since the crisis, Gruenberg said, "noncurrent and charge-off rates remain elevated."

"But the declining trend in troubled loans has meant that banks have been able to reduce their provisions for credit losses, and that more revenue is passing through to the bottom line," he said.

The FDIC's report also identified capital levels as being "at or near record levels." The average leverage capital ratio at the end of the quarter of 9.2% "matched an all-time high," while the average Tier 1 risk-based capital ratio of 13.28% was a new record.

The FDIC's list of "problem" institutions fell by 41 institutions to 772. Assets for those on the list dropped by $27 billion to $292 billion. Meanwhile, the agency's ratio of insurance reserves to insured deposits rose 5 basis points to 0.22%.