Flush with capital and anxious about the impact of rising interest rates on monthly loan payments, more commercial real estate investors than ever are paying off their bank loans before they mature.

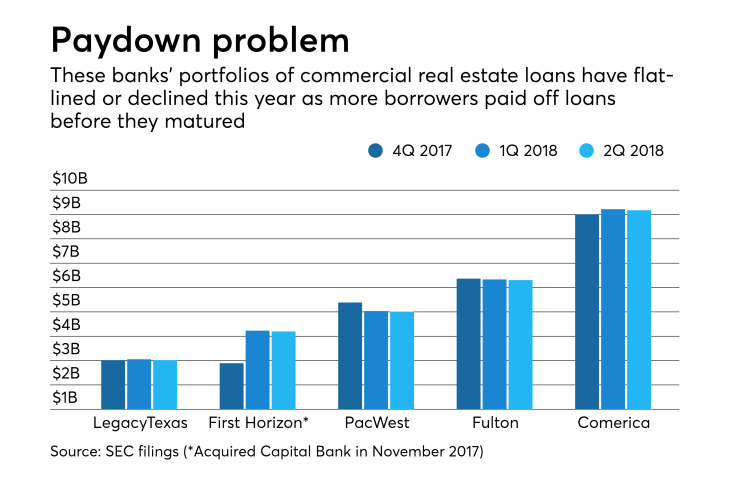

The result is that while demand for new loans remains relatively strong, commercial real estate portfolios at many regional banks have either flatlined or shrunk in recent quarters as payoffs have outpaced originations, according to bankers and industry analysts.

“Commercial real estate originations have been good, but paydown and payoff levels have been really high,” said Jared Shaw, an analyst at Wells Fargo Securities.

These early paydowns represent yet another challenge for many banks already

“Commercial real estate may be the toughest [loan category] because that is where we’re getting most of our payoffs and pricing competition is really tough,” Philip Wenger, the chairman and CEO of Fulton Financial in Lancaster, Pa., said during a July 18 conference call.

Banks first started to flag the problem of

Several other banks also reported slight quarterly declines in their CRE loan books. At the $461 billion-asset U.S. Bancorp, average CRE loans fell 1.3% to $39.9 billion, largely due to early paydowns. At the $70.5 billion-asset Comerica in Dallas, CRE loans fell 0.5% to $9.2 billion.

Two main factors are driving the early-payoff trend: the Federal Reserve’s recent interest rate hikes and more aggressive competition from nonbank lenders.

A growing number of real estate investors are worried about floating-rate loans repricing as rates rise and are asking their banks to restructure loans before they mature, said Jeremy Starkey, head of commercial real estate finance at the $10.6 billion-asset TowneBank in Portsmouth, Va.

“They’re seeing that, if rates continue to go up, they may be at 6% or 6.5% on their next [refinancing],” Starkey said. “They want to take advantage of rates right now.”

If a bank won’t work with them, many customers are simply paying off loans with cash on hand or fleeing to other banks or nonbank lenders such as private equity funds and life insurance companies that offer more borrower-friendly rates and terms, bankers say.

“The alternative financing markets are wide open and generally attractive to borrowers,” Terry Turner, the CEO of the $24 billion-asset Pinnacle Financial Partners in Nashville, Tenn., said during a July 18 conference call, referring to nonbank lenders.

Nonbank lenders "are able to take projects and put them in [loans] at very low rates with no recourse,” Turner said. “We and others in the industry are likely to see a heavy level of paydowns over an extended period of time in the CRE book.”

In a nonrecourse loan, the lender only requires the underlying property as collateral and does not mandate that individual borrowers pledge their personal assets.

Many depository institutions will not make nonrecourse loans.

“We’re just not playing there,” Clarke Starnes, chief risk officer at the $215 billion-asset BB&T, said during a July 19 conference call. “We think that that’s just too much leverage.”

However, some bankers are willing to take the risk, under certain circumstances, said Brian Schmitt, the CEO of the $558 million-asset SouthCrest Financial Group in Atlanta.

“It’s not the type of loan that I love the most,” Schmitt said. “But if it has the right tenants with the right metrics, we’ll do them.”

SouthCrest may include additional loan guarantees, scheduled to sunset after a set period of time, to provide the bank with extra protection on nonrecourse loans, he said.

Banks can also try to compete on price, though few bankers will admit to offering rates as low as private-equity firms do.

“We rarely lose a deal,” Kevin Hanigan, CEO at the $9.2 billion-asset LegacyTexas Financial Group in Plano, said during a July 18 call. But some nonbank lenders “offer lower pricing than we offer by some basis points,” he said.

“Usually if we lose [a potential new borrower], we lose to the life insurance company market or to the [commercial mortgage-backed securities] market, the other … nonrecourse lenders,” Hanigan said.

In some cases, banks are opting to let customers go without even putting up much of a fight.

At TowneBank, one of Starkey’s former clients who owns a small retail strip center in the Hampton Roads, Va., area asked to refinance his loan before maturity. TowneBank won’t offer the lowest rate in the market, but that’s what this client wanted, so Starkey let the client walk.

Some banks might have trouble finding another loan to replace this lost asset and thus might have offered an ultra-low rate. But TowneBank’s CRE markets are healthy and it’s important to replace a lost loan with another asset with a comparable yield.

“We have pretty decent loan demand,” Starkey said. “We can see that we’re expecting so many loan payoffs next week. But we’ve got a lot more in the loan pipeline.”

In other instances, TowneBank might have tried to work with a borrower who asked to renegotiate loan terms early. If a CRE investor has several other accounts at the bank, such as his personal mortgage or investments, TowneBank might be more inclined to bargain, Starkey said.

“What we do is, we look at the relationship and the better and more significant our relationship is with that borrower, those are the folks we are typically more flexible for,” Starkey said.