Consumers in emerging markets are more likely to use a mobile app than a credit card for payments. That's driving Boku's move to unite mobile wallets and wireless operators to provide an interoperable cross-border alternative to Visa and Mastercard in the battle for unbanked consumers.

"If you want to reach people with payments technology, you have to use the payment methods that they use," said Jon Prideaux, Boku's chief executive. "We're connecting to a mobile class that you can't reach with cards."

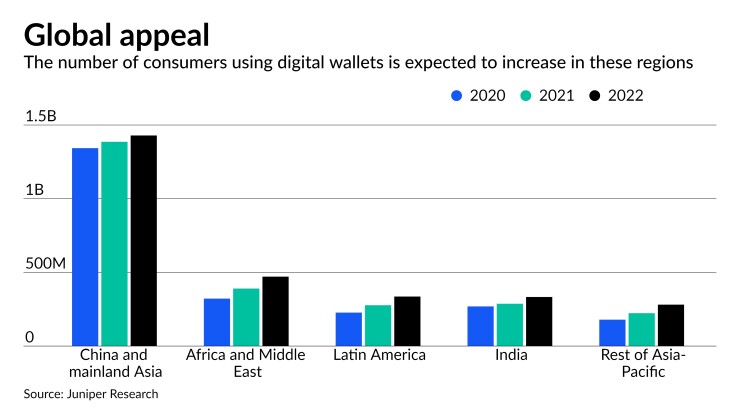

Boku, which allows consumers to make payments via their mobile accounts, just launched M1ST, a network that connects more than 330 mobile payment services in 90 countries, with as many as 5.7 billion accounts, mostly in Asia, Latin America and Africa. Mastercard and Visa and large banks are also pursuing these regions, but the San Francisco-based Boku says mobile wallets that don't rely on cards have a head start given the relative lack of existing bank infrastructure in M1ST's footprint.

Boku, which reports it has processed about $9 billion in payments over the past year through its core business, offers carrier billing and

The M1ST network allows merchants to use an application programming interface to connect with mobile wallets, use carrier billing rails and integrate with real-time payment schemes to support international shopping and payments.

Mobile payment systems that rely partially or entirely on telecom billing have struggled in developed banking markets. The AT&T, T-Mobile and Verizon-backed

Prideaux contends the relative lack of bank cards in emerging markets puts mobile wallets that rely on wireless networks in a better position. Two-thirds of underbanked people globally have a mobile phone, according to the

"Imagine a world that's bifurcated into card and not card," Prideaux said. A market that lacks an existing card infrastructure can adopt digital payments faster because there's less of an adjustment, he said.

M1ST's challenge is solving the fragmentation among mobile wallets, a drawback for merchants that want to sell internationally and accept cross-border payments but don't want to establish relationships with dozens of apps. Most mobile money offerings use a single mobile operator or a wireless operator in a handful of markets, so reaching a large number of them would be difficult for an individual merchant. Safaricom powers MPesa in Kenya, for example;

"One of the challenges of mobile money is the general lack of interoperability between payment platforms," said Thad Peterson, a senior analyst at Aite-Novarica.

Prideaux acknowledges that lack of interoperability. "There are many different mobile wallets and payment systems that have evolved in a way that have resulted in different standards," he said.

M1ST attempts to solve this problem by managing technical, legal and contractual considerations tied to each mobile wallet on behalf of the merchant, creating a single location to manage different payment systems. It's a similar concept to the U.S. card brands'

"Developing an interoperable platform that could ensure that a 'buy button' from any mobile money platform would work on any other mobile money platform would be a more powerful approach," Peterson said.

Visa and Mastercard did not respond to requests for comment. But both card brands have made investments in financial inclusion that include work with mobile network operators, providing competition for M1ST.

The card brands' plays include partnerships such as Visa's collaboration with

There are also technology companies building systems designed to use alternative payment methods to bring new users into the financial system. The pending Facebook-affiliated Diem stablecoin has long sold blockchain-driven financial inclusion as a benefit to assuage skeptical regulators. David Marcus, the head of Facebook's financial services group, last week argued in a post on

And Ripple, which uses blockchain technology to help users execute cross-border payments without correspondent banks, is part of the