-

Bankers appear set to get their long-awaited rate rise, but the top executives of the biggest banks still have lukewarm expectations for the coming year, according to forecasts laid out by the top brass from JPMorgan, Wells Fargo, PNC and others.

December 8 -

There is a growing belief that reserves for energy loans should represent 5% of a bank's exposure to the sector. Three banks have already announced plans to move in that direction, prompting speculation as to which other lenders will be next.

January 13 -

The Basel Committee on Banking Supervision released the text of its anticipated revised market risk framework on Thursday, one of the last and most important remaining unfinished aspects of the 2010 Basel III accords.

January 14 -

Eileen Serra, 61, the chief executive of the Chase Card Services unit, will step down in January and become an adviser to the company on growth initiatives, according to a memo Wednesday from Gordon Smith, JPMorgan's CEO of consumer and community banking.

December 9

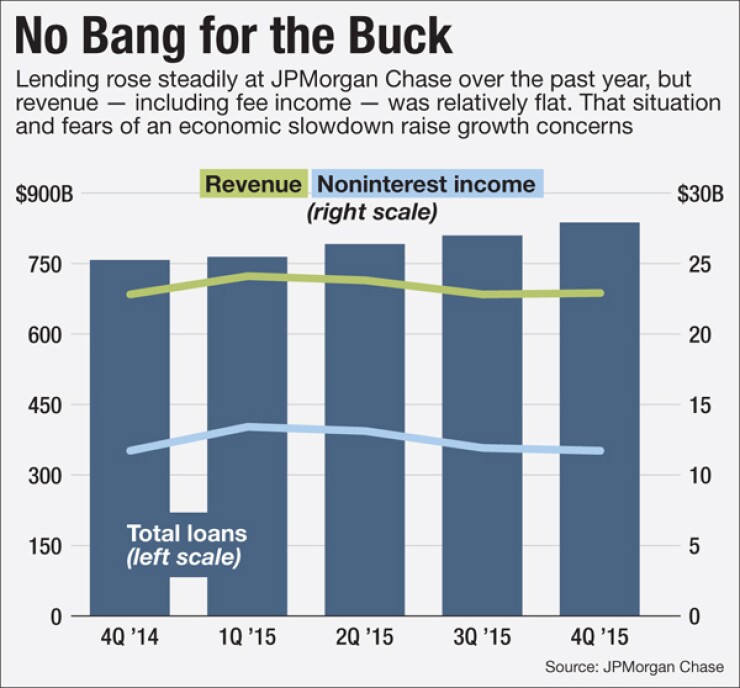

Normally double-digit loan growth would be something to chirp about, but JPMorgan Chase executives spent much of Thursday morning fielding questions about what could go wrong in 2016.

Is there going to be a recession? Are your energy loans slowly turning into time bombs? How much will interest rate increases (if there are many more) really help?

These are the kinds of questions all bank chiefs will face as more of them report fourth-quarter results in the coming weeks. JPMorgan's leaders, who bore the initial brunt as their report kick-started the new earnings season, tried to be reassuring. Yet it was clear many factors that could determine what kind of year they — and other bankers — have are beyond the industry's control.

At JPMorgan, for instance, most of the low-hanging fruit for cutting costs has been exhausted, analysts said. The company predicts margins will stay flat, as the Federal Reserve weights a series of gradual increase on short-term rates. And though total loans rose 11%, consumer credits provided the biggest boost, and consumer demand could falter if the economy slows down as some fear it might.

JPMorgan's prospects for growth in the coming months will be "largely dependent on the operating environment," Jeffrey Harte, an analyst at Sandler O'Neill, said after its conference call with analysts.

The bank's chairman and chief executive, Jamie Dimon, chose his words carefully during the call.

"Credit card, commercial bank, middle-market, large corporate credit is as good as it's ever been," Dimon said in a discussion about whether there are any signs of an economic slowdown. "I wouldn't call it a cycle, per se. If you have a recession you will see normal cyclical increases in all those losses. I wouldn't call it a recession."

The economy "has been chugging along," Dimon added, citing the recent boom in car sales, job growth and the overall strength of corporate credit.

His comments came as markets have taken a hit in recent weeks, amid concerns over volatility in China and a glut in the global supply of oil.

The Dow Jones industrial average fell 364 points, or 2.2%, on Wednesday, to its lowest level in more than three months. The S&P 500 sunk, amid a sell-off in global stocks. Both indexes rallied Thursday.

Concerns about energy also weighed on markets, as oil dipped to its lowest point in over a decade, below $30 per barrel at times this week. The trend has prompted several smaller lenders to increase reserves in their energy books.

At several points in their call with investors, JPMorgan executives were pressed about their exposure to energy markets — and about their predictions for potential losses. The company increased its reserves for oil by $125 million in the quarter, to a total of $550 million for the year.

"It is very name by name," said Chief Financial Officer Marianne Lake, describing the pressures posed by energy companies.

Lake also noted that—despite predictions for oil to slip to $20 per barrel—the bank expects it to increase over the coming year, perhaps to as high as $48 by yearend.

At one point in the call, Mike Mayo, an analyst with CSLA, asked executives if they think they will regret not setting aside more in reserves, to guard against potential losses.

"Is that going to be enough, and one year from now are you going to look back and say, 'Whoops, we didn't get ahead of this enough?' " Mayo asked.

Dimon argued that the bank has taken a "conservative" approach to its oil book — which accounts for about 5% of its wholesale portfolio — and that, overall, its energy exposure is a small percentage of its total balance sheet.

"I'd put up more if I could, but accounting rules dictate what you can do," Dimon said. "We're not worried about the big oil companies. These are mostly the smaller ones that you're talking about."

Still, while concerns about broader markets dominated the conversation, there were bright spots in the company's quarterly results.

The country's largest bank by assets reported a jump in fourth-quarter profits — boosted, in large part, by a year-long expense-cutting initiative. Net income rose 10% from the previous year, to $5.4 billion, largely on a mix of lower compensation and legal expenses.

Total loans grew 11%, to $837 billion, boosted by a jump in consumer lending — which executives attributed to "improvement in the U.S. economy." Auto loans and leases grew at a particularly fast clip, increasing by 37% from the previous year, to $9.1 billion.

Commercial lending was also strong, as lending to midsize and large businesses rose by 9%, to $361 billion.

Still, revenue was relatively flat overall, as low rates weighed on yields. Net revenue grew by just 1%, to $22.8 billion. The company's net interest margin was 2.23%, an expansion of about 9 basis points from a year earlier.

The margin was boosted in part by gains from securities, Lake said.

JPMorgan's consumer and community bank—which includes its auto, credit card, and mortgage banking business—posted a 10% increase in net income, to $2.4 billion. Higher revenue from credit card services helped to offset lower mortgage banking revenue.

The company's commercial bank, meanwhile, saw a 21% decline in profits, to $550 million, as higher reserves for oil and mining-related credits weighed on revenue.

Profits in the JPMorgan's investment banking unit increased. Net income in asset management declined, however, amid market volatility.

The company continued to shed deposits from large institutional clients, and bulk up on retail deposits, Lake said. It reduced commercial deposits by approximately $200 billion. Overall, total deposits declined 6%, to $1.3 trillion.

The bank has said previously that it plans to shed high-cost deposits and focus instead on smaller retail clients.

Trimming deposits also helped JPMorgan lower its estimated capital surcharge to 3.5%, Lake said. The company had previously estimated a 4% surcharge.

JPMorgan expects its net interest income and margins to be relatively flat in the first quarter, Lake said. Still, the company expects to add about $2 billion in net interest income over the coming year, boosted by a gradual increase in rates.

The bank expects "a couple more rate hikes" by the Fed, Lake said. It also expects that "continued loan growth" will be a boon to interest income, she said.