Subprime loan originations for three out of four major credit products declined for the first time since 2012, a TransUnion study released Wednesday found.

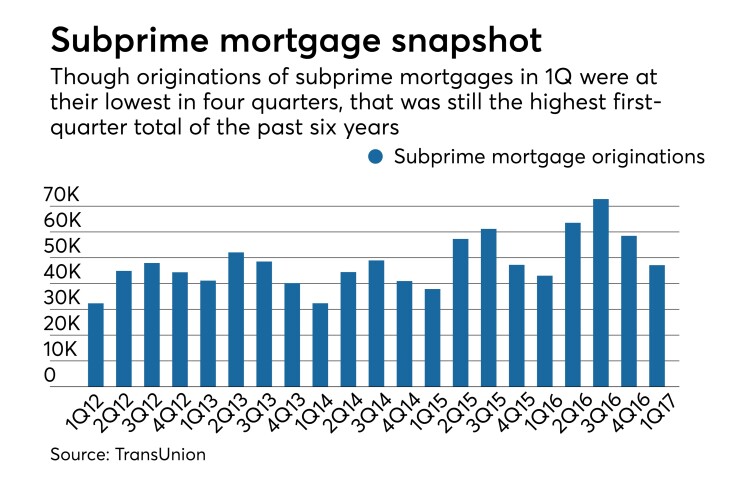

Originations of subprime auto loans, personal loans and credit cards dropped 5.3% in the first quarter from a year earlier to 4.63 million, the study said. Subprime mortgages, a lower-volume category, were the exception, rising nearly 10% to 47,125.

Researchers consider the declines in the three categories to be only “a pause” on the part of lenders after several years of heightened subprime activity and rising delinquencies, according to a press release issued by the credit reporting agency.

“Lenders are seeking to maintain the proper balance between return to investors, services to consumers and potential losses,” Ezra Becker, senior vice president of research and consulting for TransUnion, said in a phone interview. “This is a temporary, periodic correction.”

It’s unclear how long the pause will last. The report offered no forecast for coming quarters, and Becker said “much of this will be dictated by the delinquency picture in the near term."

The study defined subprime as loans made to consumers with VantageScore 3.0 credit scores of 300-600 (out of a range of 300-850) in the quarter that the loans were originated. The latest origination data available was for loans made in the first quarter because of reporting lags, officials said.

Subprime personal loan originations in the first quarter declined 10.6% to 882,303, compared with a positive annual growth rate of 11% a year earlier. That marked three straight quarters of year-over-year declines in origination.

In the credit card market, subprime originations declined 1.8% to 2.7 million in the first quarter. Subprime credit card originations had increased at a rapid rate since 2014, averaging growth of 29.2% in the first quarters of 2014, 2015 and 2016.

Subprime auto loan originations declined 8.9% to 1.1 million.

The pullback in subprime loans originations coincides with recent increases in delinquency rates for consumer credit. The study’s latest delinquency data was from the second quarter and related to all risk categories, not just subprime.

Looser lending standards over past years have contributed to an uptick in overall auto delinquencies. The auto delinquency rate increased 10.8% to 1.23% in the second quarter compared with a year earlier.

Lenders have also seen the downward pressure on used-car values, which hampers origination growth, the report said.

The overall credit card delinquency rate increased by 13.3%, to 1.46%, which is above the average second-quarter delinquency reading of 1.27% for the last three years.

Personal loan originations declined for all risk tiers, but at lower rates than for subprime originations. The overall personal loans delinquency rate declined by 8.5%, to 3.02%.

To be sure, the mortgage delinquency rate reached the lowest level in the second quarter since the recession. The mortgage delinquency rate was 1.92%, dropping below 2% for the first time in almost 10 years.

The slowdown in subprime lending is a sign of a healthy economy, Becker said.

“It is good for lenders to continue to find balance between all priorities they have, and it’s good for consumers not to overextend themselves in their use of credit,” Becker said.