WASHINGTON — Democratic lawmakers are zeroing in on the 2018 banking bill that eased requirements for some midsize banks as the culprit behind this weekend's bank failures, and are gearing up to repeal the measure as a means of ensuring such a crisis never happens again.

Since the failure of Silicon Valley Bank on Friday, a Trump-era regulatory relief effort has come under scrutiny, with some questioning whether Silicon Valley Bank or Signature Bank would have failed had either still been subject to tougher liquidity and supervisory requirements. In 2018, lawmakers — led by Sen. Mike Crapo, R-Idaho, then chairman of the Senate Banking Committee —

More than a dozen Senate Democrats joined Republicans in passing the law, which raised the threshold for enhanced prudential standards from $50 billion to $250 billion and gave the Federal Reserve discretion to determine how banks with more than $100 billion of assets should be supervised.

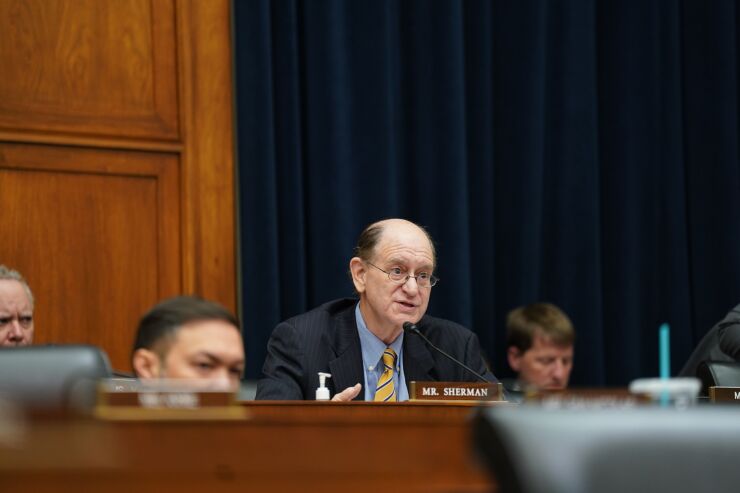

On Sunday evening, after financial regulators took extraordinary efforts to bail out uninsured depositors in Silicon Valley Bank and Signature, Rep. Brad Sherman, D-Calif., a senior member of the House Financial Services Committee, said in an interview that he's focused on legislation to beef up the inspection and regulation of medium-size banks.

"In 2018, Republicans passed the law that took away strict oversight of medium-size banks, and now we got Signature, we have Silicon Valley Bank," he said. "We should go back to something close to the Dodd-Frank rule where your medium large banks are subject to stress testing."

Sherman said that there's been too much focus on credit risk when, especially in the case of Silicon Valley Bank, regulators should have been more focused on interest rate risk, and said that he believes that focus has hurt small business capital formation.

"I think most medium-size banks are good institutions, I think they play an important role in our economy, and at the same time, two of them have bitten the dust," he said. "One bank failure can be sold to the people of this country as an aberration. Two is a flock."

He joins Rep. Katie Porter, D-Calif., who's said that she's working on a bill to roll back S. 2155. Porter, a financial consumer protection lawyer

President Joe Biden on Monday morning said he would call on Congress to

Thomas Hoenig, the anti-inflation hawk who served as president of the Federal Reserve Bank of Kansas City and vice chairman of the FDIC, said that Congress and the banking regulators should raise capital rules for midsize banks. He also said regulators should simplify risk-weighted rules which aren't well understood by the public — or in some cases, the banks themselves.

"If we continue to play games with the rules, we will continue to fool ourselves and we will continue to be surprised," Hoenig said.

Hoenig said that regulators and lawmakers let a red-hot economy compensate for growing risk in the banking sector, and let post-2008 rules slip.

"People became very complacent and not understanding that it takes time for high interest rates to begin to affect the value of assets," he said. "I think that complacency among the regulators and perhaps among the monetary policymakers overwhelmed them and caused them to be too complacent when they knew they were creating serious risks."

While Democratic lawmakers have been quick to turn their attention to potential legislation to shore up midsize bank regulation, some policy experts caution that it will still be difficult for them to roll back that deregulation bill with a Republican-controlled House.

House Financial Services Committee Chairman Patrick McHenry issued a moderated response to the regulators' moves Sunday evening: "This was the first Twitter-fueled bank run. At this time, it is important to remain levelheaded and look at the facts — not speculation — when assessing the right path forward," he said. "I have confidence in our financial regulators and the protections already in place to ensure the safety and soundness of our financial system."

Sen. Tim Scott, R-S.C., who serves as ranking member of the Senate Banking Committee,

"The regulators seem to have been asleep at the wheel," Scott said. "They're going to have the greatest form of corporate cronyism that we've seen in a very long time. It sends a very negative statement to the marketplace and we're going to have to rustle with over the next couple of days as we delve into what actually happened. The one thing we know for sure: The American taxpayer should not be on the hook for this failure."

Ian Katz, a managing director with Capital Alpha Partners, said that while Democrats may be coalescing around a legislative solution to the crisis, the odds are long that Congress as a whole will be similarly persuaded that a repeal of S. 2155 is an appropriate response.

"I'd be surprised if Congress can agree on anything significant in this area," Katz said. "I don't see enough lawmakers willing to trash S. 2155 like that."

John Heltman contributed to this report.