Wells Fargo had a lot of explaining to do about its expenses after issuing second-quarter results Tuesday.

That might seem like a welcome break for a company that in recent years has spent too much time doing damage control after scandals or answering questions about CEO changes — it’s on its third leader in three years and looking for the fourth.

However, it remains hard for Wells to escape its problems. Its spending on compliance is taking a budgetary toll. Couple that burden with

Interim CEO Allen Parker and Chief Financial Officer John Shrewsberry acknowledged to analysts on a conference call that the bank’s expenses are too high, but they declined to say whether they would be able to lower expenses next year. They also sought to manage expectations, saying the bank is likely to come in on the higher end of its expense target of $52-$53 billion this year.

“Our expenses are too high, and while we're working hard to execute on our expense initiatives, we also have higher ongoing investment spend,” Shrewsberry said.

The bank’s lack of a permanent CEO is one major reason executives did not offer much specific guidance about what the expense picture could look like next year. Some of these are things "a new CEO, a permanent CEO, is going to have a point of view on," Shrewsberry said. He also suggested Tuesday that the bank is unlikely to make any serious investments in new technologies or growth initiatives until after it has a new CEO.

Parker has served as interim CEO of the $1.9 trillion-asset Wells Fargo since March,

Wells Fargo has been under harsh scrutiny since September of 2016, when it came to light that millions of accounts had been opened without customers’ permission. The bank is still operating under an asset cap

Overall, net income rose 20% to $6.2 billion from the year-earlier quarter, but the bank had some one-time expenses last year that flattened earnings at that time, including a tax expense of $481 million.

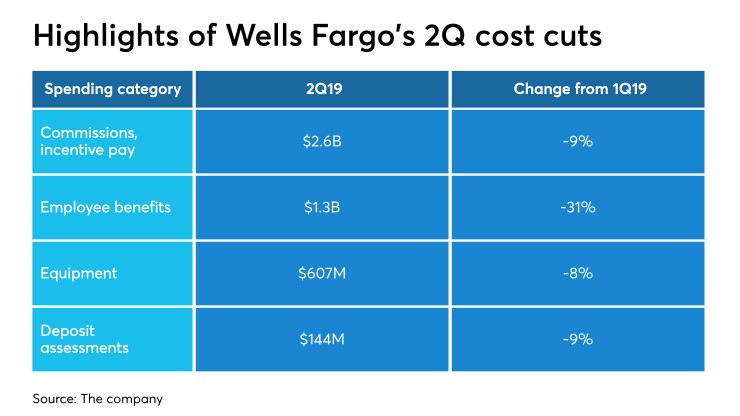

To be sure, Wells Fargo has been cutting costs. Second-quarter noninterest expenses fell 4% to $13.4 billion from a year earlier and 3% from the prior quarter. After certain seasonal factors drove up spending in the first quarter, it reduced equipment spending, commissions and incentives, and employee benefits. Those moves contributed to a 21-basis-point linked-quarter decline in its efficiency ratio.

Its efficiency ratio stood at 62.3%, compared with 64.9% a year earlier, although it is still a long way from its target range of 55% to 59%. In a phone call with reporters Tuesday, Shrewsberry said that he expects Wells Fargo will be able to achieve that goal “over the next couple years.”

Shrewsberry said on the conference call that “more than half” of its investment spending had been devoted to compliance and risk management, as opposed to new technologies that could boost revenue.

“If you're thinking about enabling technologies, or new capabilities, etc., it's a minority of the investment spend,” he said. “The majority of it is really more on the things that we're talking about in terms of compliance and risk management, and having said that, the downside of not being excellent in those areas produced more than its share of cost over the last few years.”

Since the beginning of 2018, Wells Fargo has reduced its full-time headcount by about 18,000 through attrition or displacement, but it also added roughly the same number of people in its risk compliance and technology functions, Shrewsberry said. Its risk department, for example, has “at least doubled” to 11,000 since the sales scandal broke in 2016. And more hiring still needs to be done, he said.

In a research note on Tuesday, Evercore ISI took issue with Wells Fargo’s exclusion of deferred compensation expense — which totaled $471 million for the first half of the year — from its expense target. The firm said that it considers deferred compensation expense to be a core expense.

Shrewsberry said during the conference call that the bank excludes deferred compensation expense from its expense target because it is subject to market fluctuations and does not produce a profit or loss for the bank.