With interest rates rising, Regions Financial has been waiting for a chunk of its deposit base to dissolve. The Birmingham, Alabama, bank is still waiting.

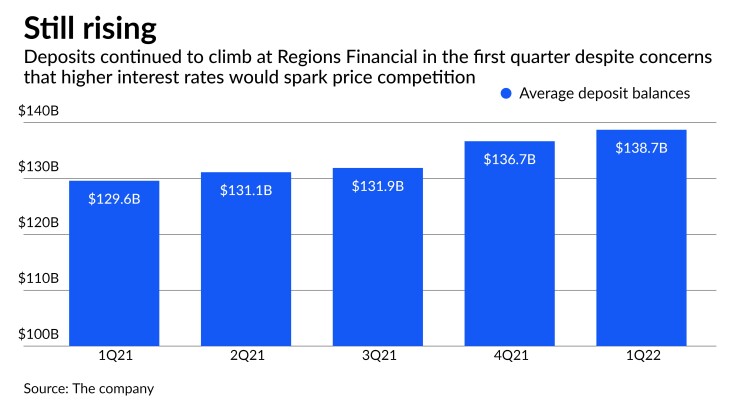

Regions executives figured that between $5 billion and $10 billion of nonoperational corporate deposits would begin to leave its balance sheet during the first quarter, as companies sought better returns on their funds. Instead, the bank’s average deposits rose to a record $138.7 billion.

The Federal Reserve’s single rate hike of 25 basis points in March simply wasn’t enough to entice companies to move their money, said Chief Financial Officer David Turner, though the pace of deposit growth at the bank did slow.

An outflow of deposits is still likely, albeit later than expected, especially if the Fed raises rates by 50 basis points in May, Turner said in an interview Friday. “When that happens, we believe we’ll start to see deposits start to decline,” he said.

When the dip does happen, it won’t have much of an impact on the bank’s overall funding base, Turner said. That’s because the majority of Regions’ deposits are stable retail deposits.

Losing the nonoperational commercial deposits “is not going to be a big deal to us,” Turner said Friday during the bank’s quarterly earnings call. “We've been planning for it all along.”

Bank deposits have surged over the last two years as a result of pandemic-induced credit line utilizations, government stimulus programs and various moves by the Fed to pump liquidity into the system.

As of April 6, deposits at U.S. commercial banks totaled $18.2 trillion, according to Fed data. That figure was up nearly 37% from January 2020, two months before the COVID-19 pandemic began to throttle the global economy.

With loan margins long squeezed, banks tried to make the best of the situation by paying near-zero rates on deposits, buying mortgage-backed securities and making loans when possible. But what was expected to be a temporary surge in deposits has now become a

Regions, which has $164 billion of assets, wasn’t the only bank where deposit trends defied expectations during the first quarter.

At the $35 billion-asset Associated Banc-Corp in Green Bay, Wisconsin, average deposits rose 7% year over year. Noninterest-bearing deposits totaled $8.3 billion, up $650 million from the year-ago period.

Associated CFO Christopher Del Moral-Niles said that he had expected non-interest-bearing deposits to flow out during the first quarter. “So the reality is they’re proving to be a lot stickier than I would have expected,” he said Thursday during a call with analysts.

Like Regions, East West Bancorp in Pasadena, California, reported record deposit levels for the first quarter. Total deposits rose to $54.9 billion, an increase of 11% from the year-ago quarter, due to strong growth in non-interest-bearing demand deposits, the bank said Thursday.

East West expects a lower level of deposit growth going forward, but core deposits will continue to arrive from retail and commercial clients, Irene Ho, the $62.2 billion-asset bank’s CFO, told analysts.

Regions classifies $42 billion of its deposits as “surge” funds that poured into the company in connection with the pandemic. Of that total, about $14 billion are corporate and commercial deposits, a large portion of which bank executives think will be less sticky than certain consumer and small-business deposits that also arrived during the pandemic.

As interest rates begin to move higher throughout the course of this year, those corporate customers “will look to put those deposits to work, receiving much higher rates that we’re willing to pay,” Turner said.

During the first quarter, Regions reported net income of $548 million and earnings per share of 55 cents, topping the average estimate of analysts compiled by FactSet Research Systems by 8 cents.

Net interest income rose 5% year over year to $1 billion, while noninterest income fell 8.9% from the same quarter last year, in part because of a decline in mortgage income.

Loans grew 3.6% from the year-ago period, while the bank’s net charge-offs as a percentage of average loans declined from 0.40% to 0.21%.

Regions, which completed three nonbank acquisitions during the fourth quarter,