WASHINGTON — Democrats may not be able to score many legislative wins in this Congress, but they appear set on slowing the process down to a snail's pace, particularly when it comes to financial appointments and efforts to roll back the Dodd-Frank Act.

Democrats appear to be slow walking appointments, using Senate rules that allow 30 hours of debate for nominees to stall the confirmation vote for Education Secretary-designate Betsy DeVos.

For the next 24 hours,

@SenateDems will#HoldTheFloor to oppose the nomination of Betsy DeVos.— Senator Bob Casey (@SenBobCasey)

February 6, 2017

"If [Democrats] think it’s in their political interest to slow down the process to try and bleed Republicans, they will," said Brian Gardner, a policy analyst at Keefe, Bruyette & Woods. "They smell blood on a handful of nominations. It is also energizing their base."

"Until they decide it is not in their interest to do so and it is hurting vulnerable Democrats they could continue" to stall the GOP agenda, Gardner added.

Democrats temporarily delayed the nomination of other cabinet appointments including Treasury Secretary-designate Steven Mnuchin and Health and Human Services Secretary-designate Rep. Tom Price, R-Ga., by boycotting a committee vote. The maneuver forced the Senate Finance Committee to hold an executive session the following day and change quorum rules in order to send the nominations to the upper chamber.

Additionally, during a meeting considering Sen. Jeff Sessions, R-Ala., for attorney general, the Senate Judiciary Committee was forced to delay a vote because of long speeches by Democrats.

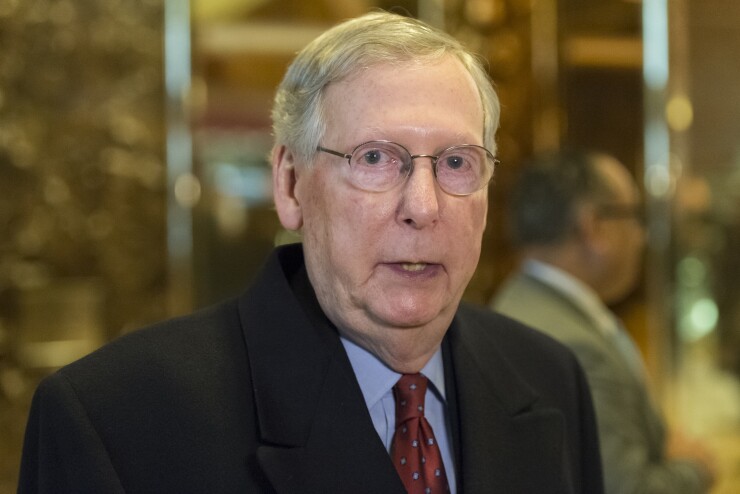

Delivering a speech on the Senate floor Monday, Republican leader Sen. Mitch McConnell, R-Ky., expressed frustration over the stall tactics.

"The Democratic leader and his colleagues are under a great deal of pressure from those on the left who simply cannot accept the results of a democratic election. They’re calling for Democrats to delay and punt and blockade the serious work of the Senate at any cost," McConnell said. "Look, enough is enough."

But the plan to stall the GOP agenda has also spilled over to the House.

Last week, Democrats offered 11 amendments during a House Financial Services Committee rules meeting, dragging the entire process out to more than six hours. By contrast, the same meeting last Congress took only two hours, during which Democrats offered just three amendments.

House Financial Services Committee Chairman Rep. Jeb Hensarling, R-Texas, plans to reintroduce legislation soon that would make significant changes to the Dodd-Frank Act and create an alternative regulatory framework. When the bill was voted on in the last Congress, the markup ended abruptly after Democrats declined to offer any amendments.

That seems likely not to be the case this time around.

"When you are completely out of power, the best you can hope for is slowing things down, which is a departure from last year when they didn't think anything could happen, so they offered no amendments to the Choice Act," said Ed Mills, an analyst at FBR Capital Markets. Mills also pointed to recent moves by the Finance Committee to change quorum rules and GOP plans to use other budget strategies to roll back Dodd-Frank.

"We are at a point in the House and Senate where the standing rules of the House, the standing rules of the Senate, and their respective committees are being poured over by both sides to see where the loopholes are or where the pressure points can be," Mills said. "Rules get changed quickly if you need to move the agenda along and the Republicans are not in the mood to adhere to these" rules.