The fintech lender tapped by the Small Business Administration to headline a policy aimed at boosting small-dollar 7(a) lending has said it would sell its U.S. operation without ever making a government-guaranteed loan.

London-based Funding Circle agreed Monday to sell the U.S. business to iBusiness Funding, a subsidiary of Ready Capital, for approximately $41.8 million. Since New York-based Ready Capital is a 7(a) lender already — it's the nation's fourth-largest — Funding Circle surrendered the small-business lending company license

Funding Circle's deal with iBusiness Funding is expected to close by the end of June.

"Funding Circle US expects to fully implement its small-dollar SBA lending strategy as part of iBusiness Funding and Ready Capital, according to Ryan Metcalf, the company's head of U.S. public affairs.

"The reality is now that we're going to be able to do exactly what we wanted to do, we're just going to do it under iBusiness Funding and Ready Capital, on their balance sheet and under their license," Metcalf said Tuesday.

"iBusiness Funding saw that we have the ability to become the number-one for SBA loans under $500,000," Metcalf added. "We have built a unique and efficient end-to-end loan origination and servicing technology platform that provides small businesses and community banks a best-in-class experience. That's why they wanted us."

Monday's sale can be viewed as a setback for the SBA and Administrator Isabel Casillas Guzman. In the face of strong, determined opposition from banks and credit unions, SBA in April 2023 reversed a 40-year-old policy that had limited the number SBLCs licensed to make 7(a) loans to 14.

The rule change was one of a number of initiatives Guzman has launched in an effort to boost the amount of small-dollar capital made available through 7(a), the idea being larger numbers of small-dollar loans will funnel more capital to women, minorities, veterans and other underserved groups.

The agency selected Funding Circle, which has lent more than $5 billion globally, to receive one of three new SBLC licenses based on its capacity to emerge quickly as a high-volume 7(a) producer. The other recipients, both small community development financial institutions, have begun making 7(a) loans, but their size, combined with narrow, mission-driven business models acts to limit the volume they're able to produce. Indeed, through Monday, Arkansas Capital Corp. and Alaska Growth Capital Bidco have closed a combined total of 49 7(a) loans, according to SBA statistics.

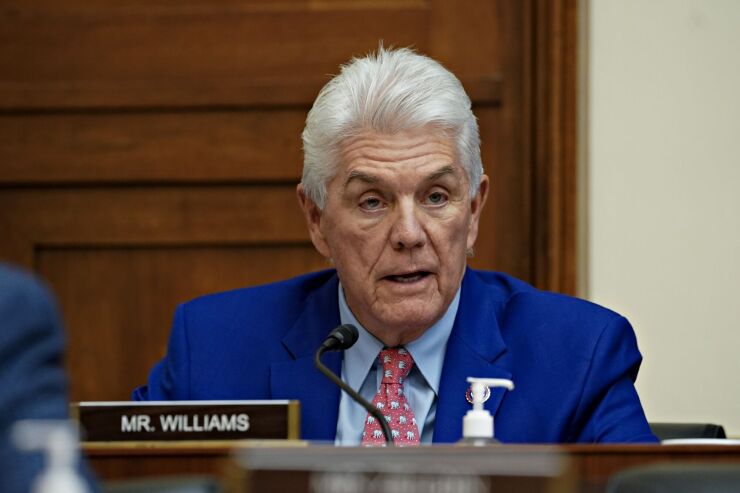

The decision to award an SBLC license to Funding Circle was flawed from the start, Rep. Roger Williams, R-Texas, chairman of the House Small Business Committee, and Iowa Republican Sen. Joni Ernst, the ranking member on the Senate Small Business Committee, said Tuesday in a statement. "As we have been saying from the moment it was announced, Funding Circle should never have received an SBLC license from the SBA," Williams and Ernst said. "We are pleased to see this license returned to the SBA, but remain concerned on how a company with such a weak financial position was granted a license in the first place."

Metcalf acknowledged the sale to iBusiness Funding marked a disappointing conclusion to a chapter that began with such significant fanfare. He insisted Funding Circle would still make a mark in SBA lending.

"SBA was really disappointed, understandably, that we surrendered the license, but they're pleased to know we're going to" participate in 7(a) going forward, Metcalf said.

Through nearly nine months of SBA's 2024 fiscal year, Ready Capital has closed 2,392 7(a) loans for $659 million, according to SBA.

"After getting under the hood and seeing the processes and procedures Funding Circle US has in place, it is no wonder that they were granted an SBLC license," iBusiness Funding CEO Justin Levy said Monday in a press release. "The robustness of their compliance programs is more in line with a large scale national bank as opposed to a fintech."

The $35 billion 7(a) program is SBA's largest regular lending program, guaranteeing qualifying private-sector loans up to $5 million.

Funding Circle

"In iBusiness, we have found a partner that shares in our mission, and we look forward to seeing the success of the combined entity," Jacobs said Monday in the press release.