Bankers were so upbeat heading into 2017. The new presidential administration was supposed to usher in an era of tax reform, regulatory relief and business activity, but with the third quarter drawing to a close many regional banks are now readjusting their outlook for commercial lending this year.

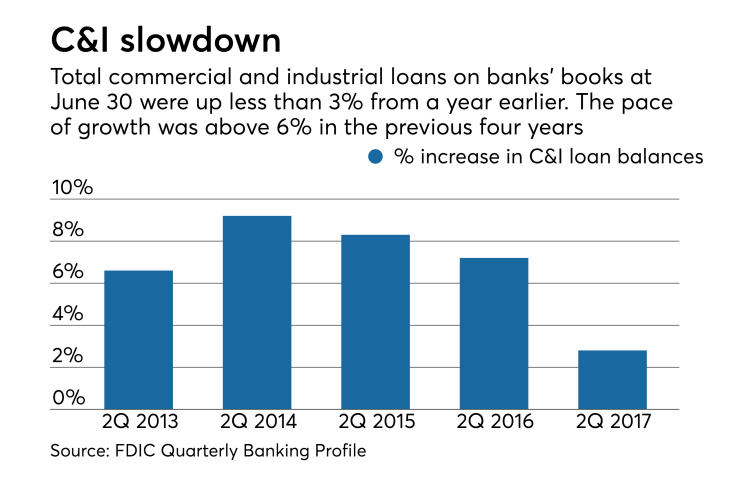

While growth in commercial and industrial loan balances had consistently topped 6% in recent years, the pace slowed considerably in the first half of 2017, according to data from the Federal Deposit Insurance Corp. At the Barclays Global Financial Services Conference in New York this week, bankers said that loan demand remained sluggish in the third quarter and is unlikely to pick up much in the fourth quarter.

“As an industry, we began the year with high hopes for an improving rate environment along with regulatory and tax reform,” PNC Financial Services Group Chairman, President and CEO Bill Demchak said Wednesday. Now, “it remains to be seen if regulatory relief, tax reform or a dramatically improved economy is going to materialize here.”

Kelly King, the chairman and CEO of BB&T in Winston-Salem, N.C., said that small and midsize business clients began to make some investments after the election, usually upgrading old and out-of-date equipment. But he said they’re still waiting for more positive signals from Washington before making bigger investments in additional staff or product lines.

Ralph Babb, the chairman and CEO of the $71.4 billion-asset Comerica in Dallas, said that global tensions are also making middle-market customers more cautious about taking on debt.

“Some of the international issues that have risen have also put uncertainty in our customers’ minds,” he said. “They are in very good shape, they are healthy and have strong cash, but they have held back on what I would call investing for the future.”

Political and economic uncertainty tell only part of the story, however. Flush with cash, many commercial firms are opting to pay down debt rather than take on new loans and those seeking financing aren’t always turning to banks to meet their needs.

Many commercial clients have also been using excess cash to finance new business investments, and still others are turning to the capital markets for money. According to Evercore ISI, corporate bond issuance has been increasing at low-single-digit rates since 2013 while commercial and industrial loan growth has increased approximately 10% per year. But this year, bond issuance is on pace to grow 7.5% while C&I loan growth among the regional banks it follows is topping out a little under 4%.

“There is underlying reason to still be positive when you look at some of the macro points,” said John Pancari, a regional bank analyst at Evercore, pointing to growth in capital expenditures and industrial production. “All those bode well for commercial growth. The problem is some of that demand is finding its way out of the banks and into the bond markets.”

Banks are also seeing more competition from nonbanks in commercial real estate lending.

Darren King, the chief financial officer of M&T Bank in Buffalo, N.Y., said insurance companies have been particularly aggressive in pursuing CRE deals.

“When we look at where we’re losing deals or being refinanced out, it tends to be longer-term mortgages provided by the insurance companies at spreads that are thinner than we can do,” he said.

U.S. Bancorp in Minneapolis had been projecting loan growth of 1% to 1.5% between the second and third quarters, but President and CEO Andy Cecere said Wednesday that he now expects growth of less than 1%. He, too, attributed much of that slowdown to clients paying down debt.

Banks have also been de-emphasizing certain businesses or exiting riskier loans in response to regulatory guidance, and that’s been a drag on growth, Pancari said.

Regions Financial in Birmingham, Ala., for instance, has been reducing its activity in riskier business lines like energy and multifamily lending. The $125 billion-asset Regions has also walked away from around $2.5 billion worth of transactions this year because it did not like the pricing or structures on those deals, said William E. Horton, head of commercial banking.

Since the start of 2016, the $140 billion-asset Fifth Third Bancorp in Cincinnati has exited around $4.5 billion in commercial loans it deemed too risky, and it intends to shed another $600 million by the year’s end, said CEO Greg Carmichael.

Of course, some banks are better positioned than others to ride out the present environment, but they don’t necessarily have one thing in common. Some, like Silicon Valley Bank in Santa Clara, Calif., and First Republic in San Francisco, are focused on niche businesses that are still doing very well, Pancari said. Others, like Citizens Financial Group in Providence, R.I., and Pittsburgh-based PNC, simply have more room to grow, either generally or in new markets, he said.

Regions and the $136 billion-asset KeyCorp in Cleveland also cited C&I lending as a bright spot, with Regions focusing on industries like technology and defense and Key seeing C&I growth among middle-market clients. Regions and Comerica also expected demand to pick up in the months ahead as some of their markets begin to rebuild following Hurricane Harve and Hurricane Irma.

“Houston has often proven its resiliency and we expect it to make a strong recovery,” Comerica's Babb said.

After years of cutting expenses, banks can’t get much leaner or meaner than they already are, Pancari said. Many bankers are now simply hoping for an end to the stalemate in Washington that will eventually translate into increased borrowing by their business clients. Until then, expect competition for quality loans to heat up.

“A lot of it comes down to borrower confidence and a lot of it’s tied to what’s going on in Washington,” Pancari said. “I believe it’s a function of the pie growing, but as long as the size of the pie is seemingly shrinking, these banks are going to get more competitive.”