DataTreasury Corp.'s courtroom victory over three major payments companies is expected to give the check-imaging technology provider more ammunition in its ongoing patent battle with some of the country's largest financial companies.

A federal jury on Friday awarded $27 million in damages to DataTreasury, ruling that U.S. Bancorp, The Clearing House Payments Co. LLC and Viewpointe LLC had infringed upon its patents for converting paper checks to digital images.

The decision in the U.S. District Court for the Eastern District of Texas is the first jury verdict to result from a series of lawsuits the Plano, Texas, payments technology company has filed against more than 70 banks, bank holding companies and other financial services firms over the past decade.

"Hopefully this decision will gain the ear of the American banking industry, that they need to respect intellectual property and they need to obey the law," said Nelson Roach, an attorney with the Daingerfield, Texas, law firm Nix, Patterson & Roach LLP, who represents DataTreasury. "It was not an innocent trespass, according to the jury. It was a willful trespass, which means they knew what they were doing and they plowed forward anyway."

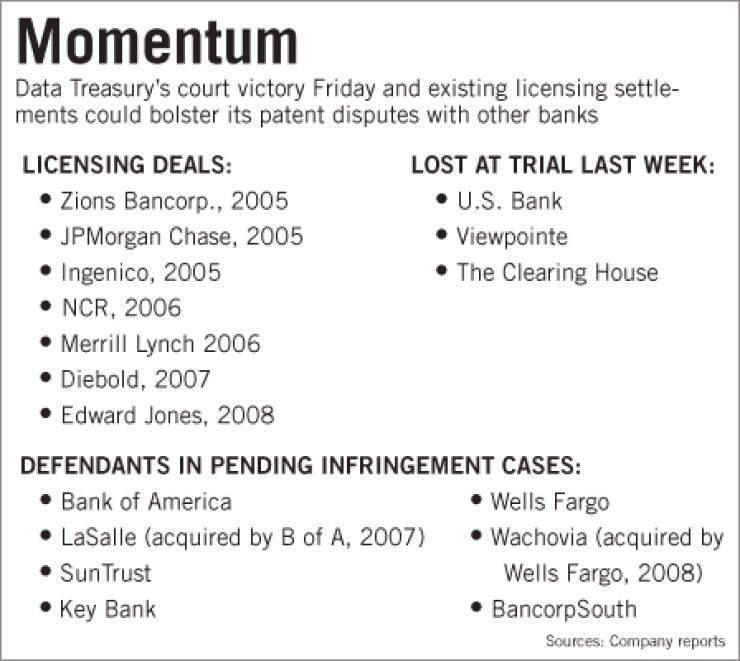

Several major financial companies have opted to sign patent licensing deals with DataTreasury, starting with JPMorgan Chase & Co. and Zions Bancorp, in 2005.

Two other lawsuits brought by DataTreasury are scheduled to go to trial this year, and Friday's verdict likely could motivate some of the financial companies that have been named as defendants to strike similar agreements, according to Jennifer Lefere, an intellectual property attorney with Hool Law Group LLC in Phoenix.

"With the jury verdict in their arsenal, depending on what happens on appeal, I think it's pretty significant to the other potential defendants to think about entering in some sort of" licensing agreement, Lefere said.

Lefere called DataTreasury's strategy of going after "anyone who might be using their technology" aggressive but not unreasonable. A company's patent is "not really worth anything unless you go out and enforce it against infringers."

A trial against Wells Fargo & Co., Wachovia Corp. (which Wells Fargo purchased in 2008) and BancorpSouth Inc. is set to begin in August; another trial, against Bank of America Corp., LaSalle Bank (which is owned by Bank of America), SunTrust Banks Inc. and KeyBank, is scheduled for October.

U.S. Bancorp spokeswoman Teri Charest wrote in an e-mail that the Minneapolis banking company was disappointed with the verdict but is "confident" it "did not infringe the patents at issue and that the patents will ultimately be held invalid."

The company intends to "pursue all avenues to protect its rights" in further proceedings and "on appeal if necessary," she wrote.

Representatives for The Clearing House and Viewpointe, both of New York, declined to comment.

The jury found that infringement by USBank and Viewpointe, which operates a repository for digital check images, was willful, meaning they knowingly violated DataTreasury's patent rights. Their portion of the damages — $26.6 million — could be tripled.

USBank and The Clearing House, which operates the SVPCO check imaging network, are jointly responsible for $394,000 of the damages the jury awarded.

DataTreasury's patents cover a system for remotely capturing check images and centralized processing, storage and retrieval of documents, Roach said.

Such technology has become a crucial part of banking operations in large part to the Check Clearing for the 21st Century Act, or Check 21, which pushed banks to process checks electronically. "The industry has embraced check image exchange much more quickly than most bankers anticipated, and today, the implementation rate is well above 90% and approaching 100%," David Walker, president and chief executive officer of the Electronic Check Clearing House Organization in Dallas, said in a statement.