WASHINGTON — Two nonprofits that provide down payment assistance on a national scale are not backing down in the face of a new federal policy that they say could drive them out of business.

The National Homebuyers Fund and the Chenoa Fund, the latter of which is fighting the policy in court, say the Department of Housing and Urban Development tried to avoid scrutiny last month when it imposed new restrictions outside a formal rulemaking process. HUD's mere letter to lenders seeking to "clarify" preexisting rules could threaten the funds' very existence, they say.

The Chenoa Fund's lead financial backers essentially walked away the day HUD issued the letter, said Helgi Walker, the nonprofit's lead counsel. "Scores of loans that were set to close were put on hold,” she said. “That is not what happens when an agency has merely issued some helpful tips.”

Both groups say HUD ran afoul of the Administrative Procedure Act, which requires significant policy changes to be subject to a notice-and-comment process. HUD originally said the letter, which was meant to provide more clarity about a 2012 rule, took effect immediately. But then, after Chenoa filed its lawsuit, HUD delayed implementation by 90 days.

The HUD policy requires nonprofits to prove they operate only within their geographic area, allowing a fund to have a broader reach only if it is authorized by each local government authority where it backs loans.

The guidance is a nonissue for and may help state housing finance agencies that have relatively small footprints yet provide most government down payment assistance.

But the Chenoa Fund and National Homebuyers Fund say the letter requires them to seek formal permission from all the different jurisdictions where they operate, which is not feasible. They warn that constraining their operations so they help borrowers only in their immediate geographic area would undermine their missions.

“In the end, the consumer gets hurt,” said Craig Ferguson, the vice president of the National Homebuyers Fund. “There’s nothing wrong with better competition, and state agencies still dominate the DPA world, but a couple of smaller options coming in doesn’t hurt anyone."

HUD's April 18 letter from FHA Commissioner Brian Montgomery tried to make clear that nonprofits providing down payment assistance must have permission from a government authority. The letter also notes data showing higher delinquency rates for FHA loans backed by governmental entities.

“This is simply requiring that lenders documented as governmental entities are acting in their capacity as governmental entities when they provide these down payment assistance grants,” said Brian Sullivan, a spokesman for HUD. “That’s in essence why we issued a mortgagee letter, because it’s really just asking for the documentation to support a rule that’s already on the books.”

But the national down payment assistance programs and even state housing finance agencies, which stand to gain from the guidance, have questioned HUD's claim that the letter simply clarified an existing rule.

“What was most surprising to us and many others in the industry was the immediate effective date, because even as we were well aware of FHA’s concern and FHA’s intention to take action on its down payment assistance policies, we were anticipating either a phased implementation process or a multistep period of comment,” said Stockton Williams, the executive director of the National Council of State Housing Agencies.

The lawsuit filed by the Cedar Band of Paiutes, the tribe that operates the Chenoa Fund, argues that federal law requires HUD to follow a more formal rulemaking process for such a significant policy change. The suit says HUD also violated an executive order currently in place requiring government officials to confer with Native American tribes when pursuing policy actions that could affect them.

HUD's 2012 interpretive rule addressed prohibited sources of down payments and cracked down on seller-funded down payments, in which a home seller would donate funds for a down payment to a nonprofit organization that would provide the assistance to a buyer. But critics of the latest policy say that 2012 rule did not specify any restrictions on down payment assistance providers operating outside of their local jurisdiction.

“The problem is that nothing in any law or existing HUD regulation restricted NHF or others from providing national programs,” said Ferguson.

While some of the mortgagee letter did clarify existing policy, other aspects do not resemble guidance at all, said Williams.

“There are some areas where it also might, if not modify policy itself, certainly add detail and requirements that demand analysis,” he said.

Some have suggested the new policy is closer to a "rule" as defined under the APA that is used to “implement, interpret or prescribe law or policy.” In such cases, agencies are required to go through a multistep rulemaking process, which includes submitting the proposal for review by the Office of Management and Budget’s Office of Information and Regulatory Affairs.

A rulemaking process could provide more information on how HUD reached the decision to restrict down payment assistance programs, compared to the little information provided in the seven-page mortgagee letter. Both the National Homebuyers Fund and the Chenoa Fund argue that HUD does not have sufficient data on services offered by governmental entities.

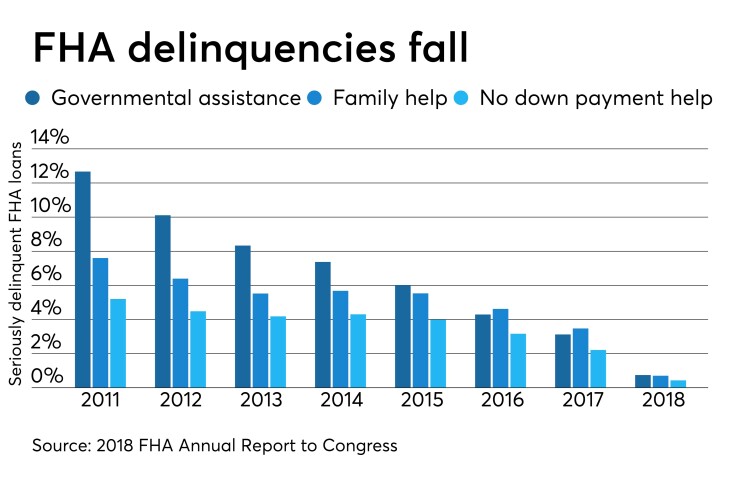

In the FHA’s annual report to Congress published November 18, the agency published data on serious delinquency rates from different sources of down payment assistance, reaching the conclusion that, “generally," higher serious delinquency rates "are associated with mortgages where down payment assistance came from governmental entities.”

But Michael Whipple, the vice president of the Chenoa Fund, expressed concern that the serious delinquency rates data was not broken up into nationwide programs versus state programs.

“HUD has no data to show that operating on a nationwide basis creates a higher rate of default," and Cedar Band Corporation Mortgage Agency "has provided HUD with data showing the CBCMA performs at least as well as any other government down payment assistance program,” he said.

While there is no question that loans backed with down payment assistance from a governmental entity default at a higher rate, Whipple said it is unclear how limiting nationwide programs would improve the default rate.

“What’s important to note is that the action that HUD took of limiting governmental entities to the reservation or to wherever they’re located has no effect on improving the default rate,” he said. “How are they demonstrating with data that national programs operating on a national basis are somehow contributing dramatically to this increase in defaults?”

The National Council of State Housing Agencies says that more information about the performance of loans from state housing finance agencies would help to illustrate why HUD and the FHA are taking steps to address down payment assistance.

“More data, which we are in the process of providing and I think FHA is attempting to get from a lot of different sources, will bring further clarity to this point,” Williams said.